Question: could you please solve using excel and show formulas. Thanks! You are considering a ten-year investment project. At present, the expected cash flow each year

could you please solve using excel and show formulas. Thanks!

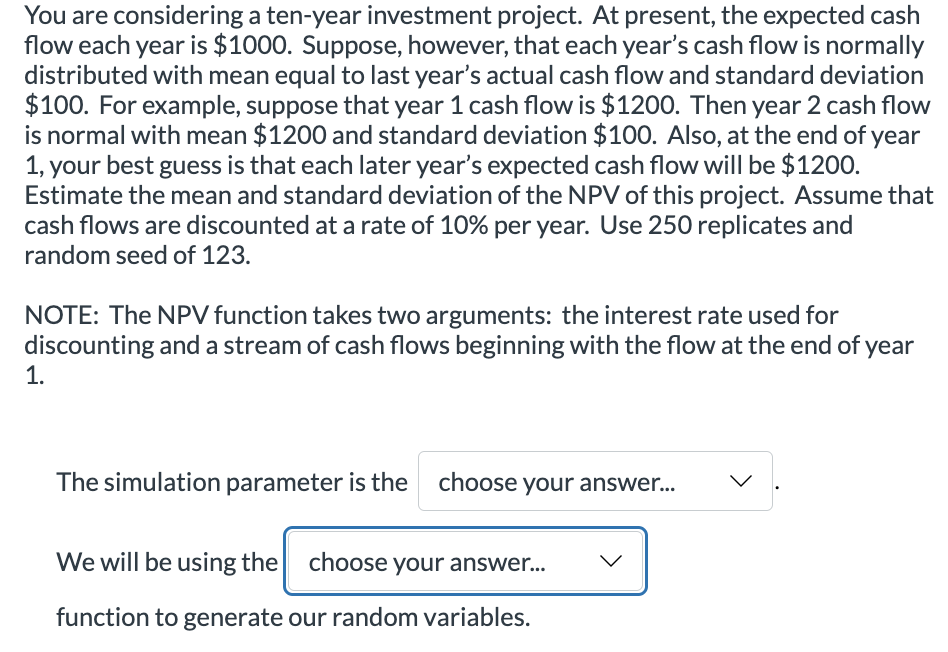

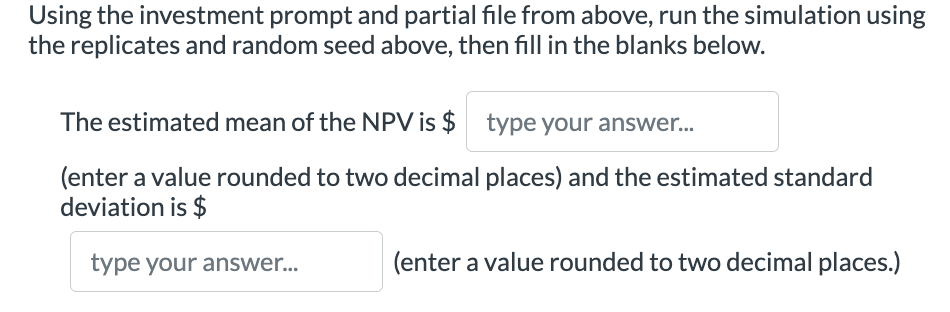

You are considering a ten-year investment project. At present, the expected cash flow each year is $1000. Suppose, however, that each year's cash flow is normally distributed with mean equal to last year's actual cash flow and standard deviation $100. For example, suppose that year 1 cash flow is $1200. Then year 2 cash flow is normal with mean $1200 and standard deviation $100. Also, at the end of year 1, your best guess is that each later year's expected cash flow will be $1200. Estimate the mean and standard deviation of the NPV of this project. Assume that cash flows are discounted at a rate of 10% per year. Use 250 replicates and random seed of 123. NOTE: The NPV function takes two arguments: the interest rate used for discounting and a stream of cash flows beginning with the flow at the end of year 1. The simulation parameter is the choose your answer... We will be using the choose your answer... function to generate our random variables. Using the investment prompt and partial file from above, run the simulation using the replicates and random seed above, then fill in the blanks below. The estimated mean of the NPV is $ type your answer... (enter a value rounded to two decimal places) and the estimated standard deviation is $ type your answer... (enter a value rounded to two decimal places.) You are considering a ten-year investment project. At present, the expected cash flow each year is $1000. Suppose, however, that each year's cash flow is normally distributed with mean equal to last year's actual cash flow and standard deviation $100. For example, suppose that year 1 cash flow is $1200. Then year 2 cash flow is normal with mean $1200 and standard deviation $100. Also, at the end of year 1, your best guess is that each later year's expected cash flow will be $1200. Estimate the mean and standard deviation of the NPV of this project. Assume that cash flows are discounted at a rate of 10% per year. Use 250 replicates and random seed of 123. NOTE: The NPV function takes two arguments: the interest rate used for discounting and a stream of cash flows beginning with the flow at the end of year 1. The simulation parameter is the choose your answer... We will be using the choose your answer... function to generate our random variables. Using the investment prompt and partial file from above, run the simulation using the replicates and random seed above, then fill in the blanks below. The estimated mean of the NPV is $ type your answer... (enter a value rounded to two decimal places) and the estimated standard deviation is $ type your answer... (enter a value rounded to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts