Question: Course: Fall 202 X HW 06: Ch 3 X VA HW 06: Ch 3 - N X C | Still Need Help X | >

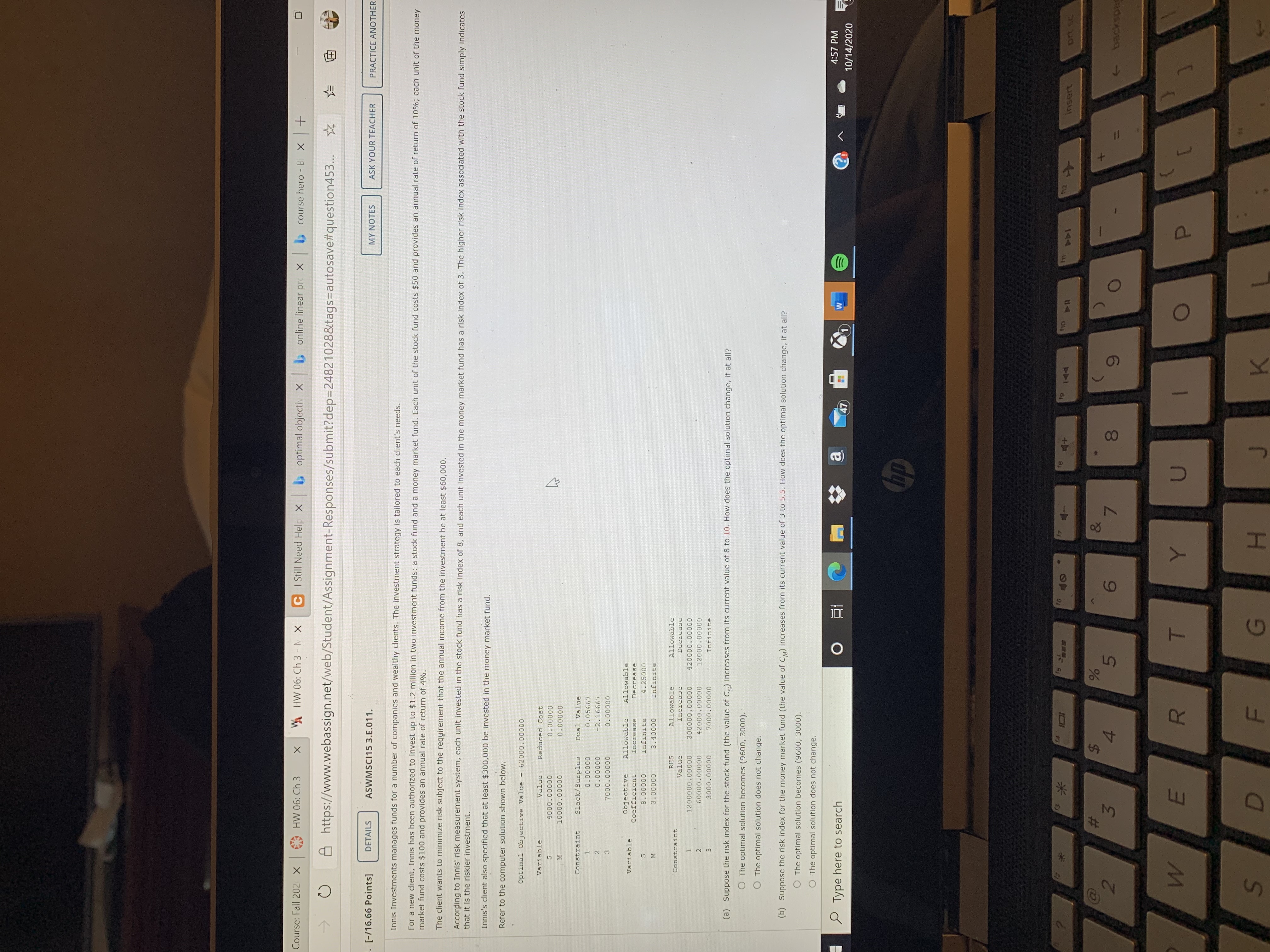

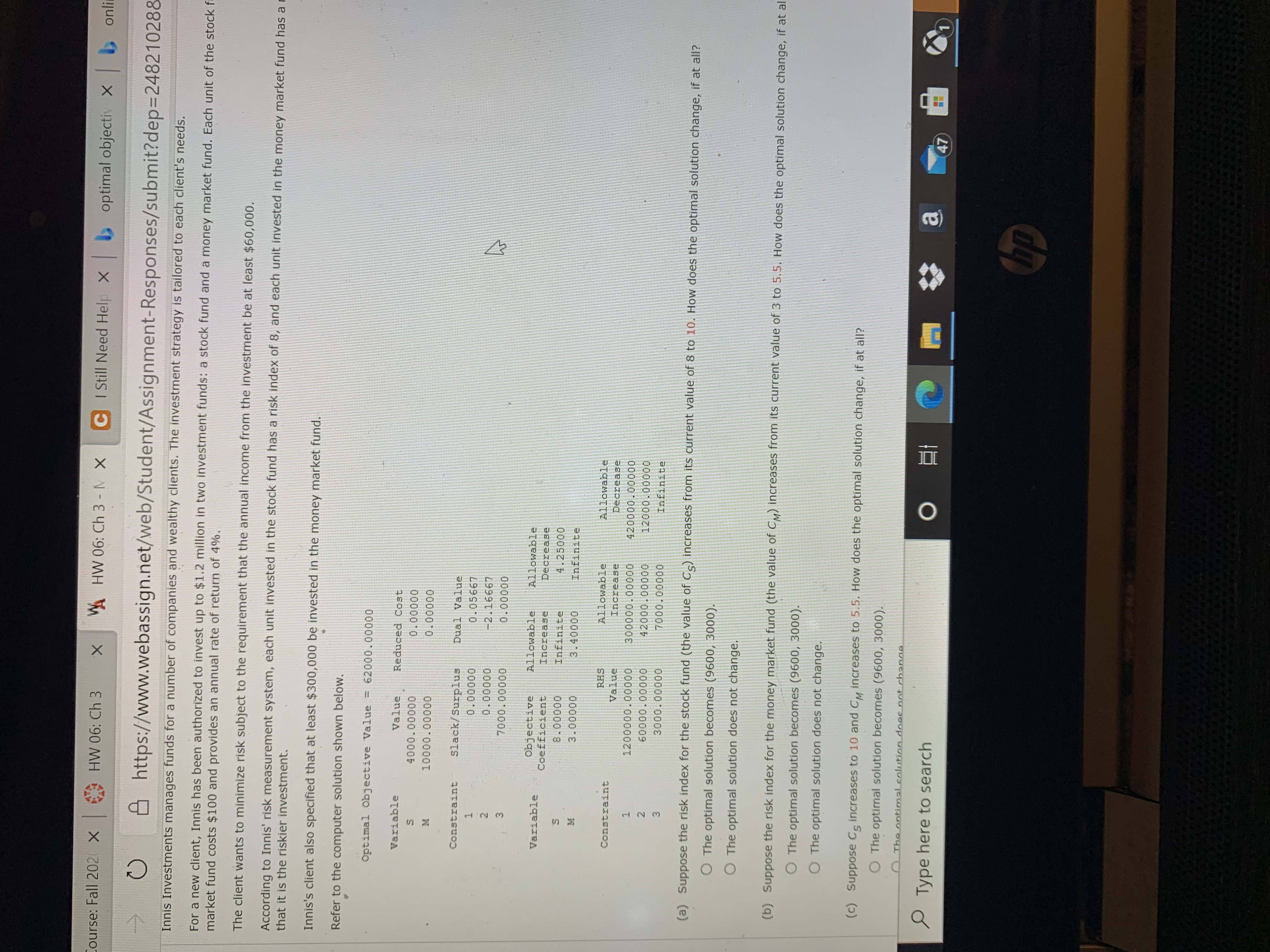

Course: Fall 202 X HW 06: Ch 3 X VA HW 06: Ch 3 - N X C | Still Need Help X | > optimal objectiveX , online linear pre X , course hero - Bi x + O https://www.webassign.net/web/Student/Assignment-Responses/submit?dep=24821028&tags=autosave#question453... [-/16.66 Points] DETAILS ASWMSCI15 3.E.011. MY NOTES ASK YOUR TEACHER PRACTICE ANOTHE Innis Investments manages funds for a number of comp nies and wealthy clients. The investment strategy is tailored to each client's needs. For a new client, Innis has been authorized to invest up to $1.2 million in two inves market fund costs $100 and provides an annual rate of retur stock fund and a money market fund. Each unit of the stock fund costs rovides an annual rate of return of 10%; each unit of the money The client wants to minimize risk subject to the requirement that the annual income from the investment be at least $60,000. According to Innis' risk measurement system, each unit invested in the stock fund has a risk index of 8, and each unit invested in the money market fund has a risk index of 3. The higher risk index associated with the stock fund simply indicates that it is the riskier investment. Innis's client also specified that at least $300,000 be invested in the money market fund. Refer to the computer solution shown below primal Objective Value = 62000.00000 Variable Value Reduced Cost M 4000 . 00000 0. 00000 10000. 00000 0. 00000 Constraint Slack/Surplus 0. 00000 Dual vary 0. 05667 0.00000 7000 . 00000 -2.16667 0.00000 Variable Objective Allowable Allowable Coefficient 8.00000 Increase Decrease 3.00000 Infinite 3. 40000 4.25000 Infinite Constraint RHS Allowable Allowable Value 1200000 .00000 Increase 300000 . 00000 Decrease 420000. 00000 60000. 00000 3000 . 00000 42000 . 00000 7000 . 00000 12000. 00000 Infinite (a) Suppose the risk index for the stock fund (the value of Cs) increases from its current value of 8 to 10. How does the optimal solution change, if at all? The optimal solution be omes (9600, 3000). The optimal solution does not change (b) Suppose the ri y market fund (the value of CM) increases from its current value of 3 to 5.5. How does the optimal solution change, if at all? The optimal solution becomes (9600, 3000). The optimal solution does not change. Type here to search O 4:57 PM 10/14/2020 16 0 18 4+ 19 144 110 11 insert prt se @ 2 # $ % & 4 5 7 backspa W E R T Y U O P S D F G H KCourse: Fall 202( X HW 06: Ch 3 X VA HW 06: Ch 3 - N X C | Still Need Help X > optimal objective onli https://www.webassign.net/web/Student/Assignment-Responses/submit?dep=24821028 Innis Investments manages funds for a number of companies and wealthy clients. The investment strategy is tailored to each client's needs. For a new client, Innis has been authorized to invest up to $1.2 million in two investment funds: a stock fund and a money market fund. Each unit of the stock market fund costs $100 and provides an annual rate of return of 4%. The client wants to minimize risk subject to the requirement that the annual income from the investment be at least $60,000. According to Innis' risk measurement system, each unit invested in the stock fund has a risk index of 8, and each unit invested in the money market fund has a that it is the riskier investment Innis's client also specified that at least $300,000 be invested in the money market fund. Refer to the computer solution shown below. Optimal Objective Value = 62000. 00000 Variable Value Reduced Cost S 4000 . 00000 0. 00000 M 10000 . 00000 0. 00000 Constraint Slack/ Surplus Dual Value 0. 00000 0 . 05667 0. 00000 2. 16667 7000. 00000 0. 00000 Variable Objective Allowable Allowable Coefficient Increase Decrease 8.00000 Infinite 4 . 25000 3 . 00000 3. 40000 Infinite Constraint RHS Allowable Allowable Value Increase Decrease 1200000 . 00000 300000. 00000 420000. 00000 60000 . 00000 42000. 00000 12000 . 00000 3000 . 00000 7000 . 00000 Infinite (a) Suppose the risk index for the stock fund (the value of C) increases from its current value of 8 to 10. How does the optimal solution change, if at all? The optimal solution becomes (9600, 3000) The optimal solution does not change. (b) Suppose the risk index for the money market fund (the value of CM) increases from its current value of 3 to 5.5. How does the optimal solution change, if at a The optimal solution becomes (9600, 3000). The optimal solution does not change. (c) Suppose Cs increases to 10 and Cy increases to 5.5. How does the optimal solution change, if at all? The optimal solution becomes (9600, 3000). atimal enlution does not change Type here to search O a 47 hp

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts