Question: Could You please explain the process of solving the problem below, I am struggling to understand. Required information [The following information applies to the questions

Could You please explain the process of solving the problem below, I am struggling to understand.

![the questions displayed below.] During the current year, Ron and Anne sold](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66ebd03c09433_29966ebd03ba5268.jpg)

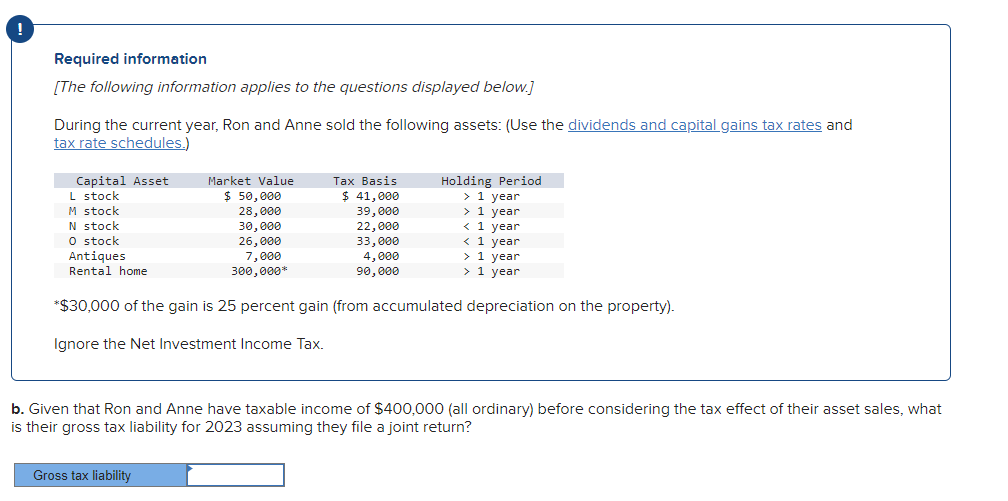

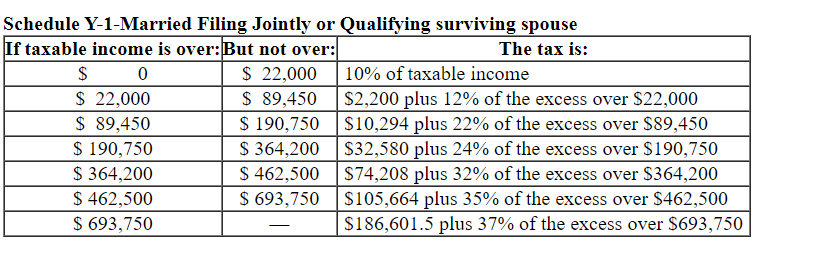

Required information [The following information applies to the questions displayed below.] During the current year, Ron and Anne sold the following assets: (Use the dividends and capital gains tax rates and tax rate schedules.) * $30,000 of the gain is 25 percent gain (from accumulated depreciation on the property). Ignore the Net Investment Income Tax. - Given that Ron and Anne have taxable income of $400,000 (all ordinary) before considering the tax effect of their asset sales, what their gross tax liability for 2023 assuming they file a joint return? Schedule Y-1-Married Filing Jointly or Qualifying surviving spouse \begin{tabular}{|c|c|l|} \hline If taxable income is over: & But not over: & \multicolumn{1}{c|}{ The tax is: } \\ \hline$0 & $22,000 & 10% of taxable income \\ \hline$22,000 & $89,450 & $2,200 plus 12% of the excess over $22,000 \\ \hline$89,450 & $190,750 & $10,294 plus 22% of the excess over $89,450 \\ \hline$190,750 & $364,200 & $32,580 plus 24% of the excess over $190,750 \\ \hline$364,200 & $462,500 & $74,208 plus 32% of the excess over $364,200 \\ \hline$462,500 & $693,750 & $105,664 plus 35% of the excess over $462,500 \\ \hline$693,750 & - & $186,601.5 plus 37% of the excess over $693,750 \\ \hline \end{tabular} Tax Rates for Net Capital Gains and Qualified Dividends purpose)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts