Question: Create Base Case using the following information. A five-year project has an estimated investment in equipment of $460 million. Transportation and installation costs are $60

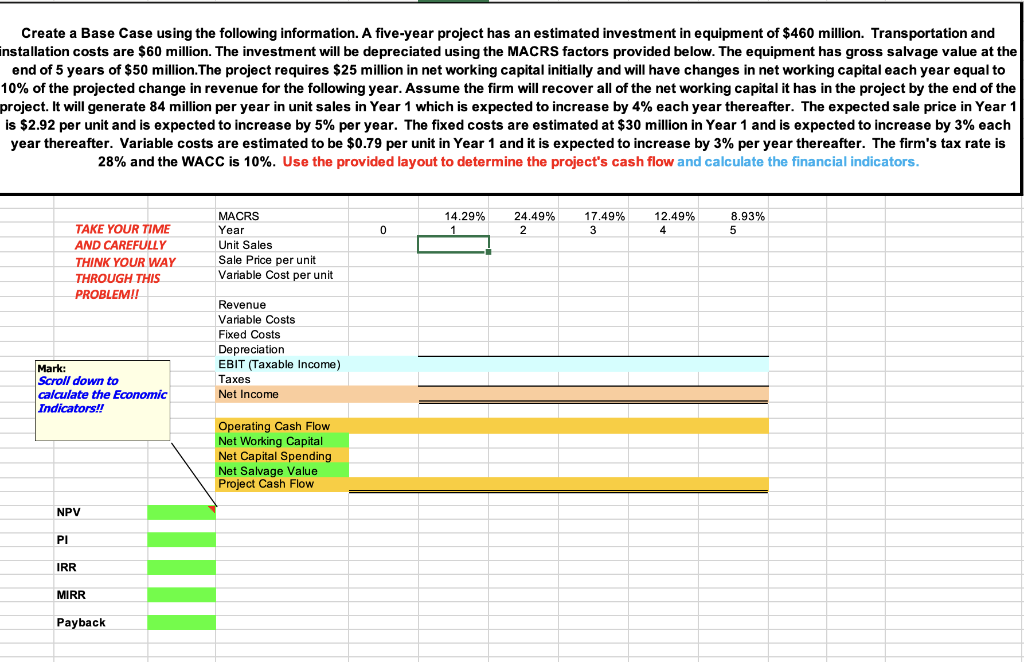

Create Base Case using the following information. A five-year project has an estimated investment in equipment of $460 million. Transportation and installation costs are $60 million. The investment will be depreciated using the MACRS factors provided below. The equipment has gross salvage value at the end of 5 years of $50 million. The project requires $25 million in net working capital initially and will have changes in net working capital each year equal to 10% of the projected change in revenue for the following year. Assume the firm will recover all of the net working capital it has in the project by the end of the project. It will generate 84 million per year in unit sales in Year 1 which is expected to increase by 4% each year thereafter. The expected sale price in Year 1 is $2.92 per unit and is expected to increase by 5% per year. The fixed costs are estimated at $30 million in Year 1 and is expected to increase by 3% each year thereafter. Variable costs are estimated to be $0.79 per unit in Year 1 and it is expected to increase by 3% per year thereafter. The firm's tax rate is 28% and the WACC is 10%. Use the provided layout to determine the project's cash flow and calculate the financial indicators. 14.29% 1 24.49% 2 17.49% 3 12.49% 4 8.93% 5 0 TAKE YOUR TIME AND CAREFULLY THINK YOUR WAY THROUGH THIS PROBLEM!! MACRS Year Unit Sales Sale Price per unit Variable Cost per unit Revenue Variable Costs Fixed Costs Depreciation EBIT (Taxable income) Taxes Net Income Mark: : Scroll down to calculate the Economic Indicators!! Operating Cash Flow Net Working Capital Net Capital Spending Net Salvage Value Project Cash Flow NPV PI IRR MIRR Payback Create Base Case using the following information. A five-year project has an estimated investment in equipment of $460 million. Transportation and installation costs are $60 million. The investment will be depreciated using the MACRS factors provided below. The equipment has gross salvage value at the end of 5 years of $50 million. The project requires $25 million in net working capital initially and will have changes in net working capital each year equal to 10% of the projected change in revenue for the following year. Assume the firm will recover all of the net working capital it has in the project by the end of the project. It will generate 84 million per year in unit sales in Year 1 which is expected to increase by 4% each year thereafter. The expected sale price in Year 1 is $2.92 per unit and is expected to increase by 5% per year. The fixed costs are estimated at $30 million in Year 1 and is expected to increase by 3% each year thereafter. Variable costs are estimated to be $0.79 per unit in Year 1 and it is expected to increase by 3% per year thereafter. The firm's tax rate is 28% and the WACC is 10%. Use the provided layout to determine the project's cash flow and calculate the financial indicators. 14.29% 1 24.49% 2 17.49% 3 12.49% 4 8.93% 5 0 TAKE YOUR TIME AND CAREFULLY THINK YOUR WAY THROUGH THIS PROBLEM!! MACRS Year Unit Sales Sale Price per unit Variable Cost per unit Revenue Variable Costs Fixed Costs Depreciation EBIT (Taxable income) Taxes Net Income Mark: : Scroll down to calculate the Economic Indicators!! Operating Cash Flow Net Working Capital Net Capital Spending Net Salvage Value Project Cash Flow NPV PI IRR MIRR Payback

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts