Question: Create a cash Flow statement regarding the following information The comparative balance sheets and income statement for Franklin Company follow: Balance Sheets As of December

Create a cash Flow statement regarding the following information

Create a cash Flow statement regarding the following information

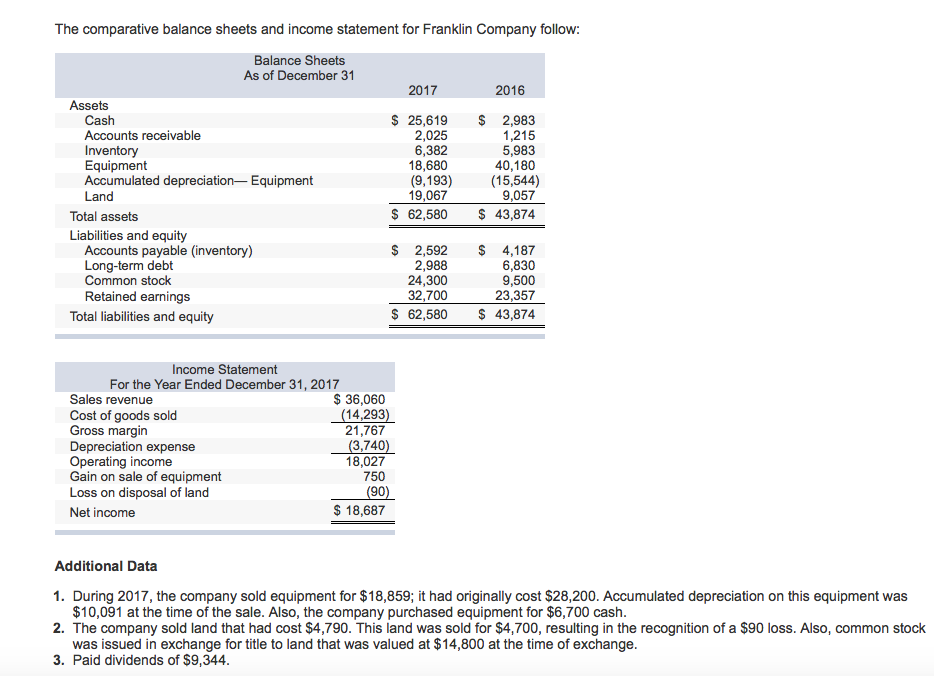

The comparative balance sheets and income statement for Franklin Company follow: Balance Sheets As of December 31 2017 2016 Assets Cash Accounts receivable Inventory Equipment Accumulated depreciation Equipment Land $ 25,619 S 2,983 1,215 5,983 40,180 (9,193) (15,544) 9,057 $ 62,580 43,874 2,025 6,382 18,680 19,067 Total assets Liabilities and equity Accounts payable (inventory) Long-term debt Common stock Retained earnings $ 2,592 S4,187 6,830 9,500 23,357 $ 62,580 43,874 2,988 24,300 32,700 Total liabilities and equity Income Statement For the Year Ended December 31, 2017 Sales revenue Cost of goods sold Gross margin Depreciation expense Operating income Gain on sale of equipmen Loss on disposal of land Net income S 36,060 14,293 21,767 3,740 18,027 750 90 $ 18,687 Additional Data 1. During 2017, the company sold equipment for $18,859; it had originally cost $28,200. Accumulated depreciation on this equipment was $10,091 at the time of the sale. Also, the company purchased equipment for $6,700 cash 2. The company sold land that had cost $4,790. This land was sold for $4,700, resulting in the recognition of a $90 loss. Also, common stock was issued in exchange for title to land that was valued at $14,800 at the time of exchange 3. Paid dividends of $9,344

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts