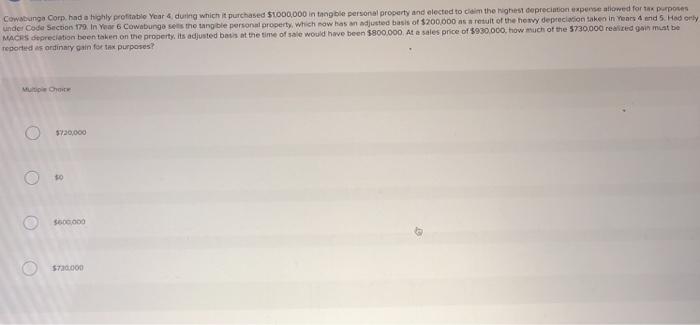

Question: Cowabung Corp. had a highly profitable Year 4 during which it purchased $1000,000 in tang ble personal property and elected to claim the highest depreciation

Cowabung Corp. had a highly profitable Year 4 during which it purchased $1000,000 in tang ble personal property and elected to claim the highest depreciation expense towed for tax purposes under Code Section 179 In Year 6 Cowabunge sets the tangible personal property, which now has an adjusted basis of $200,000 as a retult of the heavy depreciation taken in Years 4 and 5. Had only MACRS depreciation been taken on the property, its adjusted bass at the time of sale would have been 5800.000 At e sales price of 5930.000, how much of the 5730,000 rested in miste reported as ordinary gain for a purposes? Chat 5730,000 600.000 $720.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts