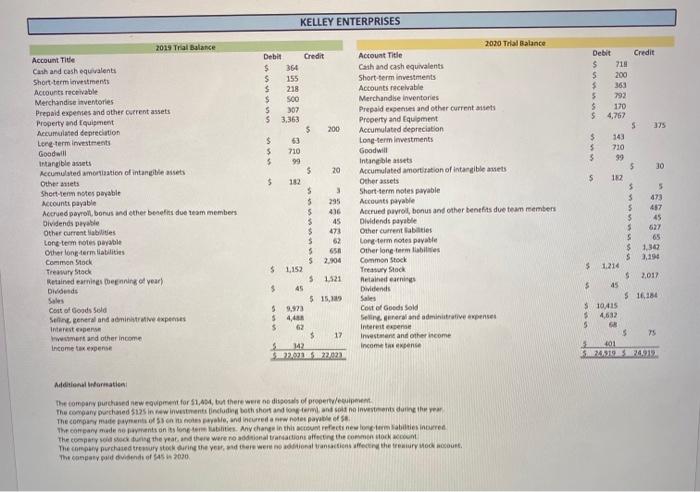

Question: Hi, please provide 2019 Closing entries. Please post so i can see entire numbers, Thank you :) KELLEY ENTERPRISES Debit 2019 Trial Balance Account Title

KELLEY ENTERPRISES Debit 2019 Trial Balance Account Title Cash and cash equivalents Short-term investments Accounts receivable Merchandise inventories Prepaid expenses and other current assets Property and Equipment Accumulated depreciation Long-term investments Goodwill Intangible assets Accumulated amortion of intangibles Other stets Short-term notes payable Account payable Credit $ 364 $ 155 $ 218 $ SOO $ 307 $ 3.363 $ 200 $ 63 $ 710 $ 99 5 20 $ 182 5 3 5 295 $ 216 $ 45 $ 473 $ 62 5 658 $ 2.904 $ 1152 5 1.521 45 $ 15,89 59.923 $4,400 $ $ 17 3 142 2020 Trial Balance Account Title Cash and cash equivalents Short-term investments Accounts receivable Merchandise inventories Prepaid expenses and other current assets Property and Equipment Accumulated depreciation Long-term investments Goodwill Intangible sets Accumulated amortization of intangible assets Other assets Short-term notes payable Accounts payable Accrued payroll, bonus and other benefits due team members Dividends payable Other current Babies Long term notes payable Other long term biles Common Stock Treasury Stock Related earnings Dividends Sales Cost of Goods Sold Seine end administrative expenses Interesten Investment and other income Income teense Debit Credit $ 713 $ 200 $ 363 5 792 $ 170 5 4,762 5 375 $ 143 5 710 5 99 5 30 5 182 $ 5 5 473 5 457 $ 45 5 5 65 $ 1,300 $ 3,194 5 1.214 $ 2,017 $ 45 516184 310415 4,632 5 GR 5 TS 401 51724319324012 Accrued payroll, bonus and other benefits due team members Dividends peable Other currenties Lone temnotes payable Other long term tatilities Common Stock Treaty Stock Retained earnings benning of year) Didonds Cost of Goods Sold Seine Beneral and administrative expenses Interest expert viwment and other income Income tax expense Additional Womation The company purchased new equipment for 51.4, but there were no dia of property The company purchased 12 in winstens including both short and long term and son investments during the year The company made aynants of all, and incurred a new payable of The correny de parents on its one bites Any change in this reflectinewone mobilities incuren The company in the year, and there were notional actions affecting the cock The company purchased tremur stock in the year, there were notional transactions were the treure court The contraddvidends of S457000 KELLEY ENTERPRISES Debit 2019 Trial Balance Account Title Cash and cash equivalents Short-term investments Accounts receivable Merchandise inventories Prepaid expenses and other current assets Property and Equipment Accumulated depreciation Long-term investments Goodwill Intangible assets Accumulated amortion of intangibles Other stets Short-term notes payable Account payable Credit $ 364 $ 155 $ 218 $ SOO $ 307 $ 3.363 $ 200 $ 63 $ 710 $ 99 5 20 $ 182 5 3 5 295 $ 216 $ 45 $ 473 $ 62 5 658 $ 2.904 $ 1152 5 1.521 45 $ 15,89 59.923 $4,400 $ $ 17 3 142 2020 Trial Balance Account Title Cash and cash equivalents Short-term investments Accounts receivable Merchandise inventories Prepaid expenses and other current assets Property and Equipment Accumulated depreciation Long-term investments Goodwill Intangible sets Accumulated amortization of intangible assets Other assets Short-term notes payable Accounts payable Accrued payroll, bonus and other benefits due team members Dividends payable Other current Babies Long term notes payable Other long term biles Common Stock Treasury Stock Related earnings Dividends Sales Cost of Goods Sold Seine end administrative expenses Interesten Investment and other income Income teense Debit Credit $ 713 $ 200 $ 363 5 792 $ 170 5 4,762 5 375 $ 143 5 710 5 99 5 30 5 182 $ 5 5 473 5 457 $ 45 5 5 65 $ 1,300 $ 3,194 5 1.214 $ 2,017 $ 45 516184 310415 4,632 5 GR 5 TS 401 51724319324012 Accrued payroll, bonus and other benefits due team members Dividends peable Other currenties Lone temnotes payable Other long term tatilities Common Stock Treaty Stock Retained earnings benning of year) Didonds Cost of Goods Sold Seine Beneral and administrative expenses Interest expert viwment and other income Income tax expense Additional Womation The company purchased new equipment for 51.4, but there were no dia of property The company purchased 12 in winstens including both short and long term and son investments during the year The company made aynants of all, and incurred a new payable of The correny de parents on its one bites Any change in this reflectinewone mobilities incuren The company in the year, and there were notional actions affecting the cock The company purchased tremur stock in the year, there were notional transactions were the treure court The contraddvidends of S457000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts