Question: could you solve this problem by using T-table and please with explanation please answer with using DDM or DCF model by using t-table I reaaly

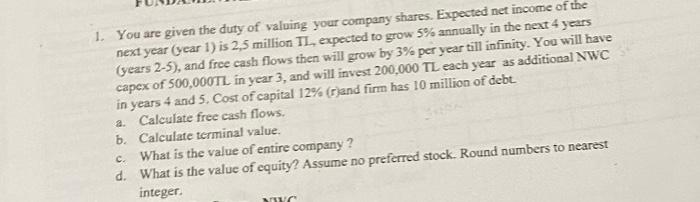

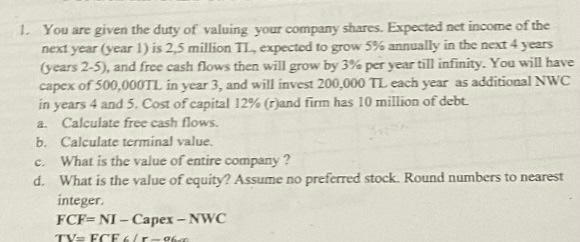

1. You are given the duty of valuing your company shares. Expected net income of the next year (year 1 ) is 2,5 million IL, expected to grow 5% annually in the next 4 years (years 2-5), and free cash flows then will grow by 3% per year till infinity. You will have capex of 500,000 TL in year 3 , and will invest 200,000 TL each year as additional NWC in years 4 and 5 . Cost of capital 12% (r)and firm has 10 million of debt. a. Calculate free cash flows. b. Calculate terminal value. c. What is the value of entire company? d. What is the value of equity? Assume no preferred stock. Round numbers to nearest integer. 1. You are given the duty of valuing your company shares. Expected net income of the next year (year 1) is 2,5 million 11, expected to grow 5% annually in the next 4 years (years 2-5), and free cash flows then will grow by 3% per year till infinity. You will have capex of 500,000T L in year 3 , and will invest 200,000 TL each year as additional NWC in years 4 and 5 . Cost of capital 12% (r)and firm has 10 million of debt. a. Calculate free cash flows. b. Calculate terminal value. c. What is the value of entire company? d. What is the value of equity? Assume no preferred stock. Round numbers to nearest integer. FCF = NI - Capex - NWC

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts