Question: could you please explain thoroughly how to solve it, I have a ready answers but dont know how they got it? . . Highprice Plc

could you please explain thoroughly how to solve it, I have a ready answers but dont know how they got it?

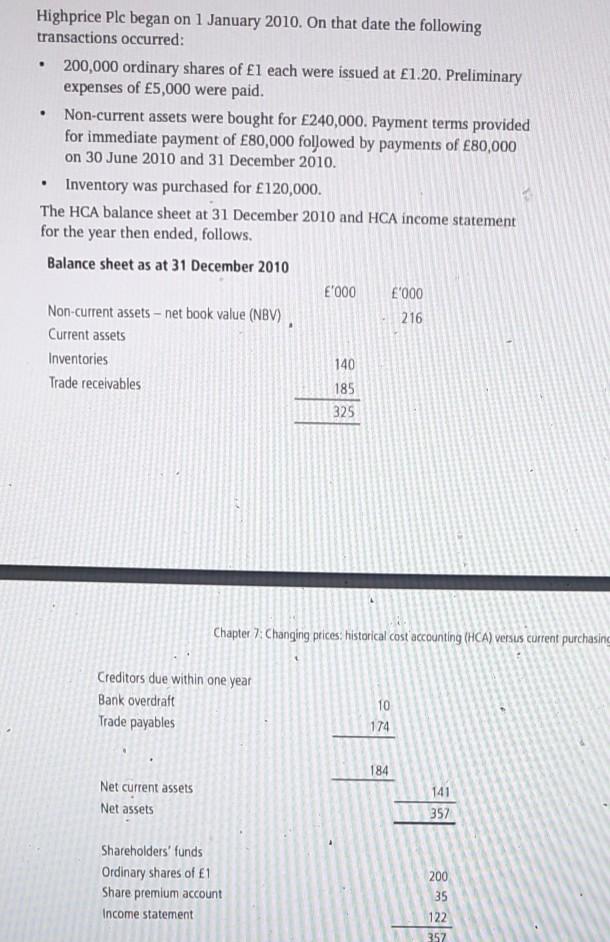

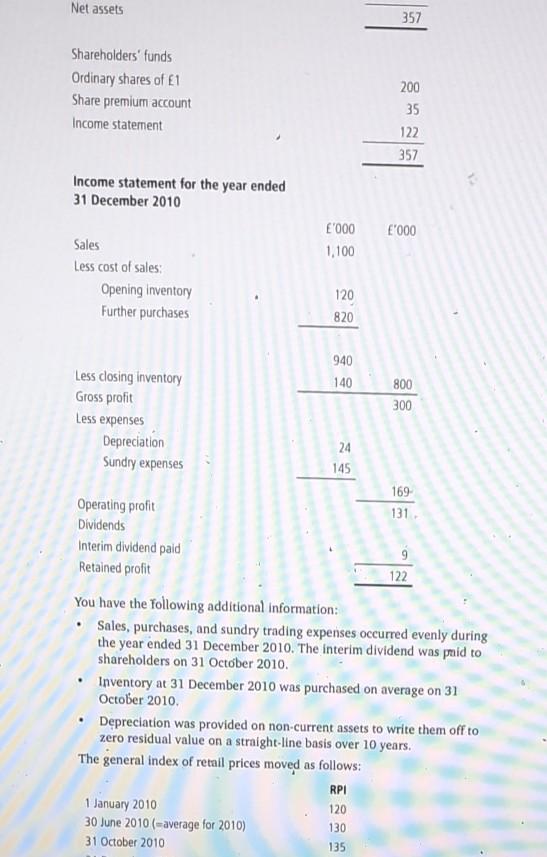

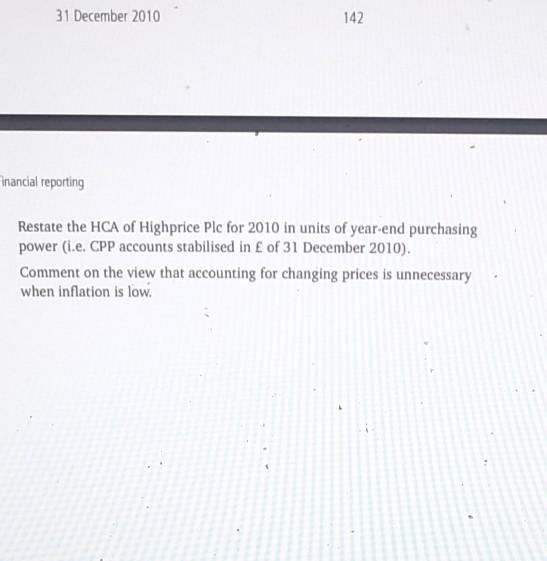

. . Highprice Plc began on 1 January 2010. On that date the following transactions occurred: 200,000 ordinary shares of 1 each were issued at 1.20. Preliminary expenses of 5,000 were paid. Non-current assets were bought for 240,000. Payment terms provided for immediate payment of 80,000 followed by payments of 80,000 on 30 June 2010 and 31 December 2010. Inventory was purchased for 120,000. The HCA balance sheet at 31 December 2010 and HCA income statement for the year then ended, follows. Balance sheet as at 31 December 2010 E'000 '000 Non-current assets - net book value (NBV) 216 Current assets Inventories 140 Trade receivables 185 325 Chapter 7: Changing prices historical cost accounting (HCA) versus current purchasing Creditors due within one year Bank overdraft Trade payables 10 174 184 Net current assets Net assets 141 357 Shareholders' funds Ordinary shares of E1 Share premium account Income statement 200 35 122 357 Net assets 357 Shareholders' funds Ordinary shares of E1 Share premium account Income statement 200 35 122 357 Income statement for the year ended 31 December 2010 E'000 E'000 1.100 Sales Less cost of sales: Opening Inventory Further purchases 120 820 140 940 Less closing inventory 800 Gross profit 300 Less expenses Depreciation 24 Sundry expenses 145 169 Operating profit 131 Dividends Interim dividend paid Retained profit 122 You have the following additional information: Sales, purchases, and sundry trading expenses occurred evenly during the year ended 31 December 2010. The interim dividend was paid to shareholders on 31 October 2010. Inventory at 31 December 2010 was purchased on average on 31 October 2010 Depreciation was provided on non-current assets to write them off to zero residual value on a straight-line basis over 10 years. The general index of retail prices moved as follows: RPI 1 January 2010 30 June 2010 (-average for 2010) 31 October 2010 120 130 135 31 December 2010 142 Financial reporting Restate the HCA of Highprice Plc for 2010 in units of year-end purchasing power (1.e. CPP accounts stabilised in of 31 December 2010). Comment on the view that accounting for changing prices is unnecessary when inflation is low. . . Highprice Plc began on 1 January 2010. On that date the following transactions occurred: 200,000 ordinary shares of 1 each were issued at 1.20. Preliminary expenses of 5,000 were paid. Non-current assets were bought for 240,000. Payment terms provided for immediate payment of 80,000 followed by payments of 80,000 on 30 June 2010 and 31 December 2010. Inventory was purchased for 120,000. The HCA balance sheet at 31 December 2010 and HCA income statement for the year then ended, follows. Balance sheet as at 31 December 2010 E'000 '000 Non-current assets - net book value (NBV) 216 Current assets Inventories 140 Trade receivables 185 325 Chapter 7: Changing prices historical cost accounting (HCA) versus current purchasing Creditors due within one year Bank overdraft Trade payables 10 174 184 Net current assets Net assets 141 357 Shareholders' funds Ordinary shares of E1 Share premium account Income statement 200 35 122 357 Net assets 357 Shareholders' funds Ordinary shares of E1 Share premium account Income statement 200 35 122 357 Income statement for the year ended 31 December 2010 E'000 E'000 1.100 Sales Less cost of sales: Opening Inventory Further purchases 120 820 140 940 Less closing inventory 800 Gross profit 300 Less expenses Depreciation 24 Sundry expenses 145 169 Operating profit 131 Dividends Interim dividend paid Retained profit 122 You have the following additional information: Sales, purchases, and sundry trading expenses occurred evenly during the year ended 31 December 2010. The interim dividend was paid to shareholders on 31 October 2010. Inventory at 31 December 2010 was purchased on average on 31 October 2010 Depreciation was provided on non-current assets to write them off to zero residual value on a straight-line basis over 10 years. The general index of retail prices moved as follows: RPI 1 January 2010 30 June 2010 (-average for 2010) 31 October 2010 120 130 135 31 December 2010 142 Financial reporting Restate the HCA of Highprice Plc for 2010 in units of year-end purchasing power (1.e. CPP accounts stabilised in of 31 December 2010). Comment on the view that accounting for changing prices is unnecessary when inflation is low

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts