Question: Eucalyptus Sdn. Bhd. has shortlisted three projects to be implemented in year 2021. All projects involve an initial investment of RM550,000. Project A is

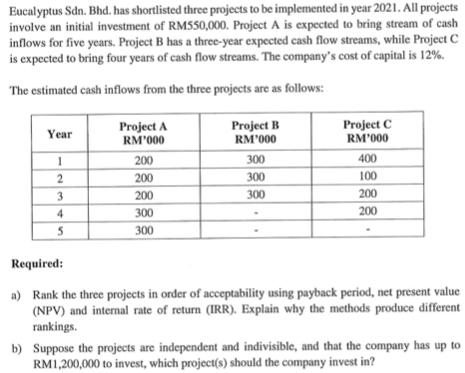

Eucalyptus Sdn. Bhd. has shortlisted three projects to be implemented in year 2021. All projects involve an initial investment of RM550,000. Project A is expected to bring stream of cash inflows for five years. Project B has a three-year expected cash flow streams, while Project C is expected to bring four years of cash flow streams. The company's cost of capital is 12%. The estimated cash inflows from the three projects are as follows: Year 1 2 3 4 5 Project A RM'000 200 200 200 300 300 Project B RM'000 300 300 300 Project C RM'000 400 100 200 200 Required: a) Rank the three projects in order of acceptability using payback period, net present value (NPV) and internal rate of return (IRR). Explain why the methods produce different rankings. b) Suppose the projects are independent and indivisible, and that the company has up to RM1,200,000 to invest, which project(s) should the company invest in?

Step by Step Solution

3.47 Rating (176 Votes )

There are 3 Steps involved in it

a The payback period for each project is as follows Project A 5 years Project B 3 years Project C 4 years Project A has the longest payback period fol... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (2 attachments)

635f25f264fd5_228988.pdf

180 KBs PDF File

635f25f264fd5_228988.docx

120 KBs Word File