Question: Course Learning Assessment 1 - CLO 1, 2, 3, 4, 5, 6 7. Please see the rubrics for grading criteria. Taxes are costs, and, therefore,

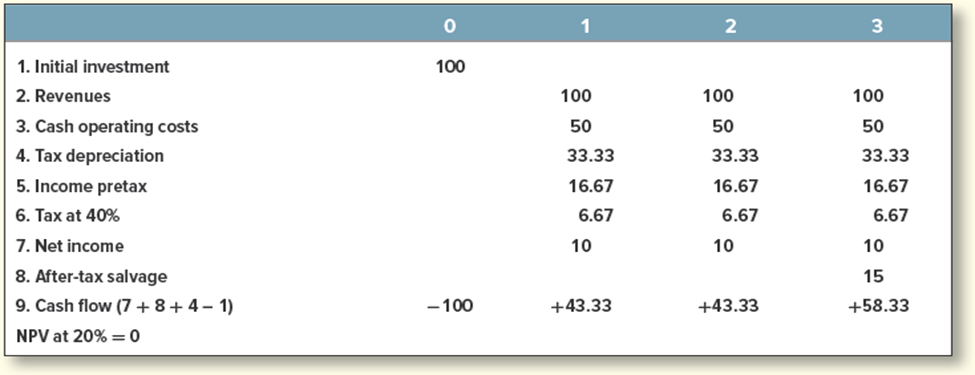

Course Learning Assessment 1 - CLO 1, 2, 3, 4, 5, 6 7. Please see the rubrics for grading criteria. Taxes are costs, and, therefore, changes in tax rates can affect consumer prices, project lives, and the value of existing firms. Evaluate the change in taxation on the valuation of the following project: Assumptions: Tax depreciation is straight-line over three years. Pre-tax salvage value is 25 in Year 3 and 50 if the asset is scrapped in Year 2. Tax on salvage value is 40% of the difference between salvage value and book value of the investment. The cost of capital is 20%. 1. Please verify that the information above yields NPV = 0. 2. If you decide to terminate the project in Year 2, what would be the NPV of the project? 3. Suppose that the government now changes tax depreciation to allow a 100% write-off in Year 1. How does this affect your answers to parts a and b above? 4. Would it now make sense to terminate the project after two rather than three years? 5. How would your answers change if the corporate income tax were abolished entirely? please make a professional assignment with proper updated citations.

\begin{tabular}{|lcccc|} \hline & 0 & 1 & 2 & 3 \\ \hline 1. Initial investment & 100 & & & \\ 2. Revenues & & 100 & 100 & 100 \\ 3. Cash operating costs & & 50 & 50 & 50 \\ 4. Tax depreciation & & 33.33 & 33.33 & 33.33 \\ 5. Income pretax & 16.67 & 16.67 & 16.67 \\ 6. Tax at 40\% & & 6.67 & 6.67 & 6.67 \\ 7. Net income & 10 & 10 & 10 \\ 8. After-tax salvage & & & & 15 \\ 9. Cash flow (7+8+41) & -100 & +43.33 & +43.33 & +58.33 \\ NPV at 20%=0 & & & & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts