Question: Courses Groups Calendar Support BAU BAUGO BAU Library Erton (1) Financial Markets and ... Overview Plans Resources Follow-up and reports Participants More The following information

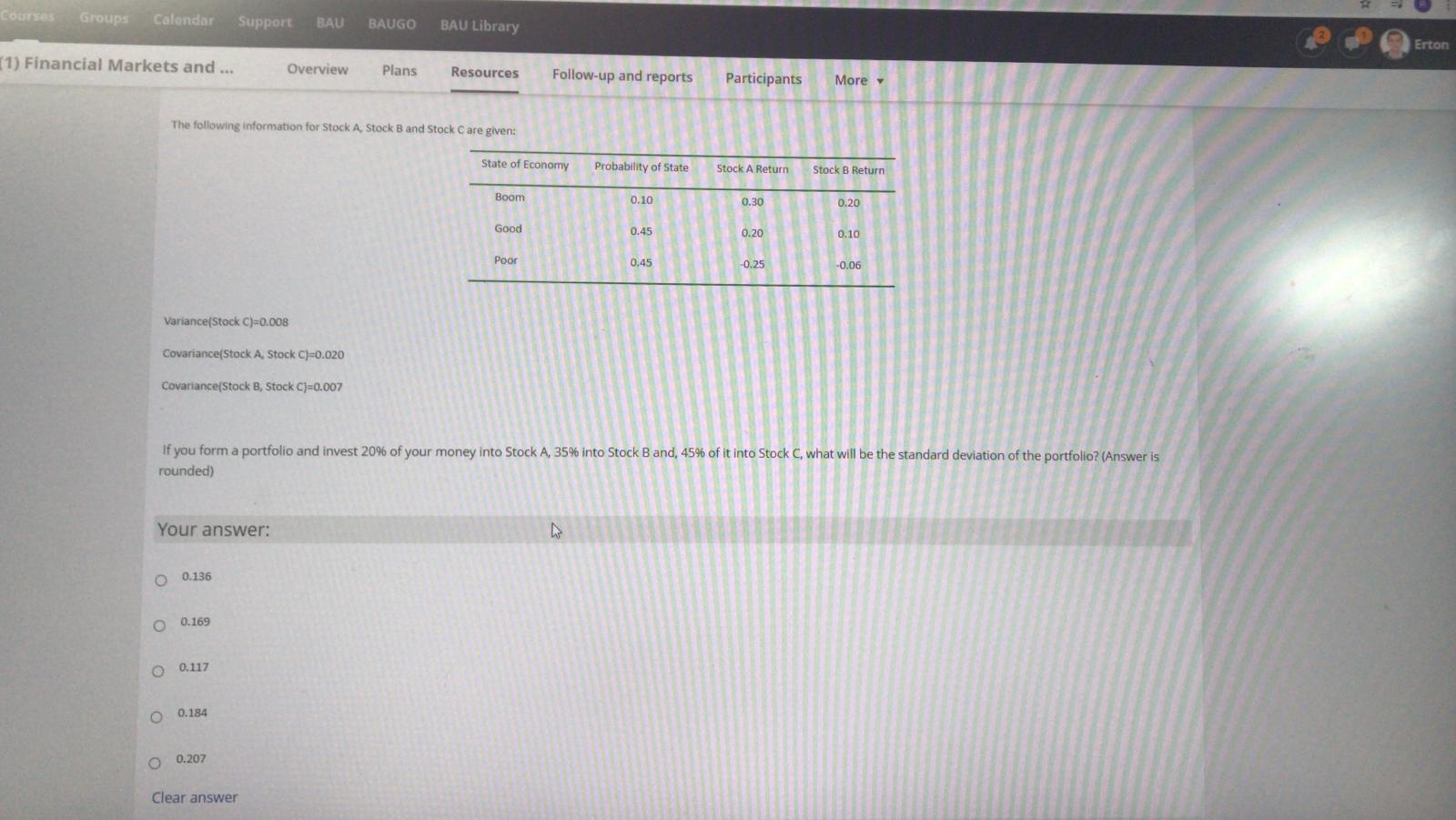

Courses Groups Calendar Support BAU BAUGO BAU Library Erton (1) Financial Markets and ... Overview Plans Resources Follow-up and reports Participants More The following information for Stock A, Stock Band Stock C are given: State of Economy Probability of State Stock A Return Stock B Return Boom 0.10 0.30 0.20 Good 0.45 0.20 0.10 Poor 0.45 -0.25 -0.06 Variance(Stock C)=0.008 Covariance(Stock A, Stock C)=0.020 Covariance(Stock B, Stock C)=0.007 If you form a portfolio and invest 20% of your money into Stock A, 35% into Stock Band, 45% of it into Stock C, what will be the standard deviation of the portfolio? (Answer is rounded) Your answer: N O 0.136 0 0.169 0.117 o 0.184 0 0.207 Clear

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts