Question: AUDITING PROBLEMS - ACCTG 301/302 2023 2024 1ST SEMESTER (SEMIFINALS) AP 06D: LOANS RECEIVABLE Problem 1. Premium On January 1, 2023, UP Bank lent

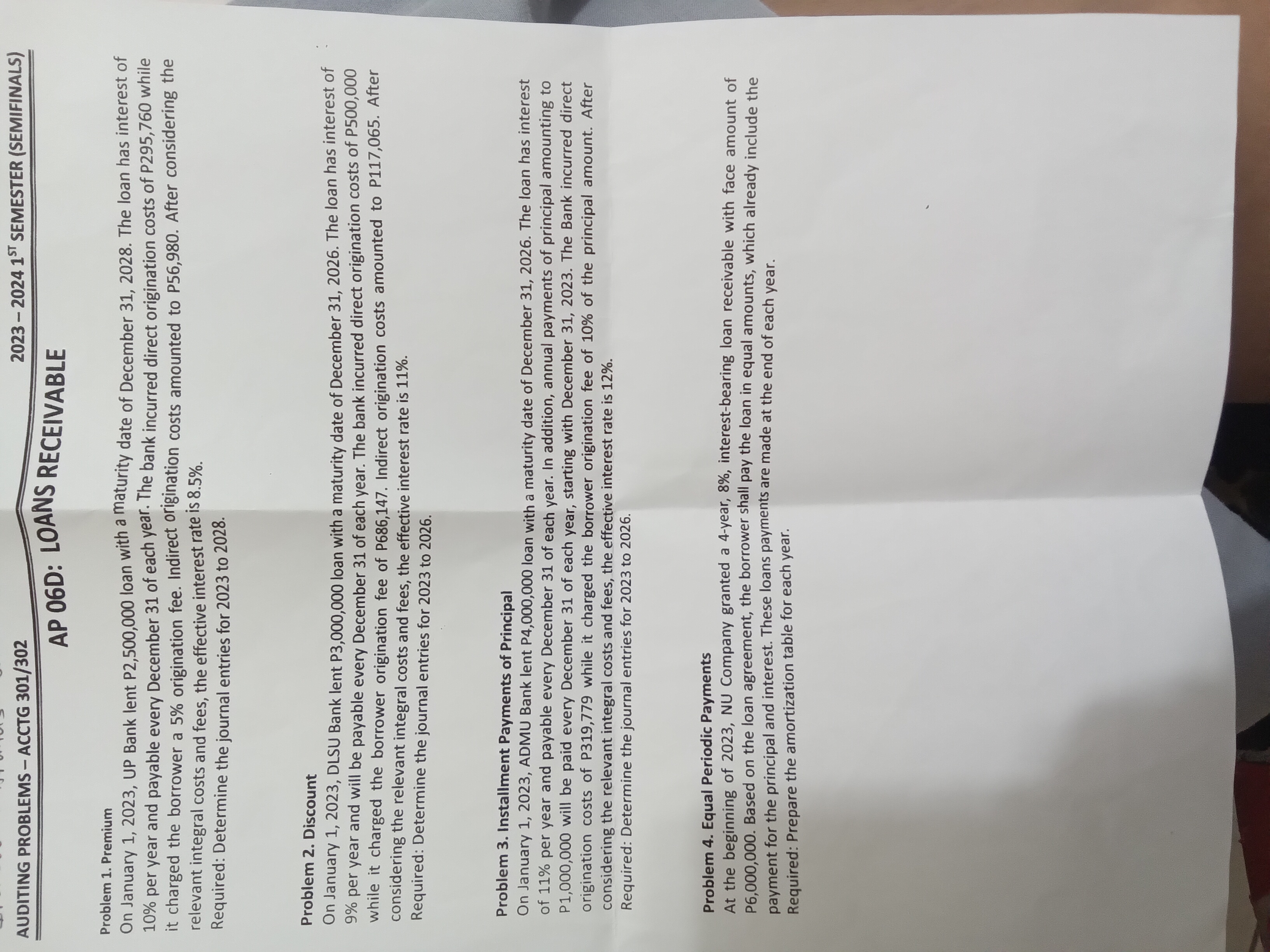

AUDITING PROBLEMS - ACCTG 301/302 2023 2024 1ST SEMESTER (SEMIFINALS) AP 06D: LOANS RECEIVABLE Problem 1. Premium On January 1, 2023, UP Bank lent P2,500,000 loan with a maturity date of December 31, 2028. The loan has interest of 10% per year and payable every December 31 of each year. The bank incurred direct origination costs of P295,760 while it charged the borrower a 5% origination fee. Indirect origination costs amounted to P56,980. After considering the relevant integral costs and fees, the effective interest rate is 8.5%. Required: Determine the journal entries for 2023 to 2028. Problem 2. Discount On January 1, 2023, DLSU Bank lent P3,000,000 loan with a maturity date of December 31, 2026. The loan has interest of 9% per year and will be payable every December 31 of each year. The bank incurred direct origination costs of P500,000 while it charged the borrower origination fee of P686,147. Indirect origination costs amounted to P117,065. After considering the relevant integral costs and fees, the effective interest rate is 11%. Required: Determine the journal entries for 2023 to 2026. Problem 3. Installment Payments of Principal On January 1, 2023, ADMU Bank lent P4,000,000 loan with a maturity date of December 31, 2026. The loan has interest of 11% per year and payable every December 31 of each year. In addition, annual payments of principal amounting to P1,000,000 will be paid every December 31 of each year, starting with December 31, 2023. The Bank incurred direct origination costs of P319,779 while it charged the borrower origination fee of 10% of the principal amount. After considering the relevant integral costs and fees, the effective interest rate is 12%. Required: Determine the journal entries for 2023 to 2026. Problem 4. Equal Periodic Payments At the beginning of 2023, NU Company granted a 4-year, 8%, interest-bearing loan receivable with face amount of P6,000,000. Based on the loan agreement, the borrower shall pay the loan in equal amounts, which already include the payment for the principal and interest. These loans payments are made at the end of each year. Required: Prepare the amortization table for each year.

Step by Step Solution

There are 3 Steps involved in it

Problem 1 Premium Journal entries for 2023 1 To record the loan disbursement Debit Loan Receivable UP Bank P2500000 Credit Cash P2500000 2 To record t... View full answer

Get step-by-step solutions from verified subject matter experts