Question: create a cash flow statement a . Income Statement Data for 2 0 XX: Units produced and sold = 4 2 0 Sales ( $

create a cash flow statement

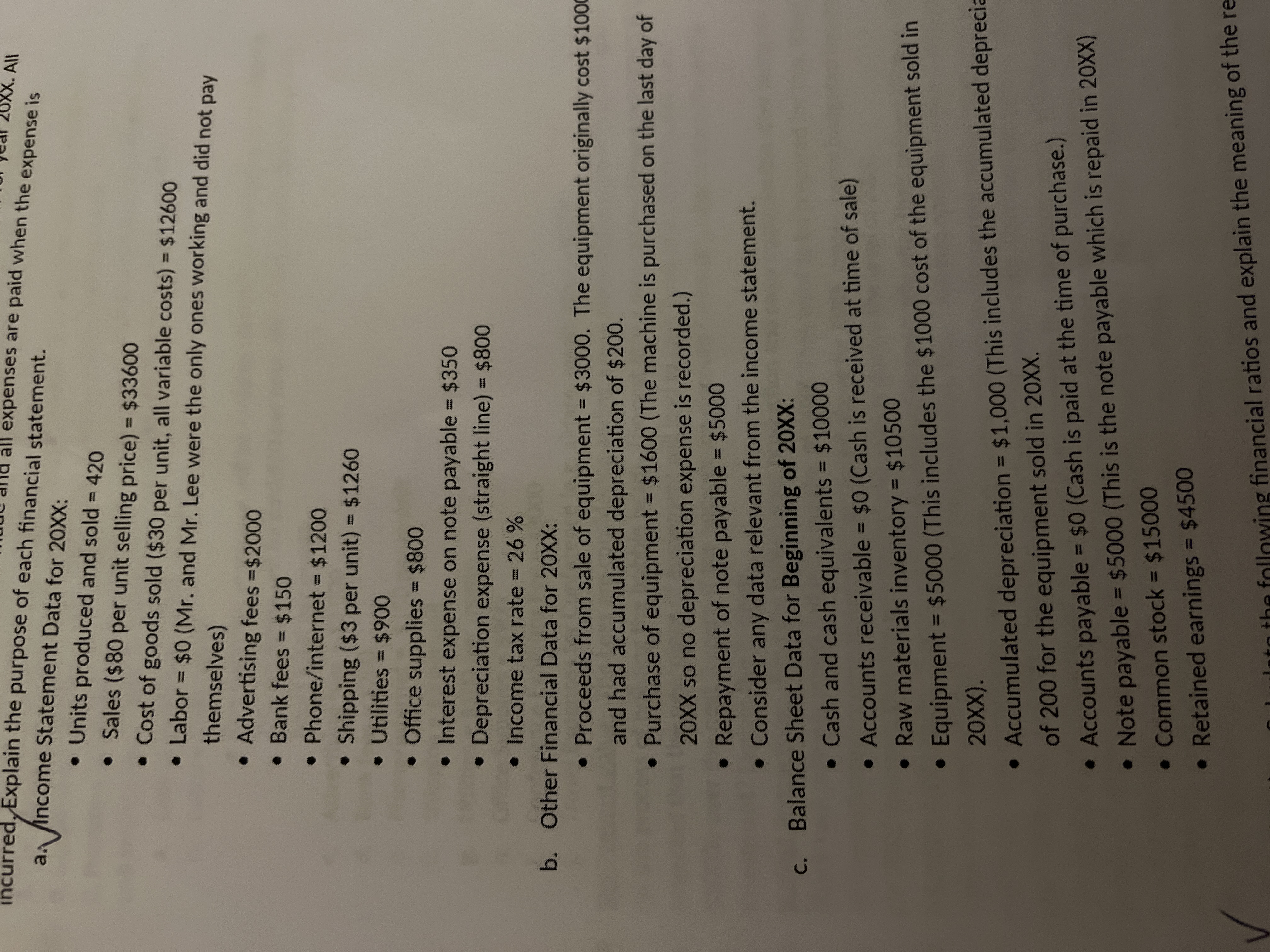

a Income Statement Data for XX:

Units produced and sold

Sales $ per unit selling price$

Cost of goods sold $ per unit, all variable costs$

Labor $Mr and Mr Lee were the only ones working and did not pay

themselves

Advertising fees $

Bank fees $

Phoneinternet $

Shipping $ per unit$

Utilities $

Office supplies $

Interest expense on note payable $

Depreciation expense straight line$

Income tax rate

b Other Financial Data for XX:

Proceeds from sale of equipment $ The equipment originally cost $

and had accumulated depreciation of $

Purchase of equipment $The machine is purchased on the last day of

so no depreciation expense is recorded.

Repayment of note payable $

Consider any data relevant from the income statement.

c Balance Sheet Data for Beginning of XX:

Cash and cash equivalents $

Accounts receivable $Cash is received at time of sale

Raw materials inventory $

Equipment $This includes the $ cost of the equipment sold in

Accumulated depreciation $This includes the accumulated deprecia

of for the equipment sold in

Accounts payable $Cash is paid at the time of purchase.

Note payable $This is the note payable which is repaid in XX

Common stock $

Retained earnings $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock