Question: Crane T Corporation is comparing two different options. Crane T currently uses Option 1, with revenues of $79,000 per year, maintenance expenses of $6,100

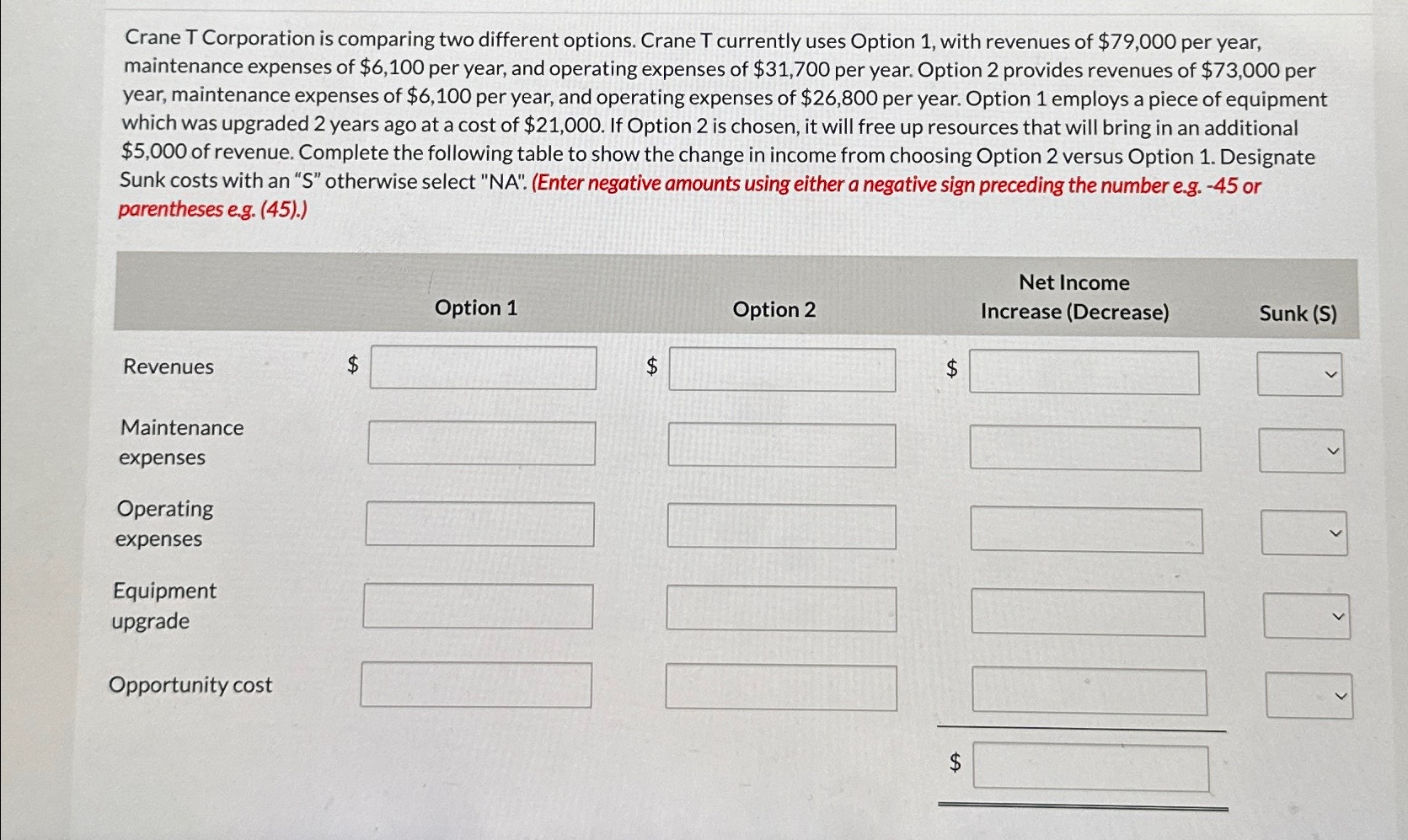

Crane T Corporation is comparing two different options. Crane T currently uses Option 1, with revenues of $79,000 per year, maintenance expenses of $6,100 per year, and operating expenses of $31,700 per year. Option 2 provides revenues of $73,000 per year, maintenance expenses of $6,100 per year, and operating expenses of $26,800 per year. Option 1 employs a piece of equipment which was upgraded 2 years ago at a cost of $21,000. If Option 2 is chosen, it will free up resources that will bring in an additional $5,000 of revenue. Complete the following table to show the change in income from choosing Option 2 versus Option 1. Designate Sunk costs with an "S" otherwise select "NA". (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Revenues Maintenance expenses Operating expenses Equipment upgrade Opportunity cost Option 1 Option 2 Net Income Increase (Decrease) Sunk (S) $ $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts