Question: Could you please answer question THREE and FOUR. Thanks. Olivia is an investor who has only two primary assets, asset A and asset B, in

Could you please answer question THREE and FOUR. Thanks.

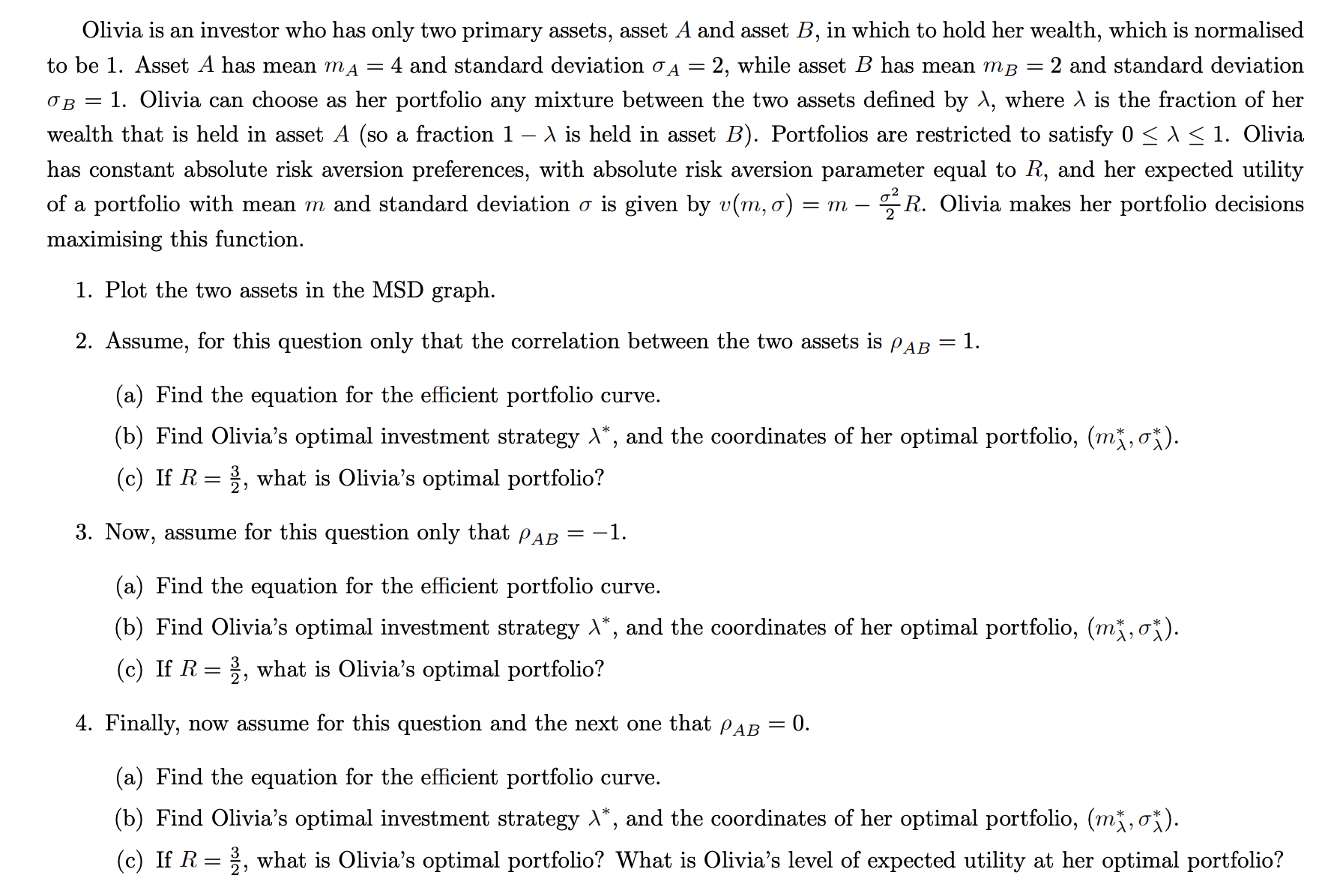

Olivia is an investor who has only two primary assets, asset A and asset B, in which to hold her wealth, which is normalisec to be 1. Asset A has mean mA=4 and standard deviation A=2, while asset B has mean mB=2 and standard deviation B=1. Olivia can choose as her portfolio any mixture between the two assets defined by , where is the fraction of hel wealth that is held in asset A (so a fraction 1 is held in asset B ). Portfolios are restricted to satisfy 01. Olivia has constant absolute risk aversion preferences, with absolute risk aversion parameter equal to R, and her expected utility of a portfolio with mean m and standard deviation is given by v(m,)=m22R. Olivia makes her portfolio decisions maximising this function. 1. Plot the two assets in the MSD graph. 2. Assume, for this question only that the correlation between the two assets is AB=1. (a) Find the equation for the efficient portfolio curve. (b) Find Olivia's optimal investment strategy , and the coordinates of her optimal portfolio, (m,). (c) If R=23, what is Olivia's optimal portfolio? 3. Now, assume for this question only that AB=1. (a) Find the equation for the efficient portfolio curve. (b) Find Olivia's optimal investment strategy , and the coordinates of her optimal portfolio, (m,). (c) If R=23, what is Olivia's optimal portfolio? 4. Finally, now assume for this question and the next one that AB=0. (a) Find the equation for the efficient portfolio curve. (b) Find Olivia's optimal investment strategy , and the coordinates of her optimal portfolio, (m,). (c) If R=23, what is Olivia's optimal portfolio? What is Olivia's level of expected utility at her optimal portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts