Question: Could you please provide the full explonation to the solution? You have the following market data from the securities you are considering investing in. You

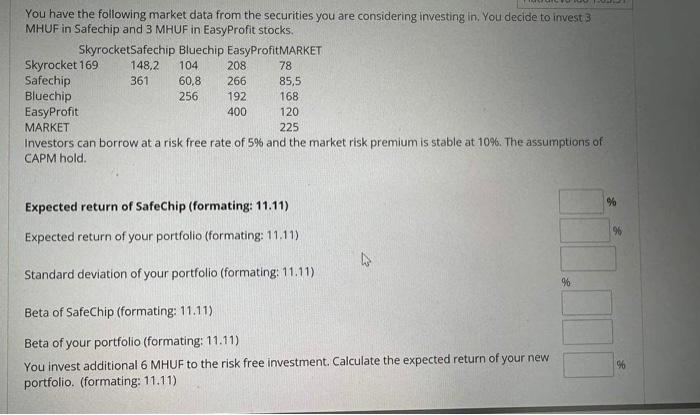

You have the following market data from the securities you are considering investing in. You decide to invest 3 MHUF in Safechip and 3 MHUF in EasyProfit stocks. Investors can borrow at a risk free rate of 5% and the market risk premium is stable at 10%. The assumptions of CAPM hold. Expected return of SafeChip (formating: 11.11) Expected return of your portfolio (formating: 11.11) Standard deviation of your portfolio (formating: 11.11) Beta of SafeChip (formating: 11.11) Beta of your portfolio (formating: 11.11) You invest additional 6 MHUF to the risk free investment. Calculate the expected return of your new portfolio. (formating: 11.11)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts