Question: Crawford Coffee is considering a project with an initial cost of $53,200, and cash flows of $19,600, $22,000, $38,000, and -$13,200 for Years 1 to

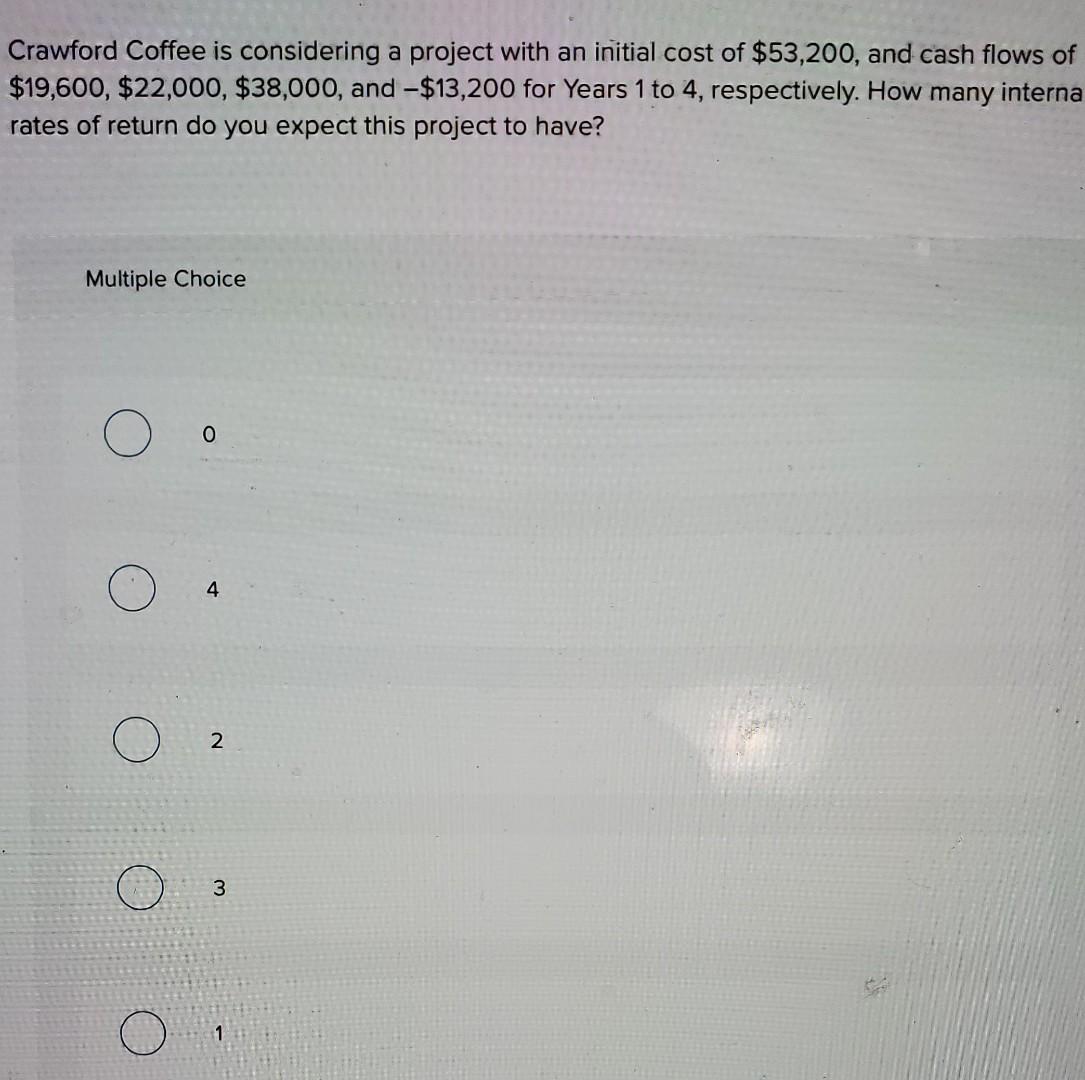

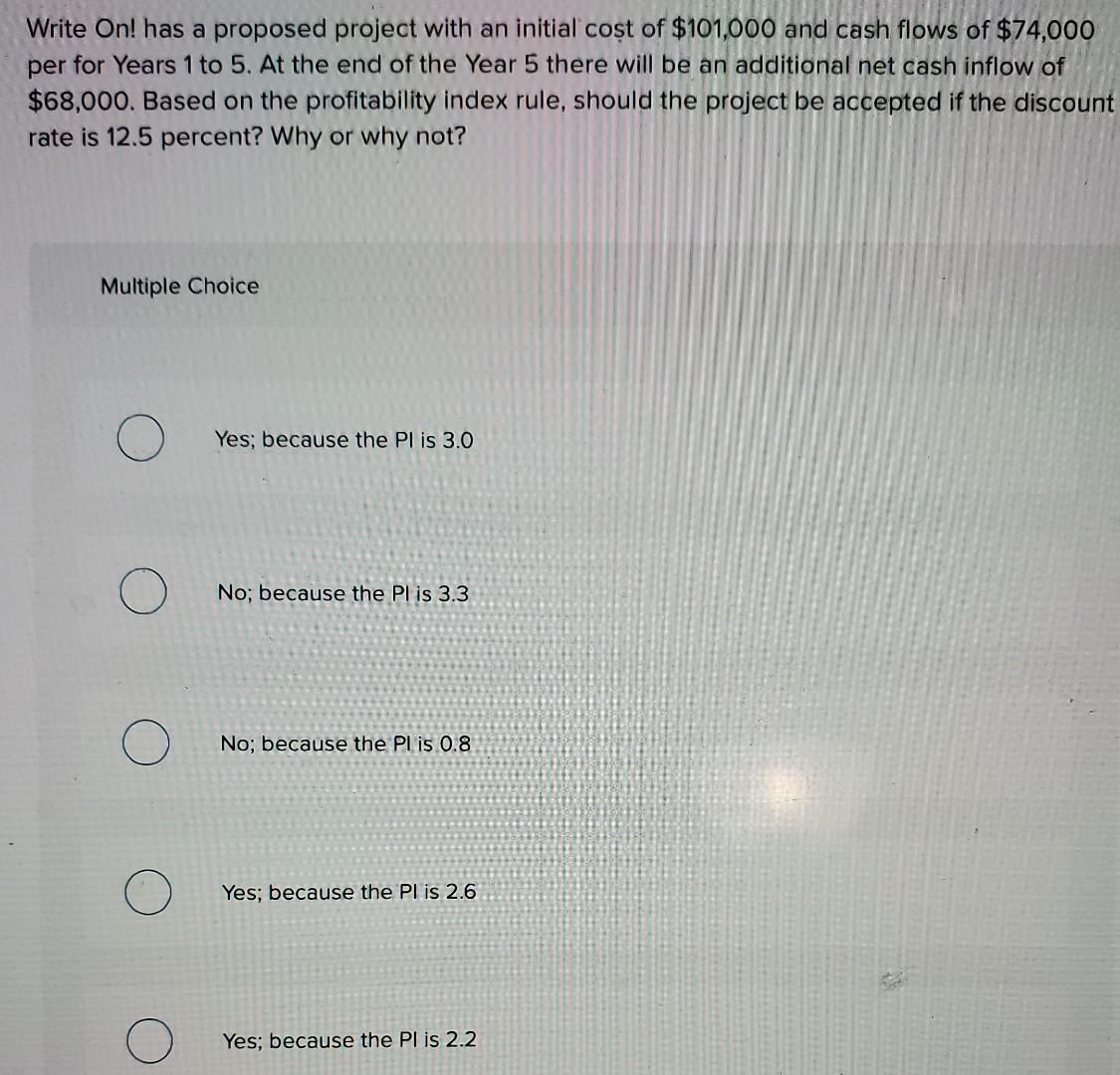

Crawford Coffee is considering a project with an initial cost of $53,200, and cash flows of $19,600, $22,000, $38,000, and -$13,200 for Years 1 to 4, respectively. How many interna rates of return do you expect this project to have? Multiple Choice 0 4 2 3 1 Write On! has a proposed project with an initial cost of $101,000 and cash flows of $74,000 per for Years 1 to 5. At the end of the Year 5 there will be an additional net cash inflow of $68,000. Based on the profitability index rule, should the project be accepted if the discount rate is 12.5 percent? Why or why not? Multiple Choice Yes, because the Pl is 3.0 No; because the Pl is 3.3 No; because the Plis 0.8 Yes; because the Pl is 2.6 Yes; because the PL is 2.2 Crawford Coffee is considering a project with an initial cost of $53,200, and cash flows of $19,600, $22,000, $38,000, and -$13,200 for Years 1 to 4, respectively. How many interna rates of return do you expect this project to have? Multiple Choice 0 4 2 3 1 Write On! has a proposed project with an initial cost of $101,000 and cash flows of $74,000 per for Years 1 to 5. At the end of the Year 5 there will be an additional net cash inflow of $68,000. Based on the profitability index rule, should the project be accepted if the discount rate is 12.5 percent? Why or why not? Multiple Choice Yes, because the Pl is 3.0 No; because the Pl is 3.3 No; because the Plis 0.8 Yes; because the Pl is 2.6 Yes; because the PL is 2.2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts