Question: Solve the following problem: 7. A foreign exchange trader gives the following quotes for the Russian ruble spot, one- month, three-month, and six-month to a

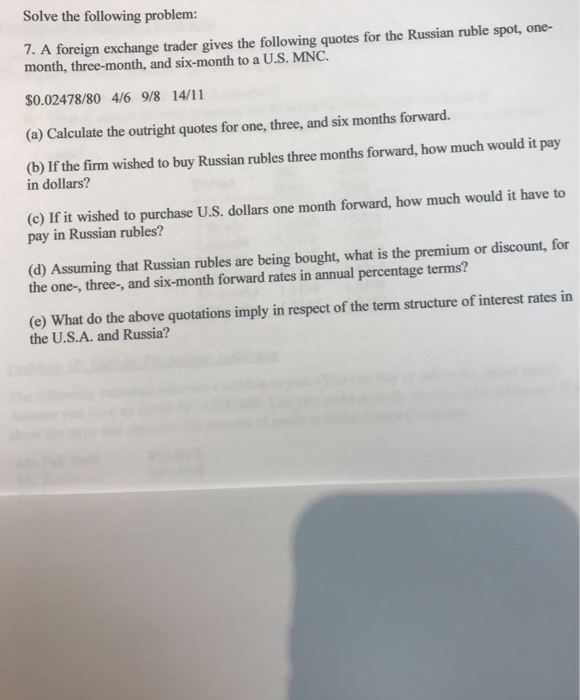

Solve the following problem: 7. A foreign exchange trader gives the following quotes for the Russian ruble spot, one- month, three-month, and six-month to a U.S. MNC $0.02478/80 4/6 9/8 14/11 (a) Calculate the outright quotes for one, three, and six months forward. (b) If the firm wished to buy Russian rubles three months forward, how much would it pay in dollars? (c) If it wished to purchase U.S. dollars one month forward, how much would it have to pay in Russian rubles? (d) Assuming that Russian rubles are being bought, what is the premium or discount, for the one-, three-, and six-month forward rates in annual percentage terms? (e) What do the above quotations imply in respect of the term structure of interest rates in the U.S.A. and Russia

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts