Question: Crane Company started operations on January 1, 2020, and has used the FIFO method of inventory valuation since its inception. In 026, it decides

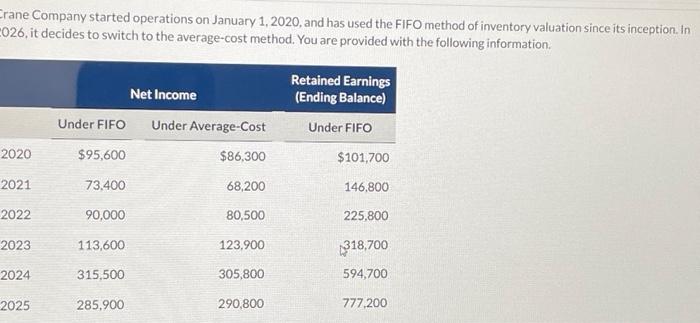

Crane Company started operations on January 1, 2020, and has used the FIFO method of inventory valuation since its inception. In 026, it decides to switch to the average-cost method. You are provided with the following information. Net Income Retained Earnings (Ending Balance) Under FIFO Under Average-Cost Under FIFO 2020 $95,600 $86,300 $101,700 2021 73,400 68,200 146,800 2022 90,000 80,500 225,800 2023 113,600 123,900 318,700 2024 315,500 305,800 594,700 2025 285,900 290,800 777,200 What is the beginning retained earnings balance at January 1, 2022, if Crane prepares comparative financial statements starting in 2022? Retained earnings, January 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts