Question: Could you please show or explain your calculations so i can learn the logic from it.Thank you very much ses / ECON-330-2204-A / Feb 15

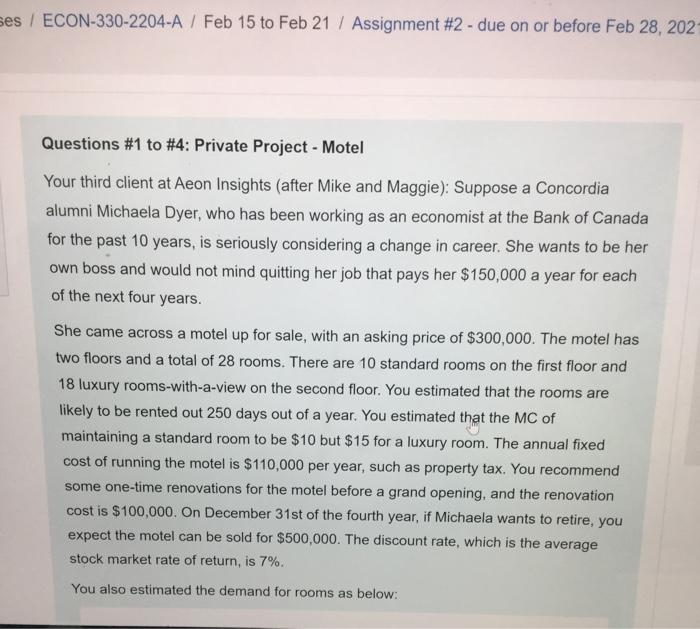

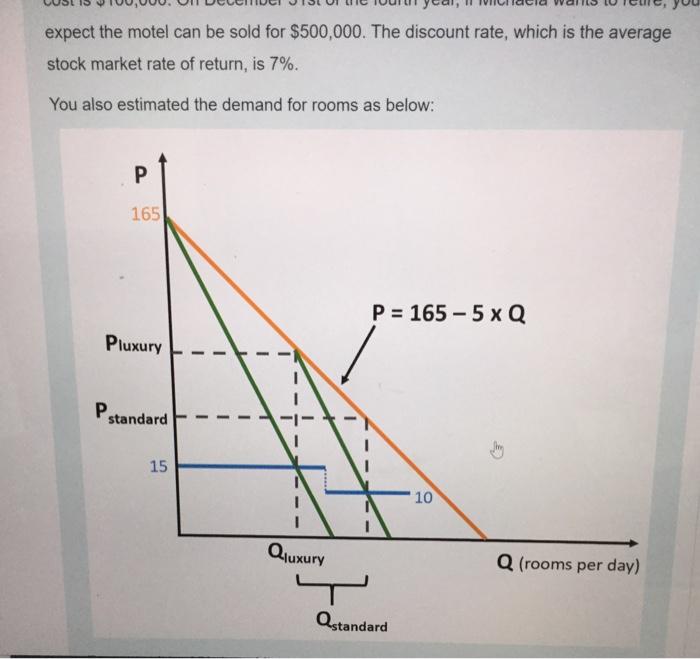

ses / ECON-330-2204-A / Feb 15 to Feb 21 / Assignment #2 - due on or before Feb 28, 202 Questions #1 to #4: Private Project - Motel Your third client at Aeon Insights (after Mike and Maggie): Suppose a Concordia alumni Michaela Dyer, who has been working as an economist at the Bank of Canada for the past 10 years, is seriously considering a change in career. She wants to be her own boss and would not mind quitting her job that pays her $150,000 a year for each of the next four years. She came across a motel up for sale, with an asking price of $300,000. The motel has two floors and a total of 28 rooms. There are 10 standard rooms on the first floor and 18 luxury rooms-with-a-view on the second floor. You estimated that the rooms are likely to be rented out 250 days out of a year. You estimated that the MC of maintaining a standard room to be $10 but $15 for a luxury room. The annual fixed cost of running the motel is $110,000 per year, such as property tax. You recommend some one-time renovations for the motel before a grand opening, and the renovation cost is $100,000. On December 31st of the fourth year, if Michaela wants to retire, you expect the motel can be sold for $500,000. The discount rate, which is the average stock market rate of return, is 7%. You also estimated the demand for rooms as below: expect the motel can be sold for $500,000. The discount rate, which is the average stock market rate of return, is 7%. You also estimated the demand for rooms as below: P 165 P = 165 -5xQ Pluxury Pstandard 15 10 Qluxury Q (rooms per day) Ostandard The NPV for this project is equal to a. $324,403 b. $705,851. c. $555,780 d. $442,955. Suppose Michaela is not too sure about the resale price after four years. Afterall, no one knows what the market condition would be in four years. You want to convince her the the resale price of $500,000 is not necessary in order for this business venture to be desirable. You tell her that as long as the resale value is at least before discounting, she should go ahead with this adventure. a. $61,038 b. $191,677. c. $74.774. d. $127.222

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts