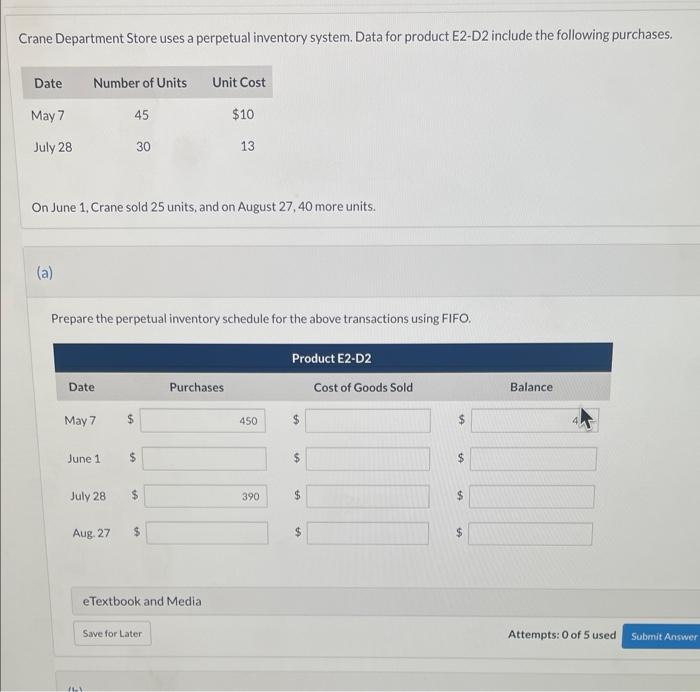

Question: Crane Department Store uses a perpetual inventory system. Data for product E2-D2 include the following purchases. On June 1, Crane sold 25 units, and on

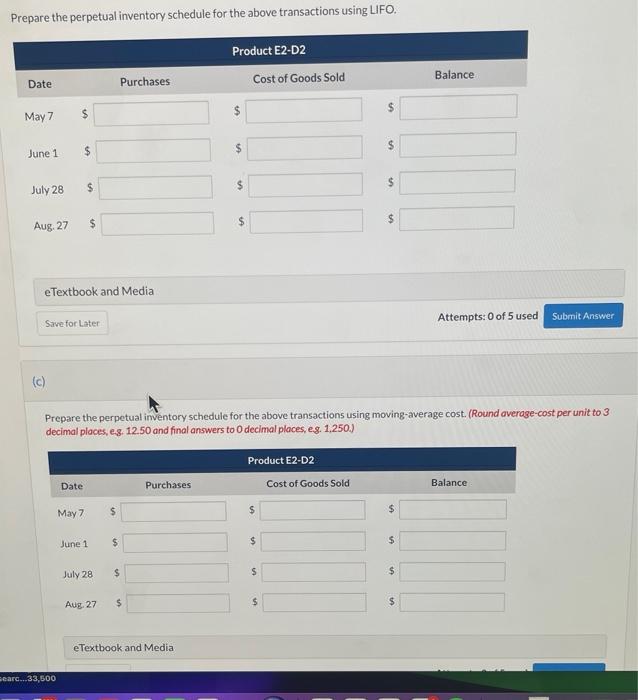

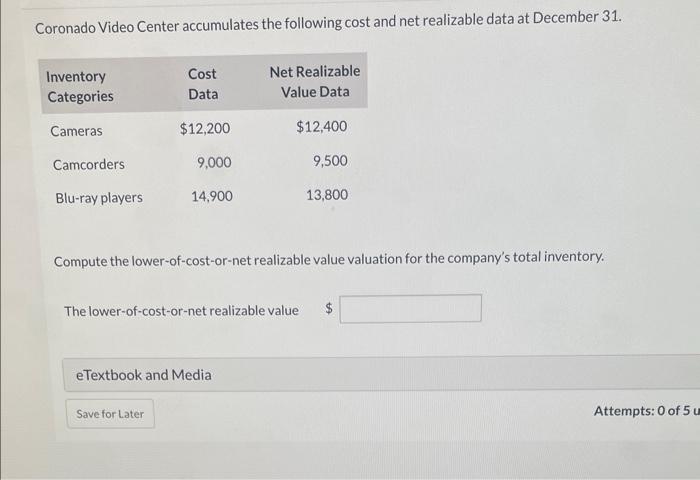

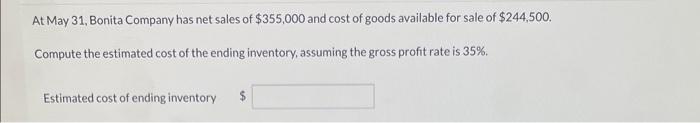

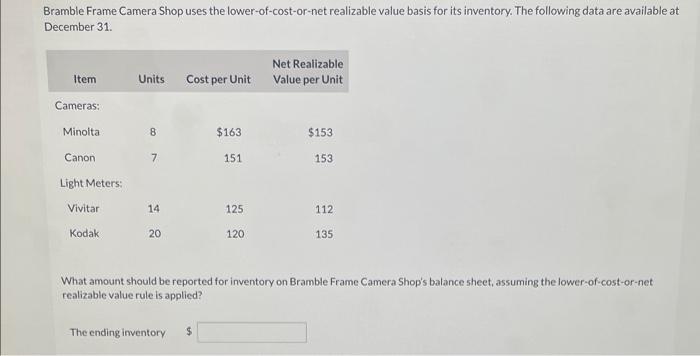

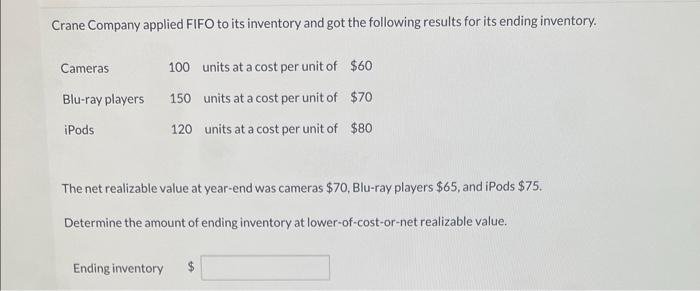

Crane Department Store uses a perpetual inventory system. Data for product E2-D2 include the following purchases. On June 1, Crane sold 25 units, and on August 27,40 more units. (a) Prepare the perpetual inventory schedule for the above transactions using FIFO. Prepare the perpetual inventory schedule for the above transactions using LIFO. eTextbook and Media Attempts: 0 of 5 used (c) Prepare the perpetual inventory schedule for the above transactions using moving-average cost. (Round average-cost per unit to 3 decimal places, e. .12.50 and final answers to 0 decimal places, eg. 1,250.) Coronado Video Center accumulates the following cost and net realizable data at December 31. Compute the lower-of-cost-or-net realizable value valuation for the company's total inventory. The lower-of-cost-or-net realizable value At May 31, Bonita Company has net sales of $355,000 and cost of goods available for sale of $244,500. Compute the estimated cost of the ending inventory, assuming the gross profit rate is 35%. Estimated cost of ending inventory Bramble Frame Camera Shop uses the lower-of-cost-or-net realizable value basis for its inventory. The following data are available at December 31 . What amount should be reported for inventory on Bramble Frame Camera Shop's balance sheet, assuming the lower-of-cost-or-net realizable value rule is applied? The ending inventory Crane Company applied FIFO to its inventory and got the following results for its ending inventory. The net realizable value at year-end was cameras $70, Blu-ray players $65, and iPods $75. Determine the amount of ending inventory at lower-of-cost-or-net realizable value. Ending inventory

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts