Question: Could you please explain HOW to solve this? preferably in Excel, thank you :) Cutting Edge Warehousing is considering a new project which would last

Could you please explain HOW to solve this? preferably in Excel, thank you :)

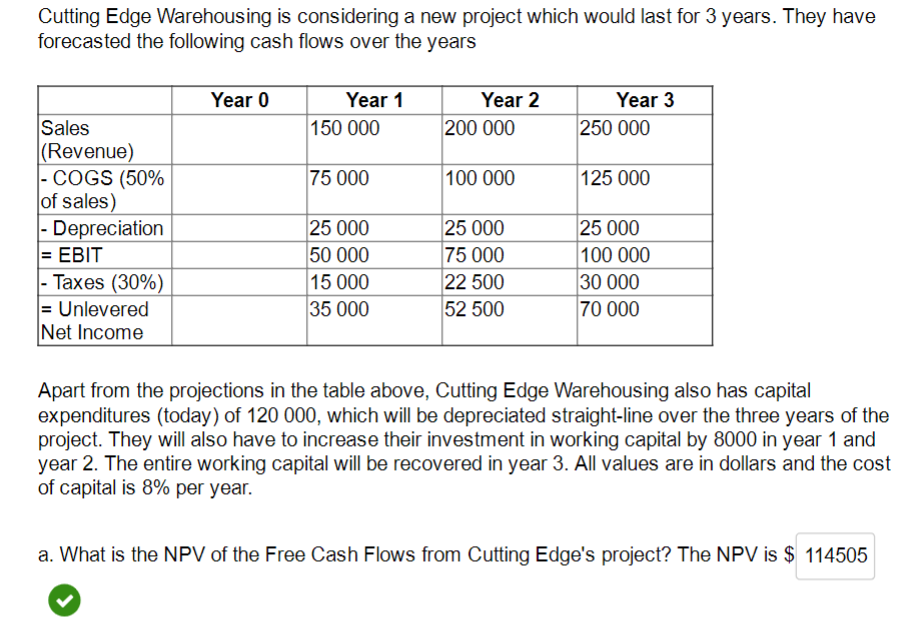

Cutting Edge Warehousing is considering a new project which would last for 3 years. They have forecasted the following cash flows over the years Year 0 Year 1 150 000 Year 2 200 000 Year 3 250 000 75 000 100 000 125 000 Sales (Revenue) |- COGS (50% of sales) - Depreciation = EBIT - Taxes (30%) = Unlevered Net Income 25 000 50 000 15 000 35 000 25 000 75 000 22 500 52 500 25 000 100 000 30 000 70 000 Apart from the projections in the table above, Cutting Edge Warehousing also has capital expenditures (today) of 120 000, which will be depreciated straight-line over the three years of the project. They will also have to increase their investment in working capital by 8000 in year 1 and year 2. The entire working capital will be recovered in year 3. All values are in dollars and the cost of capital is 8% per year. a. What is the NPV of the Free Cash Flows from Cutting Edge's project? The NPV is $ 114505

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts