Question: Crane Stores is a new company that started operations on March 1, 2024. The company has decided to use a perpetual inventory system. The

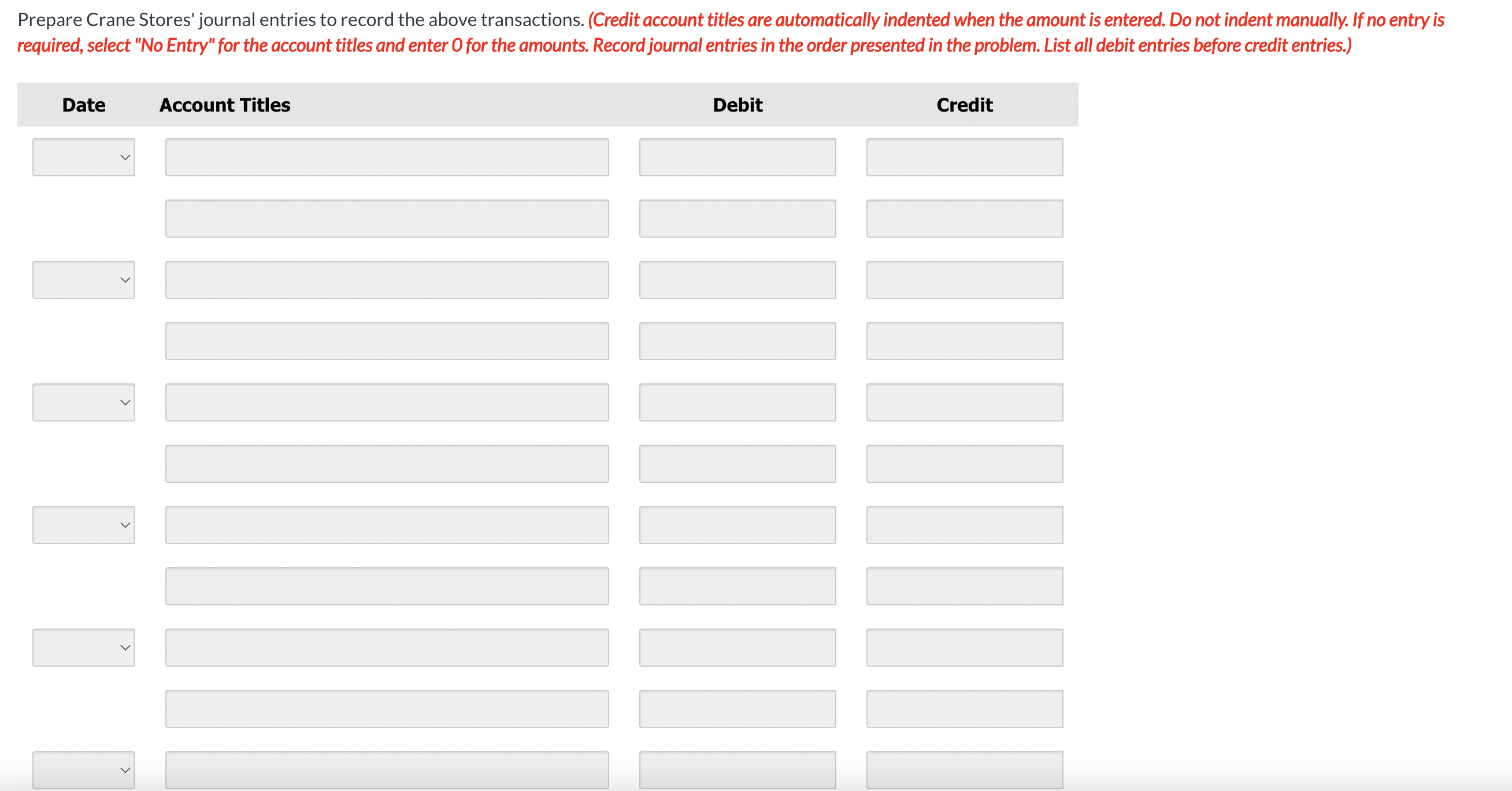

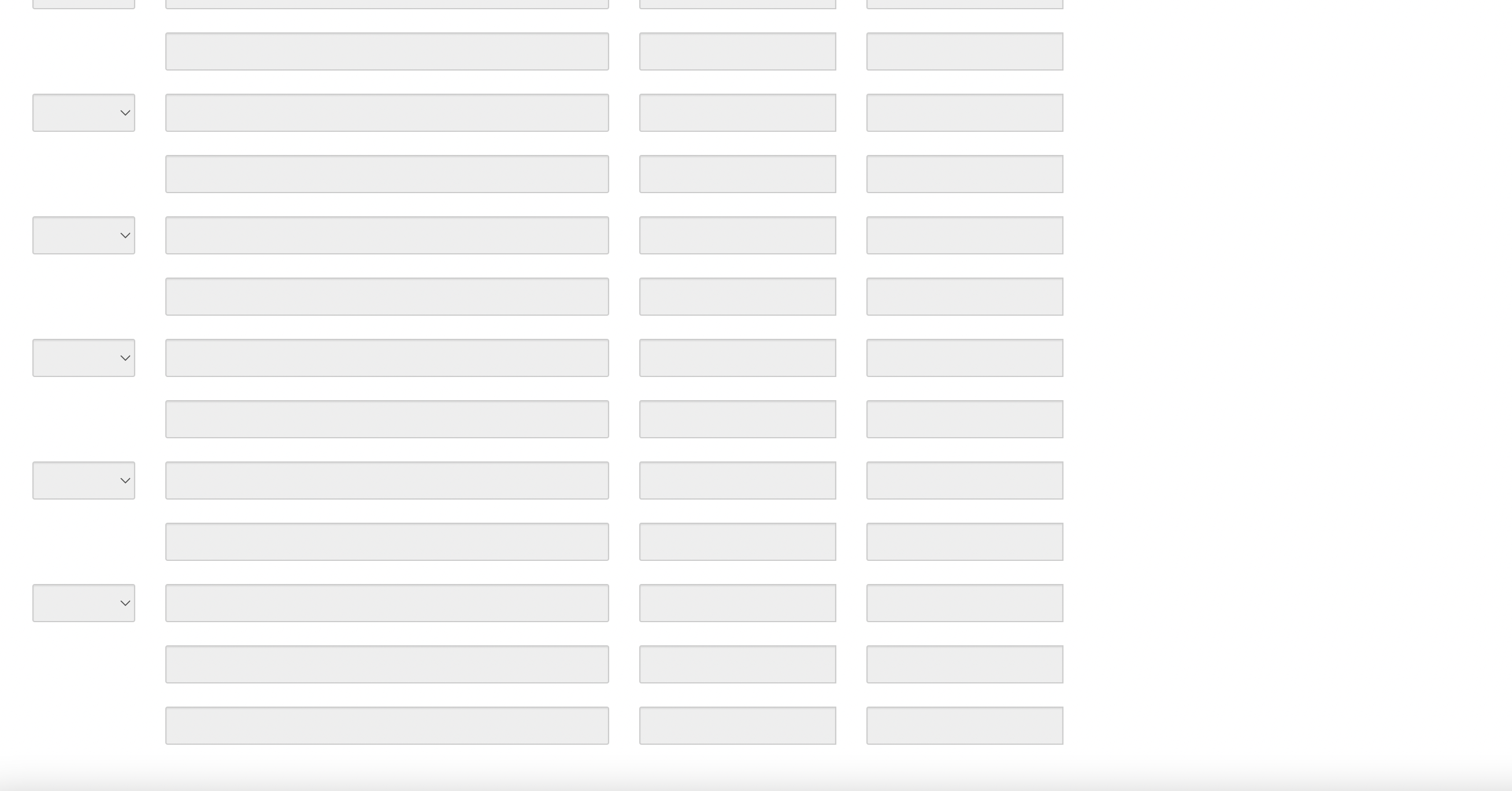

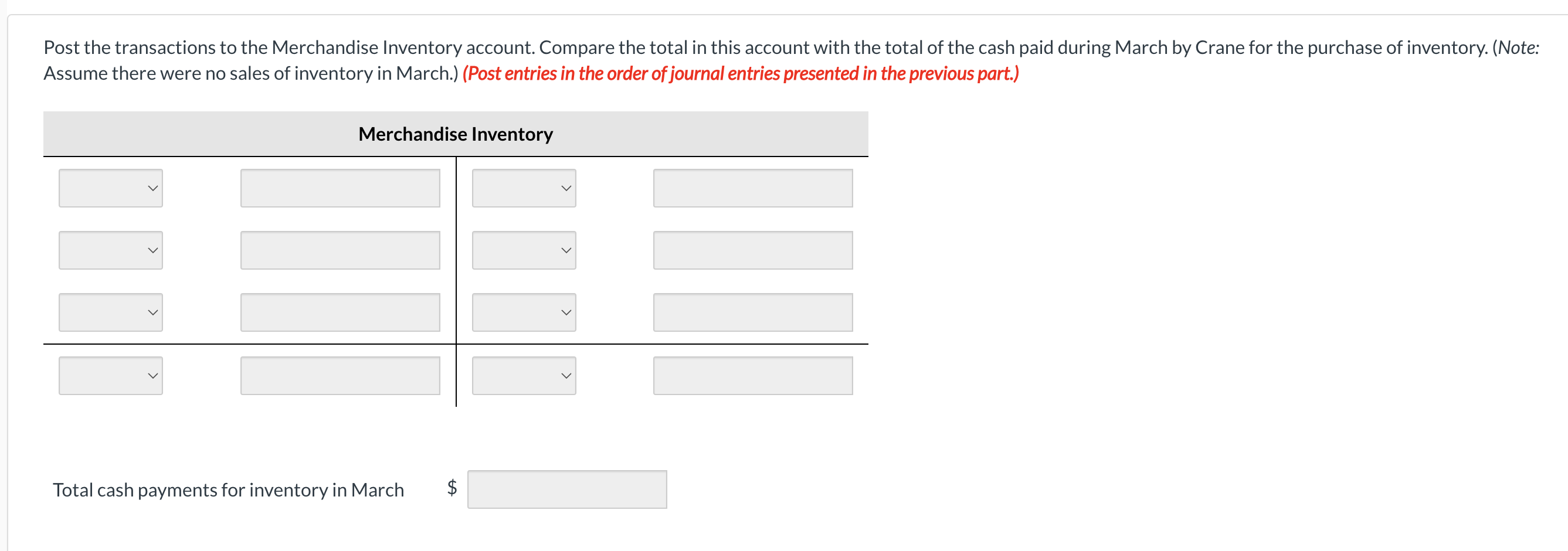

Crane Stores is a new company that started operations on March 1, 2024. The company has decided to use a perpetual inventory system. The following purchase transactions occurred in March: Mar. 1 Crane Stores purchases $8,600 of merchandise for resale from Octagon Wholesalers, terms 2/10, n/30, FOB shipping point. 2 The correct company pays $145 for the shipping charges. 3 Crane returns $1,200 of the merchandise purchased on March 1 because it was the wrong colour. Octagon gives Crane a $1,200 credit on its account. 21 Crane Stores purchases an additional $12,000 of merchandise for resale from Octagon Wholesalers, terms 2/10, n/30, FOB destination. 22 The correct company pays $160 for freight charges. 23 30 31 Crane returns $500 of the merchandise purchased on March 21 because it was damaged. Octagon gives Crane a $500 credit on its account. Crane paid Octagon the amount owing for the merchandise purchased on March 1. Crane paid Octagon the amount owing for the merchandise purchased on March 21. Prepare Crane Stores' journal entries to record the above transactions. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Record journal entries in the order presented in the problem. List all debit entries before credit entries.) Date Account Titles Debit Credit > > > > > Post the transactions to the Merchandise Inventory account. Compare the total in this account with the total of the cash paid during March by Crane for the purchase of inventory. (Note: Assume there were no sales of inventory in March.) (Post entries in the order of journal entries presented in the previous part.) Merchandise Inventory Total cash payments for inventory in March +A

Step by Step Solution

There are 3 Steps involved in it

To determine the cost of goods sold ending inventory and accounts payable for Crane Stores in March lets analyze the purchase transactions 1 March 1 C... View full answer

Get step-by-step solutions from verified subject matter experts