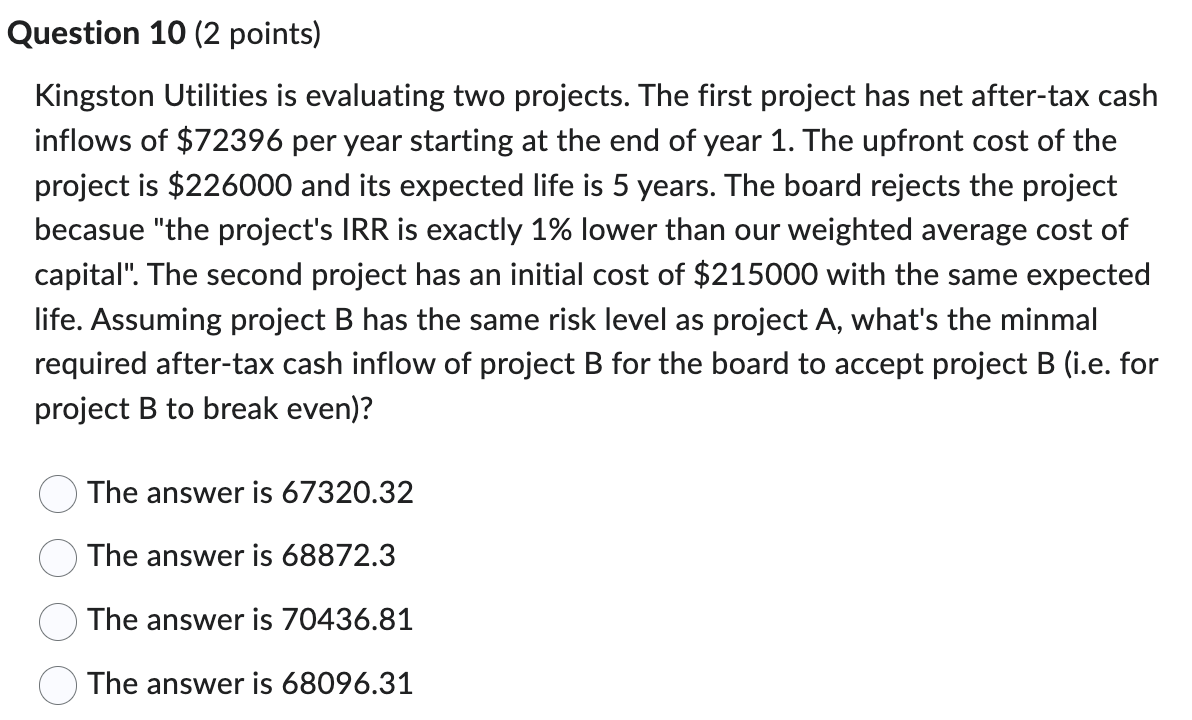

Question: Question 1 0 ( 2 points ) Kingston Utilities is evaluating two projects. The first project has net after - tax cash inflows of

Question points Kingston Utilities is evaluating two projects. The first project has net aftertax cash inflows of $ per year starting at the end of year The upfront cost of the project is $ and its expected life is years. The board rejects the project becasue "the project's IRR is exactly lower than our weighted average cost of capital". The second project has an initial cost of $ with the same expected life. Assuming project B has the same risk level as project A what's the minmal required aftertax cash inflow of project B for the board to accept project B ie for project B to break even The answer is The answer is The answer is The answer is

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock