Question: Could you please help me to answer these questions: Question 13 (1 point) Assume that the real risk-free rate is 0.5% and that the maturity

Could you please help me to answer these questions:

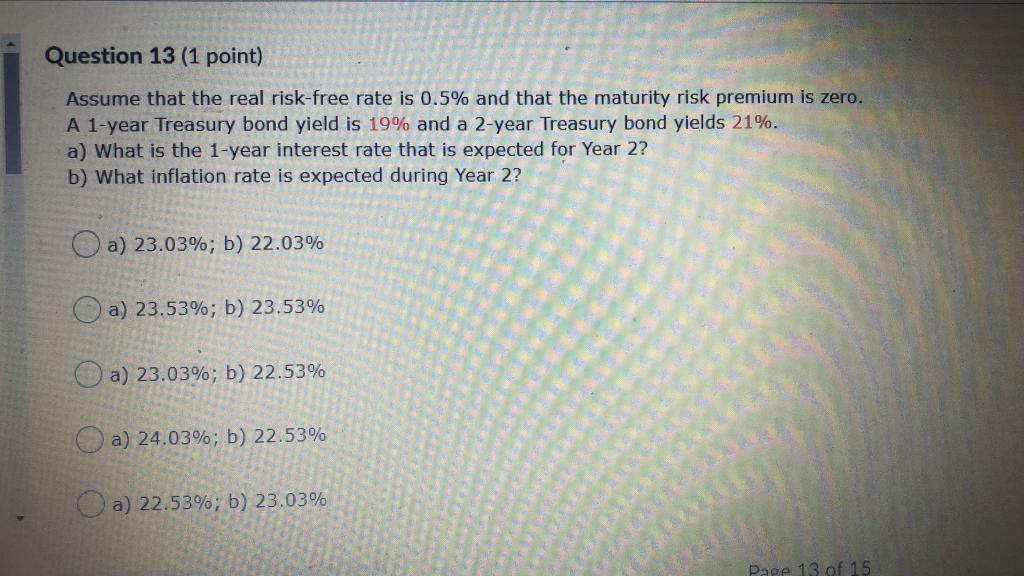

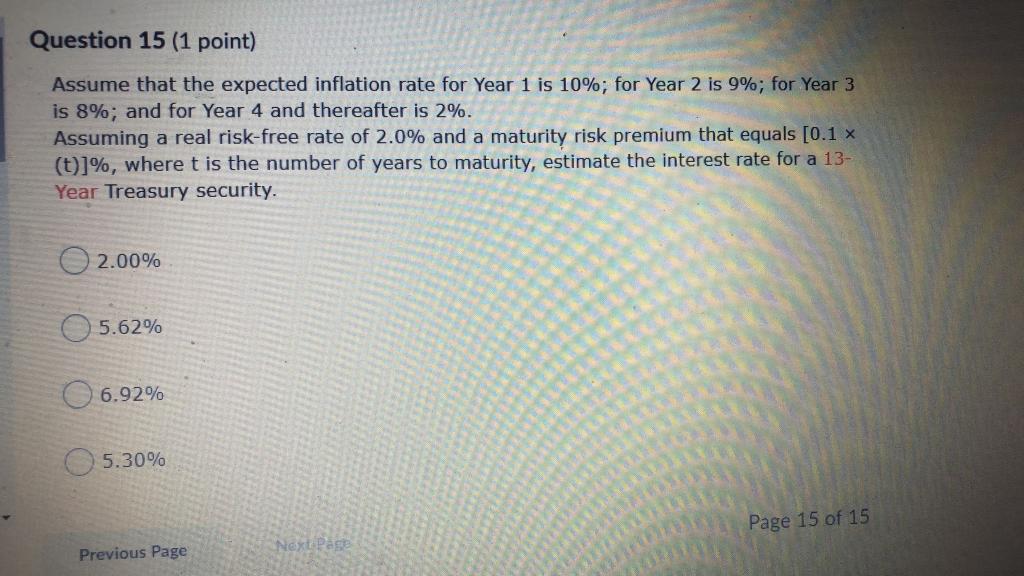

Question 13 (1 point) Assume that the real risk-free rate is 0.5% and that the maturity risk premium is zero. A 1-year Treasury bond yield is 19% and a 2-year Treasury bond yields 21%. a) What is the 1-year interest rate that is expected for Year 2? b) What inflation rate is expected during Year 2? a) 23.03%; b) 22.03% a) 23.53%; b) 23.53% a) 23.03%; b) 22.53% a) 24.03%; b) 22.53% a) 22.53%; b) 23.03% Page 13 of 15 Question 15 (1 point) Assume that the expected inflation rate for Year 1 is 10%; for Year 2 is 9%; for Year 3 is 8%; and for Year 4 and thereafter is 2%. Assuming a real risk-free rate of 2.0% and a maturity risk premium that equals [0.1 x (t)]%, where t is the number of years to maturity, estimate the interest rate for a 13- Year Treasury security. 2.00% 5.62% 6.92% 5.30% Page 15 of 15 Next Page Previous Page

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts