Question: its Home Courses Groups Calendar Support BAU BAUGO BAU Library Gamtegul Ersahin19 BA2223 (1) Principles ... Overview Plans Resources Status and follow-up Participants More Question

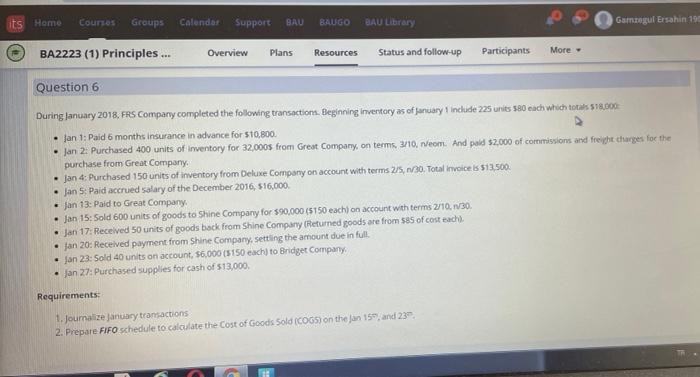

its Home Courses Groups Calendar Support BAU BAUGO BAU Library Gamtegul Ersahin19 BA2223 (1) Principles ... Overview Plans Resources Status and follow-up Participants More Question 6 During January 2018, FRS Company completed the following transactions. Beginning inventory as of January 1 include 225 units 580 each which total 598.000 Jan 1: Paid 6 months Insurance in advance for $10,800 Jan 2: Purchased 400 units of inventory for 32,000from Great Company, on terms, 3/10/com. And paid $2,000 of commissions and freight charges for the purchase from Great Company Jan 4: Purchased 150 units of inventory from Deluxe Company on account with terms 2/5,1/30. Total invoice 513,500. Jan 5: Paid accrued salary of the December 2016, 516,000 jan 13: Paid to Great Company Jan 15: Sold 600 units of goods to Shine Company for $90,000 (5150 each) on account with terms 2/10, 1/30 Jan 17: Received 50 units of goods back from Shine Company (Returned goods are from $85 of cost each) Jan 20: Received payment from Shine Company, Setting the amount due in full. Jan 23: Sold 40 units on account, $6,000 (5150 each) to Bridget Company jan 27: Purchased supplies for cash of $13,000 Requirements: 1. Journalize January transactions 2. Prepare FIFO schedule to calculate the cost of Goods Sold (COG) on the Jan 159 and 23

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts