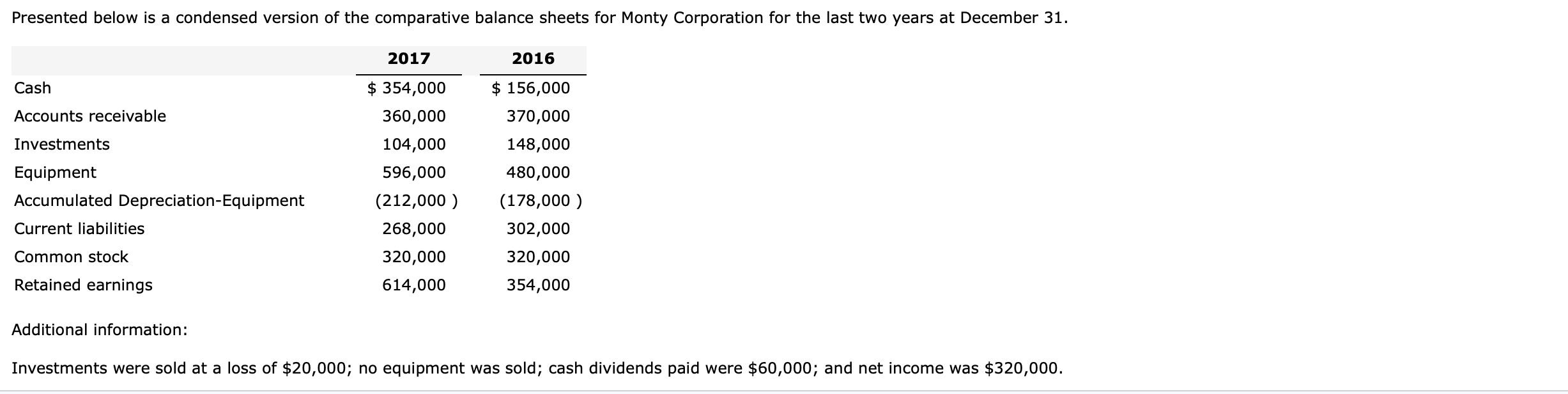

Question: Presented below is a condensed version of the comparative balance sheets for Monty Corporation for the last two years at December 31. 2017 2016 Cash

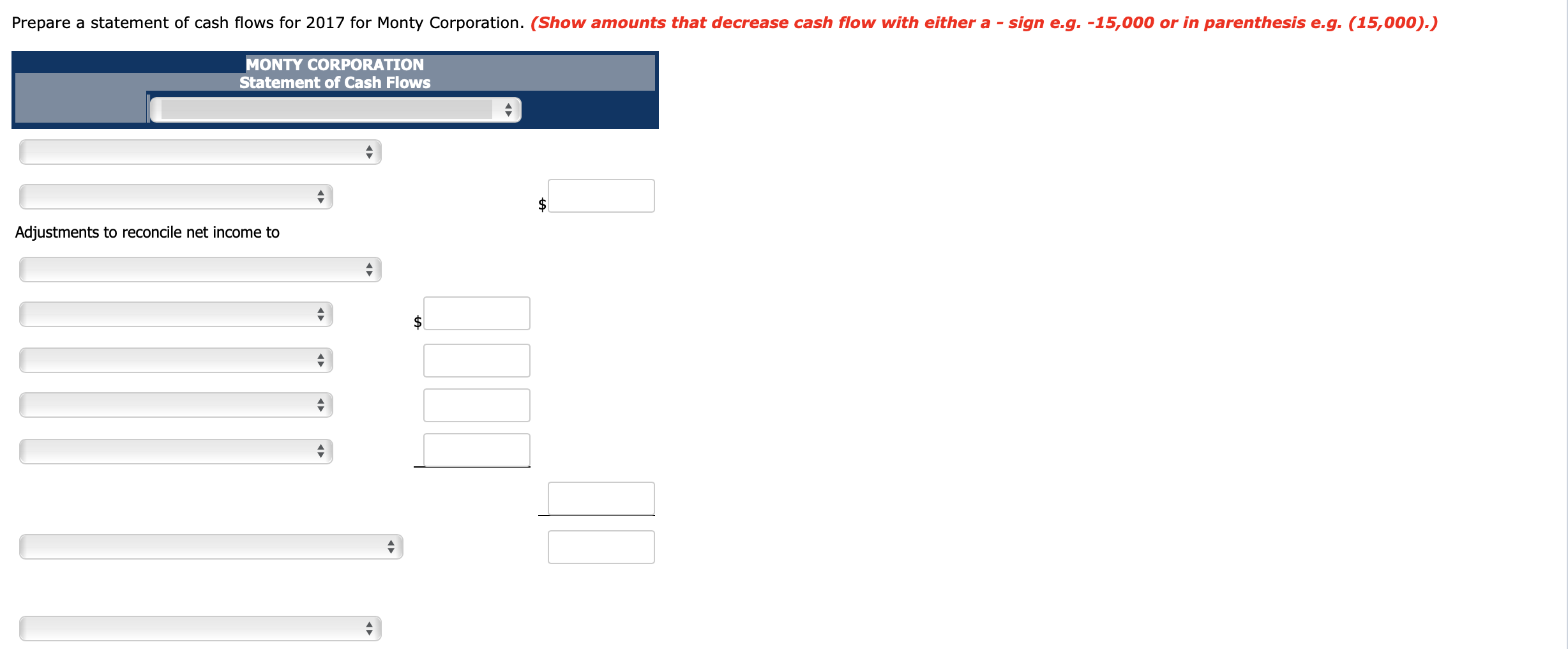

Presented below is a condensed version of the comparative balance sheets for Monty Corporation for the last two years at December 31. 2017 2016 Cash Accounts receivable Investments Equipment Accumulated Depreciation-Equipment Current liabilities $ 354,000 360,000 104,000 596,000 (212,000 ) 268,000 320,000 614,000 $ 156,000 370,000 148,000 480,000 (178,000 ) 302,000 320,000 354,000 Common stock Retained earnings Additional information: Investments were sold at a loss of $20,000; no equipment was sold; cash dividends paid were $60,000; and net income was $320,000. Prepare a statement of cash flows for 2017 for Monty Corporation. (Show amounts that decrease cash flow with either a - sign e.g. -15,000 or in parenthesis e.g. (15,000).) MONTY CORPORATION Statement of Cash Flows Adjustments to reconcile net income to to Determine Monty Corporation's free cash flow. Free cash flow Click if you would like to Show Work for this question: Open Show Work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts