Question: courses/_4959_1/cl/outline software math study G Google Apple Suggested Sites IELTS Listening Tips math calculater M Gmail YouTube Other bookmarks Remaining Time: 19 minutes, 05 seconds.

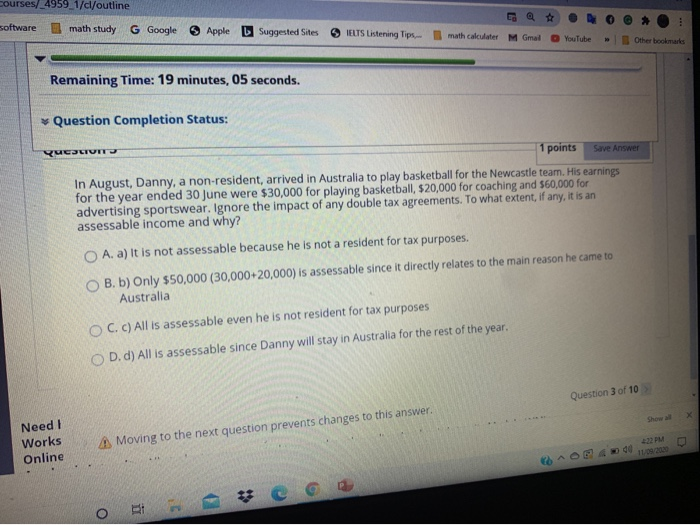

courses/_4959_1/cl/outline software math study G Google Apple Suggested Sites IELTS Listening Tips math calculater M Gmail YouTube Other bookmarks Remaining Time: 19 minutes, 05 seconds. Question Completion Status: YUESLUIT 1 points Save Answer In August, Danny, a non-resident, arrived in Australia to play basketball for the Newcastle team. His earnings for the year ended 30 June were $30,000 for playing basketball, $20,000 for coaching and $60,000 for advertising sportswear. Ignore the impact of any double tax agreements. To what extent, if any, it is an assessable income and why? A. a) It is not assessable because he is not a resident for tax purposes. OB. b) Only $50,000 (30,000+20,000) is assessable since it directly relates to the main reason he came to Australia OC. C) All is assessable even he is not resident for tax purposes O D. d) All is assessable since Danny will stay in Australia for the rest of the year, Question 3 of 10 Need! Works Online Moving to the next question prevents changes to this answer. O

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts