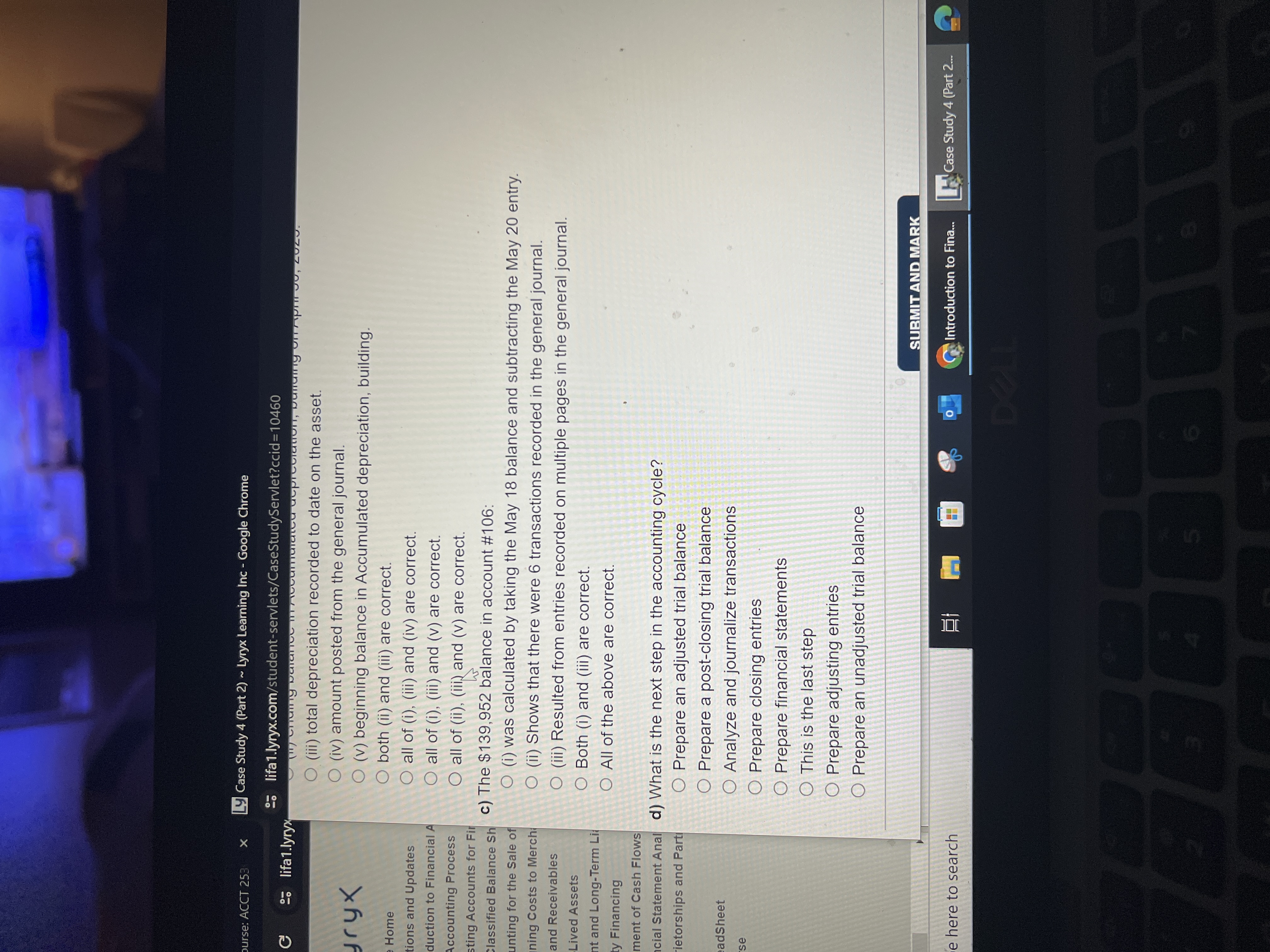

Question: Course: ACCT 253 Ly Case Study 4 (Part 2) - Lyryx Learning Inc - Google Chrome lifa1.lyryx.com/student-servlets/CaseStudyServlet?ccid=10460 C lifa1.lyryx Part 2 [20 points] Tyryx

![Inc - Google Chrome lifa1.lyryx.com/student-servlets/CaseStudyServlet?ccid=10460 C lifa1.lyryx Part 2 [20 points] Tyryx](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/03/65f8282014223_01565f8281fcb747.jpg)

Course: ACCT 253 Ly Case Study 4 (Part 2) - Lyryx Learning Inc - Google Chrome lifa1.lyryx.com/student-servlets/CaseStudyServlet?ccid=10460 C lifa1.lyryx Part 2 [20 points] Tyryx purse Home SunBlush Technologies Inc.'s May journal entries have been posted to the general ledger for you as shown below. This is similar to how an accounting software package posts automatically. orrections and Updates Introduction to Financial The Accounting Process Adjusting Accounts for Fir The Classified Balance Sh Accounting for the Sale of Assigning Costs to Merch Date 30/Apr Cash Explanation Account No. 101 LL F Debit Credit Balance Opening balance 132,500 1/May Issued shares 1/May Earned and received consulting revenue GJ1 GJ1 80,000 396 212,500 212,896 1/May Prepaid for insurance GJ1 3,600 209,296 Cash and Receivables 3/May Received payment for consulting in advance GJ1 7,800 217,096 Long-Lived Assets 4/May Paid for repairs to building GJ2 400 216,696 Current and Long-Term Li 8/May Earned and received consulting revenue GJ2 371 217,067 Equity Financing 18/May Paid for dinner with client GJ2 90 *216,977 Statement of Cash Flows 20/May Received customer payment GJ3 5,088 222,065 Financial Statement Anal 25/May Paid cash for salaries GJ3 15,200 206,865 Proprietorships and Part 31/May ossary 31/May Paid bill for utilities expense Dividends GJ3 700 206,165 GJ4 4,500 201,665 ni SpreadSheet 31/May Paid for property taxes expense. GJ4 600 201,065 it Course Date Accounts Receivable Explanation Account No. 106 F Debit Credit Balance Type here to search 30/Apr Opening balance. 6/May Earned consulting revenue 15/May Earned consulting revenue 18/May Earned consulting revenue 20/May Received customer payment 122,000 GJ2 5,088 127,088 GJ2 10,032 137,120 GJ3 7,920 145,040 GJ3 5,088 139,952 O Introduction to Fina... Case Study 4 (Part 2... 8:00 PM 2/12/2024 W H C 0 X 1.lyryx Case Study 4 (Part 2) - Lyryx Learning Inc - Google Chrome 2 lifa1.lyryx.com/student-servlets/CaseStudyServlet?ccid=10460 Prepaid Insurance Account No. 128 Date 1/May Explanation F Debit Credit Balance Prepaid for insurance GJ1 3,600 3,600 Computers Account No. 151 tes ancial A ocess Date 2/May Explanation F Debit Credit Received computers GJ1 15,600 Balance 15,600 s for Fir nce Sh Date Sale of Merch 30/Apr Opening balance Building Explanation Account No. 173 F LL Debit Credit Balance 54,500 les Accumulated Depreciation, Building Account No. 174 Date erm Li 30/Apr Opening balance Explanation LL Debit Credit Balance 4,000 Flows nt Anal nd Parti Date 30/Apr Opening balance Accounts Payable Explanation Account No. 201 F Debit Credit Balance 70,500 2/May Received computers GJ1 15,600 86,100 22/May Received bill for utilities expense GJ3 700 86,800 31/May Paid bill for utilities expense GJ3 700 86,100 Date 3/May Unearned Consulting Revenue Explanation Account No. 230 F Debit Received payment for consulting in advance GJ1 Credit Balance 7,800 7,800 Date Share Capital Explanation F Debit Credit Account No. 301 Balance search Introduction to Fina... Case Study 4 (Part 2... e: ACCT 253 x LY Case Study 4 (Part 2) Lyryx Learning Inc - Google Chrome 2 lifa1.lyryx.com/student-servlets/CaseStudyServlet?ccid=10460 lifa1.lyryx 10 ryx Date 30/Apr 1/May Share Capital Explanation Account No. 301 F Debit Credit Balance Opening balance. 188,000 Issued shares ome ns and Updates ction to Financial A counting Process ng Accounts for Fir ssified Balance Sh ting for the Sale of ng Costs to Merch ad Receivables Date 31/May Dividen Dividends GJ1 Dividends Explanation 80,000 268,000 Account No. 302 F GJ4 Debit 4,500 Credit Balance 4,500 Date Retained Earnings Explanation Account No. 318 LL F Debit Credit Balance 30/Apr Opening balance_ 46,500 ved Assets Consulting Revenue Earned Account No. 403 and Long-Term Li Financing Date Explanation LL F Debit Credit Balance 1/May Earned and received consulting revenue GJ1 396 396 ent of Cash Flows ial Statement Anal torships and Part 6/May Earned consulting revenue GJ2 5,088 5,484 8/May Earned and received consulting revenue. GJ2 371 5,855 15/May Earned consulting revenue GJ2 10,032 15,887 18/May Earned consulting revenue GJ3 7,920 23,807 dSheet e Date Salaries Expense Explanation Account No. 622 F 25/May Paid cash for salaries GJ3 Debit 15,200 Credit Balance 15,200 Food and Drinks Expense Account No. 668 Date Explanation F 18/May Paid for dinner with client GJ2 Debit 90 Credit Balance 90 e here to search W E R Introduction to Fina... Case Study 4 (Part 2... urse: ACCT 253 C X lifa1.lyryx 2 Ly Case Study 4 (Part 2) Lyryx Learning Inc - Google Chrome lifa1.lyryx.com/student-servlets/CaseStudyServlet?ccid=10460 C gryx Home ions and Updates duction to Financial A Accounting Process ting Accounts for Fir Classified Balance Sh unting for the Sale of ning Costs to Merch and Receivables Account No. 668 Balance 90 Date Food and Drinks Expense Explanation 18/May Paid for dinner with client. F Debit GJ2 Credit 90 Date Property Taxes Expense Explanation LL 31/May Paid for property taxes expense. Account No. 683 Debit Credit GJ4 600 Balance 600 Date 4/May Repair Expense Explanation Account No. 684 F Debit Credit Paid for repairs to building GJ2 400 Balance 400 Utilities Expense Explanation F Debit GJ3 700 Credit Account No. 690 Balance 700 Lived Assets Date nt and Long-Term Li y Financing ment of Cash Flows cial Statement Anal ietorships and Parti adSheet se 22/May Received bill for utilities expense a) In account #668: O (i) the $90 debit came from page GJ2 in the general journal. O(ii) the $90 debit came from page GJ2 in the general ledger. O (iii) the balance is $90 on May 18. O (iv) $90 was posted from the general ledger on May 18. both (i) and (iii) are correct. both (ii) and (iv) are correct. all of (i), (ii) and (iii) are correct. all of (ii), (iii) and (iv) are correct. O none of the above. b) In account #174, the balance of $4,000 is the: e here to search Introduction to Fina... Case Study 4 (Part 2... Course: ACCT 253 C Tyryx Course Home X lifa1.lyryx Corrections and Updates 1 Introduction to Financial A 2 The Accounting Process 3 Adjusting Accounts for Fir 4 The Classified Balance Sh 5 Accounting for the Sale of 6 Assigning Costs to Merch 7 Cash and Receivables 8 Long-Lived Assets 9 Current and Long-Term Li 10 Equity Financing 11 Statement of Cash Flows 12 Financial Statement Anal 13 Proprietorships and Parti Glossary Mini SpreadSheet Exit Course Ly Case Study 4 (Part 2) Lyryx Learning Inc - Google Chrome 2 lifa1.lyryx.com/student-servlets/CaseStudyServlet?ccid=10460 O none of the above. b) In account #174, the balance of $4,000 is the: (i) cash balance in Accumulated depreciation, building. (ii) ending balance in Accumulated depreciation, building on April 30, 2023. (iii) total depreciation recorded to date on the asset. (iv) amount posted from the general journal. (v) beginning balance in Accumulated depreciation, building. O both (ii) and iii) are correct. O all of (i), (iii) and (iv) are correct. O all of (i), (iii) and (v) are correct. O all of (ii), (iii) and (v) are correct. c) The $139,952 balance in account #106: (i) was calculated by taking the May 18 balance and subtracting the May 20 entry. O (ii) Shows that there were 6 transactions recorded in the general journal. (iii) Resulted from entries recorded on multiple pages in the general journal. O Both (i) and (iii) are correct. O All of the above are correct. d) What is the next step in the accounting cycle? O Prepare an adjusted trial balance O Prepare a post-closing trial balance Analyze and journalize transactions O Prepare closing entries O Prepare financial statements O This is the last step 1 Type here to search T 5 Introduction to Fina... Case Study 4 (Part 2... 8 Ourse: ACCT 253 C X 2 Ly Case Study 4 (Part 2) ~ Lyryx Learning Inc - Google Chrome lifa1.lyryx.com/student-servlets/Case StudyServlet?ccid=10460 lifa1.lyryx (ii) Granny barano Cumulated depreciation, Dummy PI 00, 2020. gryx e Home tions and Updates duction to Financial A Accounting Process sting Accounts for Fir (iii) total depreciation recorded to date on the asset. (iv) amount posted from the general journal. (v) beginning balance in Accumulated depreciation, building. both (ii) and (iii) are correct. all of (i), (iii) and (iv) are correct. all of (i), (iii) and (v) are correct. O all of (ii), (iii) and (v) are correct. Classified Balance Sh c) The $139,952 balance in account #106: unting for the Sale of ning Costs to Merch and Receivables -Lived Assets nt and Long-Term Li ty Financing ment of Cash Flows ncial Statement Anal rietorships and Parti eadSheet se O (i) was calculated by taking the May 18 balance and subtracting the May 20 entry. O (ii) Shows that there were 6 transactions recorded in the general journal. O (iii) Resulted from entries recorded on multiple pages in the general journal. O Both (i) and (iii) are correct. O All of the above are correct. d) What is the next step in the accounting cycle? O Prepare an adjusted trial balance O Prepare a post-closing trial balance O Analyze and journalize transactions O Prepare closing entries O Prepare financial statements O This is the last step O Prepare adjusting entries O Prepare an unadjusted trial balance e here to search SUBMIT AND MARK Introduction to Fina... Case Study 4 (Part 2... .. DELL

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts