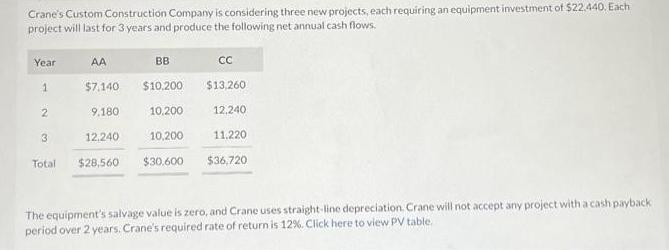

Question: Crane's Custom Construction Company is considering three new projects, each requiring an equipment investment of $22.440. Each project will last for 3 years and

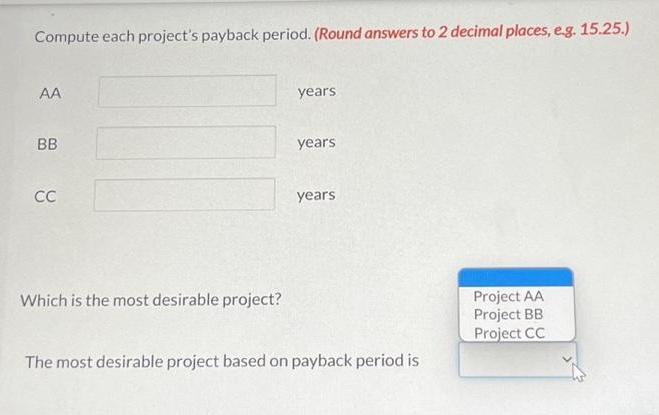

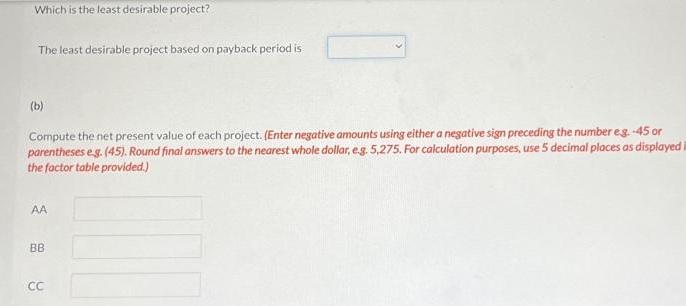

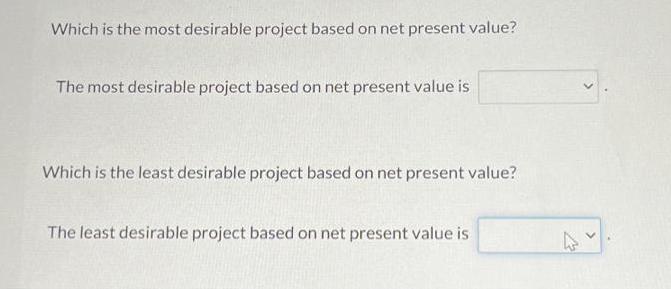

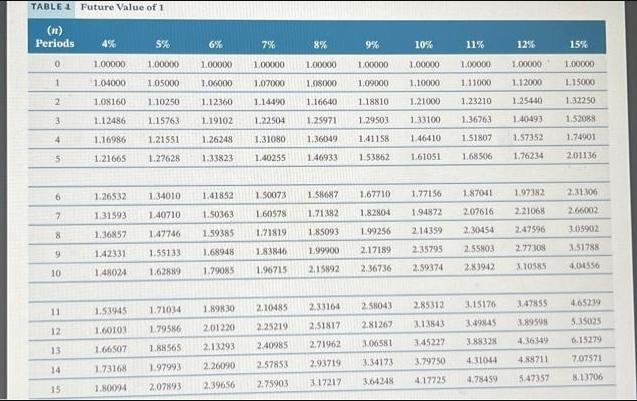

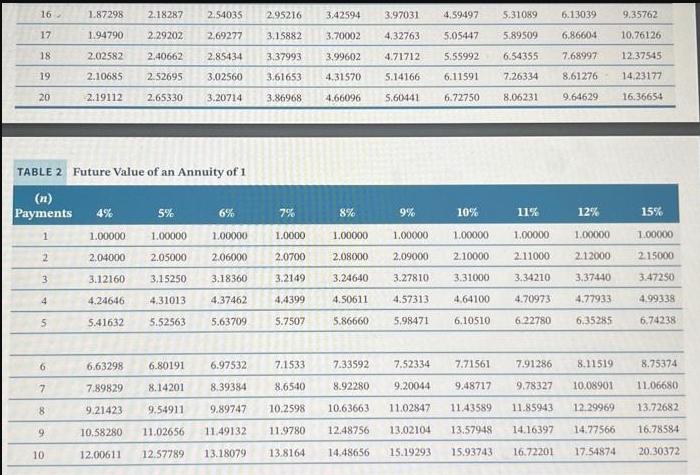

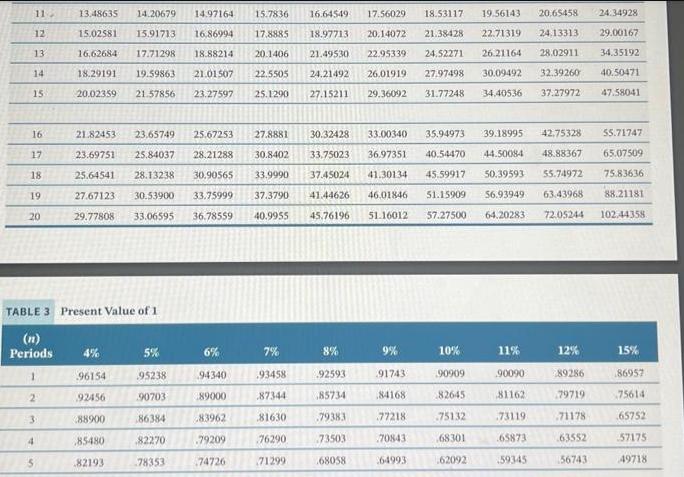

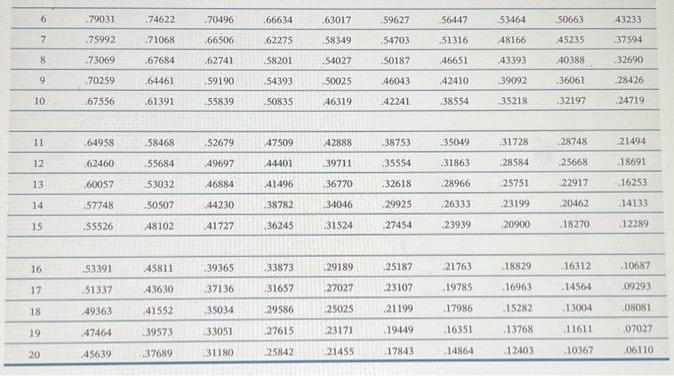

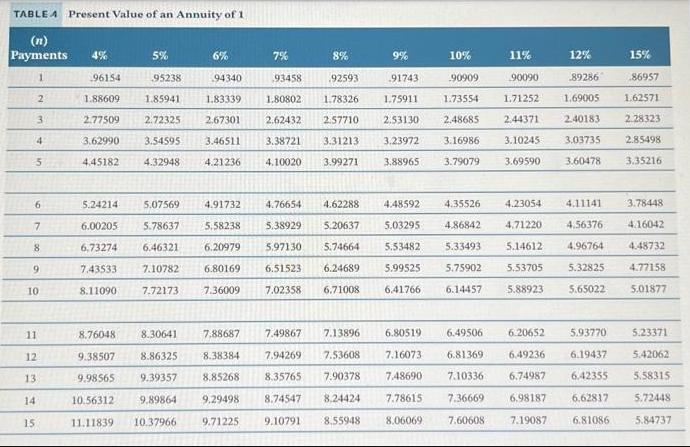

Crane's Custom Construction Company is considering three new projects, each requiring an equipment investment of $22.440. Each project will last for 3 years and produce the following net annual cash flows. Year 1 2 AA BB $7.140 $10,200 9.180 12.240 10,200 10,200 3 Total $28,560 $30.600 CC $13,260 12,240 11.220 $36,720 The equipment's salvage value is zero, and Crane uses straight-line depreciation. Crane will not accept any project with a cash payback period over 2 years. Crane's required rate of return is 12%. Click here to view PV table.

Step by Step Solution

3.63 Rating (161 Votes )

There are 3 Steps involved in it

To compute each projects payback period we need to determine how long it takes for the cumulative ca... View full answer

Get step-by-step solutions from verified subject matter experts