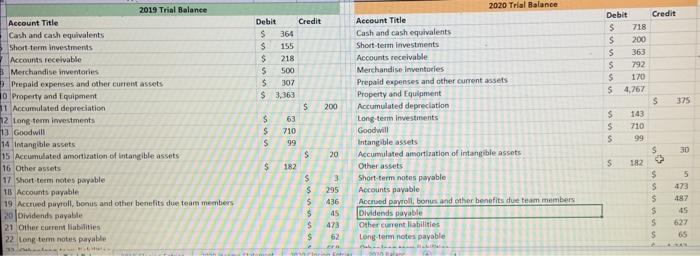

Question: create 2019 closing entries and 2020 closing entries using given information Credit Debit $ 364 $ 155 $ 218 $ 500 $ 307 $ 3,363

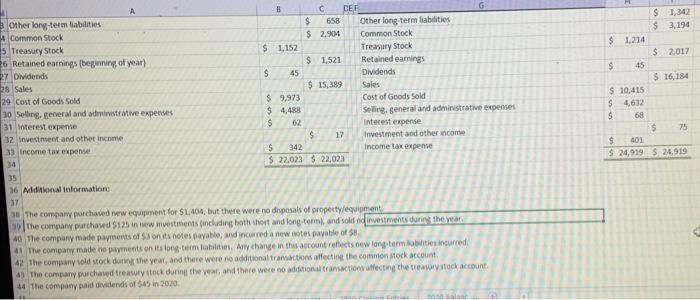

Credit Debit $ 364 $ 155 $ 218 $ 500 $ 307 $ 3,363 375 S 200 2019 Trial Balance Account Title Cash and cash equivalents Short-term investments Accounts receivable Merchandise inventories Prepaid expenses and other current assets 10 Property and Equipment Accumulated depreciation 2 long term investments 13 Goodwill 14 Intangible assets 15 Accumulated amortization of intangible assets 16 Other assets 17 Short term notes payable 16 Accounts payable 19 Accrued payroll, bonus and other benefits due team members 20 Dividends payable 21 Other current liabilities 22 Long term notes payable $ $ $ 63 710 99 2020 Trial Balance Account Title Cash and cash equivalents Short-term investments Accounts receivable Merchandise inventories Prepaid expenses and other current assets Property and Equipment Accumulated depreciation Long-term Investments Goodwill Intangible assets Accumulated amortization of intangible assets Other assets Short-term notes payable Accounts payable Accrued payroll, bonus and other benefits due team members Dividends payable Other current liabilities Long-term notes payable Debit Credit $ 718 s 200 S 363 $ 792 s 170 S 4,767 $ $ 143 5 710 $ 99 $ -30 5 182 + $ 5 S 473 5 487 $ 45 S 627 S 65 S 20 $ 182 3 $ $ 5 $ S $ 295 436 45 473 62 CEF B Other long-term liabilities $ 658 Other long-term liabilities Common Stock $ 2.904 Common Stock 5. Treasury Stock $ 1,152 Treasury Stock 6 Retained earnings (beginning of year) $ 1,521 Retained earnings 27 Dividends $ 45 Dividends 28 Sales $ 15,389 Sales 29 Cost of Goods Sold $ 9,973 Cost of Goods Sold 30 Selling general and administrative expenses $ 4,488 Selling general and administrative expenses 31 interest expense $ 62 Interest expense 32 investment and other income $ 19 Investment and other income 33 Income tax expense 5 342 Income tax expense 34 $ 22,022 $ 22,023 35 36 Additional information 37 30 The company purchased new equipment for $1,404, but there were no disposals of property/equipment The company purchased $125 in new investments including both short and long term and sold nd investments in the war 40 The company made payments of 53 on its notes payable, and incurred a new notes payable of 41 The company made no payments on its long term liabilities. Ally change in this account reflects new long-term Babilities incurred 42 The company old stock dur the year, and there were no additional transactions affecting the common stock account 41 The company purchaud treasury stock during the year, and there were no additional transactions affecting the treasury stock account 44 The company paid dividends of 545 in 2020 $ 1,342 $ 3,194 $ 1,214 $ 2,017 $ 45 $. 16, 184 $ 10,415 $ $ 68 $ 75 $ 401 $ 24,919 $ 24.919

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts