Question: Covered Question # 4 ( 2 0 marks ) Target Inc sells credit card machines to banks. The credit cards are sold on the

Covered Question # marks

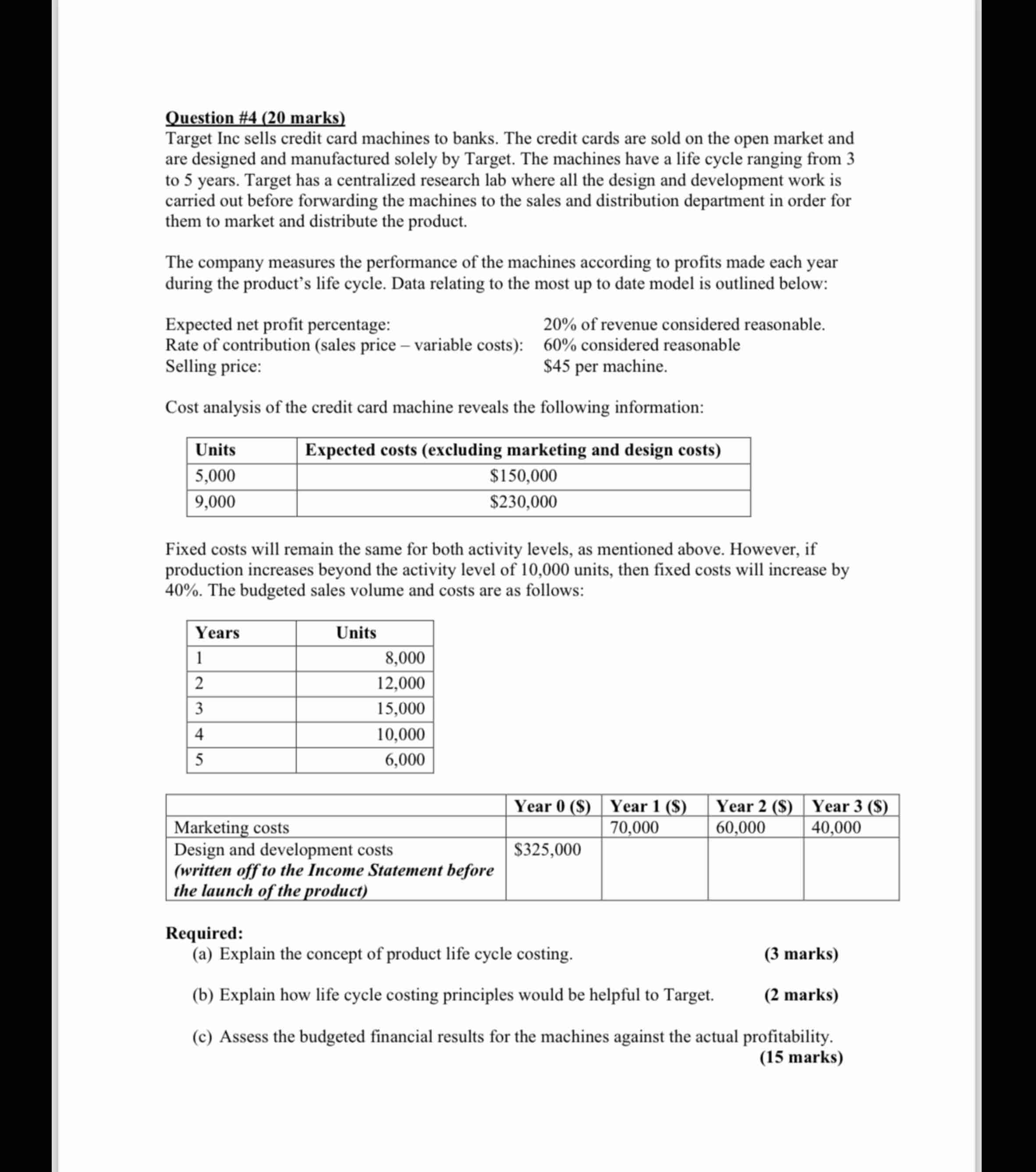

Target Inc sells credit card machines to banks. The credit cards are sold on the open market and are designed and manufactured solely by Target. The machines have a life cycle ranging from to years. Target has a centralized research lab where all the design and development work is carried out before forwarding the machines to the sales and distribution department in order for them to market and distribute the product.

The company measures the performance of the machines according to profits made each year during the product's life cycle. Data relating to the most up to date model is outlined below:

Expected net profit percentage:

Rate of contribution sales price variable costs:

Selling price:

of revenue considered reasonable.

considered reasonable

$ per machine.

Cost analysis of the credit card machine reveals the following information:

Fixed costs will remain the same for both activity levels, as mentioned above. However, if production increases beyond the activity level of units, then fixed costs will increase by The budgeted sales volume and costs are as follows:

Required:

a Explain the concept of product life cycle costing.

marks

b Explain how life cycle costing principles would be helpful to Target.

marks

c Assess the budgeted financial results for the machines against the actual profitability. marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock