Question: Create a Base Case using the following information. A project has an estimated investment in equipment of $440 million. Transportation and installation costs are $60

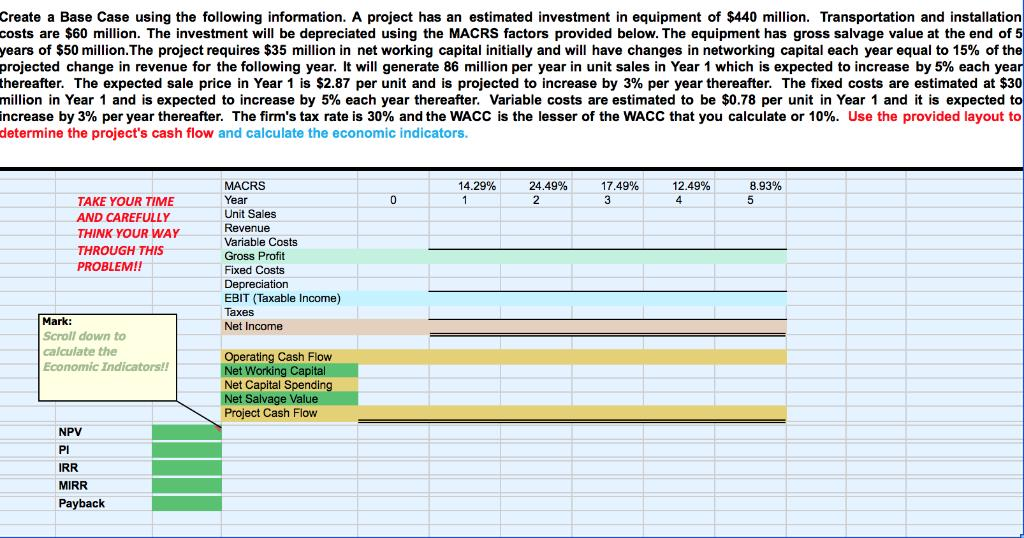

Create a Base Case using the following information. A project has an estimated investment in equipment of $440 million. Transportation and installation costs are $60 million. The investment will be depreciated using the MACRS factors provided below. The equipment has gross salvage value at the end of 5 years of $50 million.The project requires $35 million in net working capital initially and will have changes in networking capital each year equal to 15% of the projected change in revenue for the following year. It will generate 86 million per year in unit sales in Year 1 which is expected to increase by 5% each year thereafter. The expected sale price in Year 1 is $2.87 per unit and is projected to increase by 3% per year thereafter. The fixed costs are estimated at $30 million in Year 1 and is expected to increase by 5% each year thereafter. Variable costs are estimated to be $0.78 per unit in Year 1 and t is expecte to increase by 3% per year thereafter. The firm's tax rate is 30% and the WACC is the lesser of the WACC that you calculate or 10%. Use the provided layout to determine the project's cash flow and calculate the economic indicators 8.93% 5 14.29% 24.49% 17.49% 12.49% 4 2 MACRS TAKE YOUR TIME AND CAREFULLY THINK YOUR WAY THROUGH THIS Gross Profit Fixed Costs Depreciation EBIT (Taxable Income) Taxes Mark: Scroll down to calculate the Operating Cash Flow Net Capital Spending Net Salvage MIRR Payback

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts