Question: Create a Indirect method Statement of Cash flows based off of the provided income statement, balance sheet, and special transactions. Special Transactions On May 15,

Create a Indirect method Statement of Cash flows based off of the provided income statement, balance sheet, and special transactions.

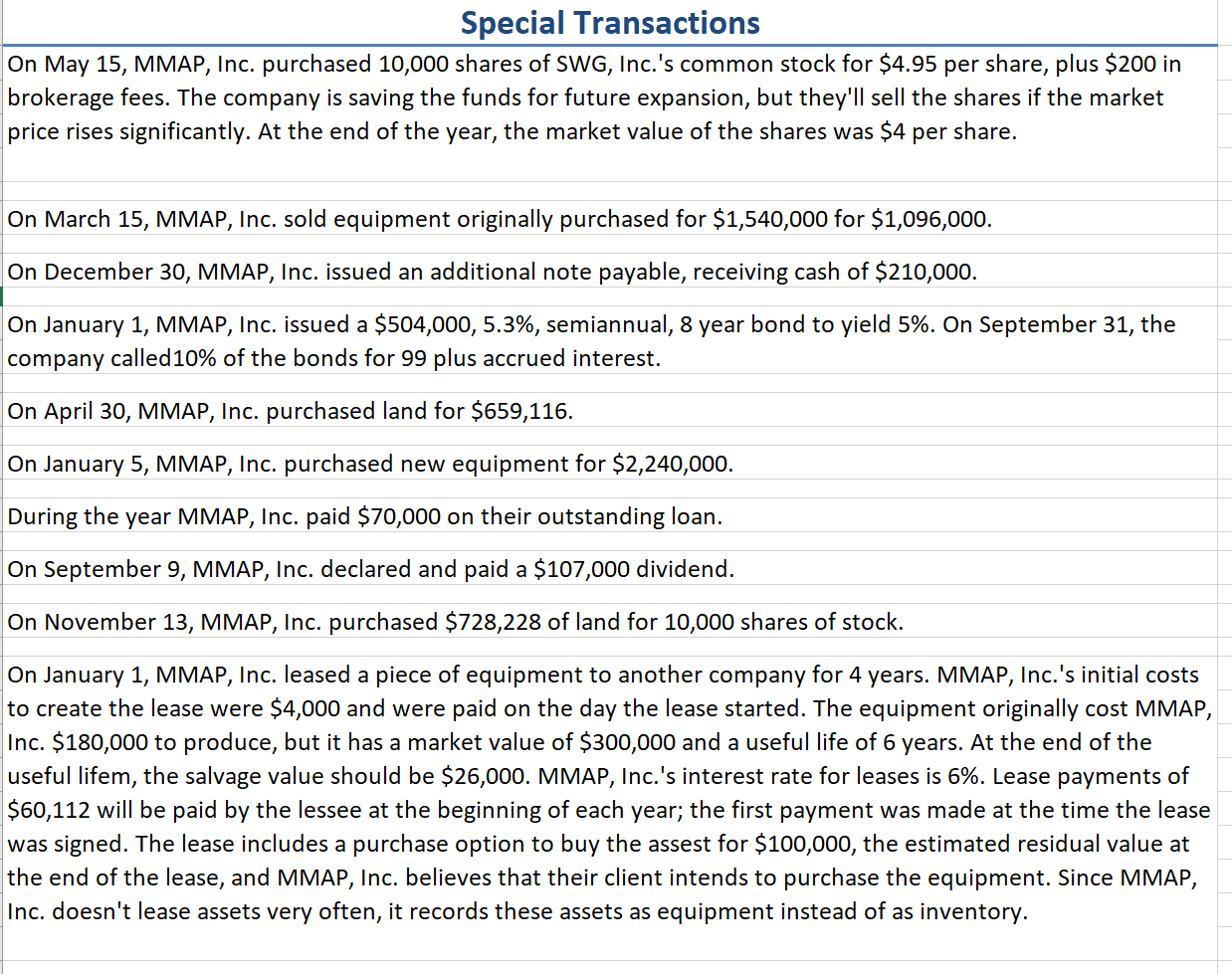

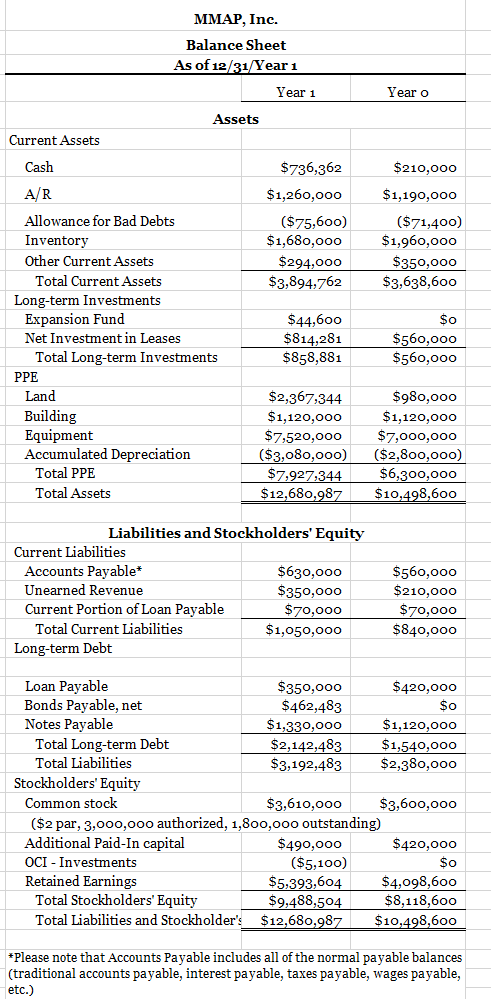

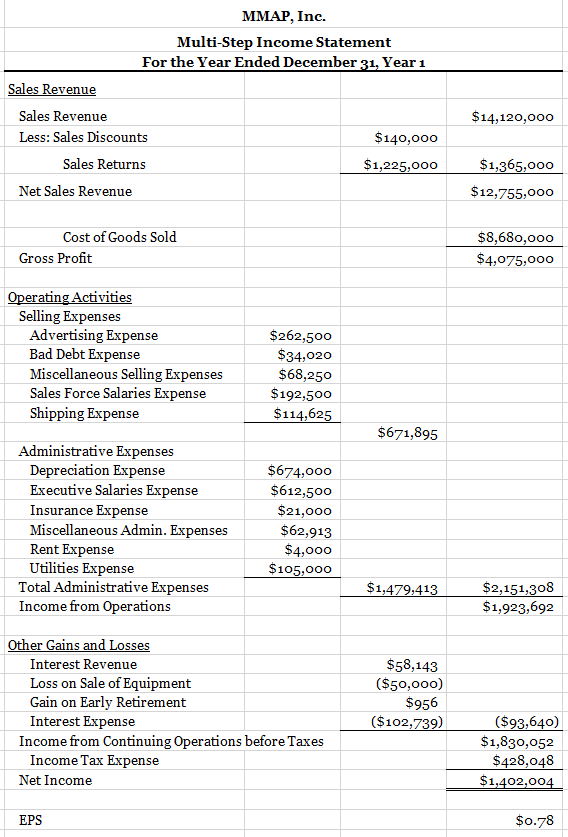

Special Transactions On May 15, MMAP, Inc. purchased 10,000 shares of SWG, Inc.'s common stock for $4.95 per share, plus $200 in brokerage fees. The company is saving the funds for future expansion, but they'll sell the shares if the market price rises significantly. At the end of the year, the market value of the shares was $4 per share. On March 15, MMAP, Inc. sold equipment originally purchased for $1,540,000 for $1,096,000. On December 30, MMAP, Inc. issued an additional note payable, receiving cash of $210,000. On January 1, MMAP, Inc. issued a $504,000, 5.3%, semiannual, 8 year bond to yield 5%. On September 31, the company called 10% of the bonds for 99 plus accrued interest. On April 30, MMAP, Inc. purchased land for $659,116. On January 5, MMAP, Inc. purchased new equipment for $2,240,000. During the year MMAP, Inc. paid $70,000 on their outstanding loan. On September 9, MMAP, Inc. declared and paid a $107,000 dividend. On November 13, MMAP, Inc. purchased $728,228 of land for 10,000 shares of stock. On January 1, MMAP, Inc. leased a piece of equipment to another company for 4 years. MMAP, Inc.'s initial costs to create the lease were $4,000 and were paid on the day the lease started. The equipment originally cost MMAP, Inc. $180,000 to produce, but it has a market value of $300,000 and a useful life of 6 years. At the end of the useful lifem, the salvage value should be $26,000. MMAP, Inc.'s interest rate for leases is 6%. Lease payments of $60,112 will be paid by the lessee at the beginning of each year; the first payment was made at the time the lease was signed. The lease includes a purchase option to buy the assest for $100,000, the estimated residual value at the end of the lease, and MMAP, Inc. believes that their client intends to purchase the equipment. Since MMAP, Inc. doesn't lease assets very often, it records these assets as equipment instead of as inventory. MMAP, Inc. Balance Sheet As of 12/31Year 1 Year 1 Year o Assets Current Assets Cash $736,362 $1,260,000 ($75,600) $1,680,000 $294,000 $3,894,762 $210,000 $1,190,000 ($71,400) $1,960,000 $350,000 $3,638,600 AR Allowance for Bad Debts Inventory Other Current Assets Total Current Assets Long-term Investments Expansion Fund Net Investment in Leases Total Long-term Investments PPE Land Building Equipment Accumulated Depreciation Total PPE Total Assets $44,600 $814,281 $858,881 $0 $560,000 $560,000 $2,367,344 $1,120,000 $7,520,000 ($3,080,000) $7,927,344 $12,680,987 $980,000 $1,120,000 $7,000,000 ($2,800,000) $6,300,000 $10,498,600 Liabilities and Stockholders' Equity Current Liabilities Accounts Payable* $630,000 Unearned Revenue $350,000 Current Portion of Loan Payable $70,000 Total Current Liabilities $1,050,000 Long-term Debt $560,000 $210,000 $70,000 $840,000 So Loan Payable $350,000 $420,000 Bonds Payable, net $462,483 Notes Payable $1,330,000 $1,120,000 Total Long-term Debt S2,142,483 $1,540,000 Total Liabilities $3,192,483 $2,380,000 Stockholders' Equity Common stock $3,610,000 $3,600,000 ($2 par, 3,000,000 authorized, 1,800,000 outstanding) Additional Paid-In capital $490,000 $420,000 OCI - Investments ($5,100) $o Retained Earnings $5,393,604 $4,098,600 Total Stockholders' Equity $8,118,600 Total Liabilities and Stockholder's $12,680,987 $10,498,600 *Please note that Accounts Payable includes all of the normal payable balances (traditional accounts payable, interest payable, taxes payable, wages payable, etc.) MMAP, Inc. Multi-Step Income Statement For the Year Ended December 31, Year 1 Sales Revenue Sales Revenue Less: Sales Discounts $140,000 Sales Returns $1,225,000 $14,120,000 $1,365,000 Net Sales Revenue $12,755,000 Cost of Goods Sold Gross Profit $8,680,000 $4,075,000 Operating Activities Selling Expenses Advertising Expense Bad Debt Expense Miscellaneous Selling Expenses Sales Force Salaries Expense Shipping Expense $262,500 $34,020 $68,250 $192,500 $114,625 $671,895 Administrative Expenses Depreciation Expense Executive Salaries Expense Insurance Expense Miscellaneous Admin. Expenses Rent Expense Utilities Expense Total Administrative Expenses Income from Operations $674,000 $612,500 $21,000 $62,913 $4,000 $105,000 $1,479,413 $2,151,308 $1,923,692 Other Gains and Losses Interest Revenue Loss on Sale of Equipment Gain on Early Retirement Interest Expense Income from Continuing Operations before Taxes Income Tax Expense Net Income $58,143 ($50,000) $956 ($102,739) ($93,640) $1,830,052 $428,048 $1,402,004 EPS $0.78 Special Transactions On May 15, MMAP, Inc. purchased 10,000 shares of SWG, Inc.'s common stock for $4.95 per share, plus $200 in brokerage fees. The company is saving the funds for future expansion, but they'll sell the shares if the market price rises significantly. At the end of the year, the market value of the shares was $4 per share. On March 15, MMAP, Inc. sold equipment originally purchased for $1,540,000 for $1,096,000. On December 30, MMAP, Inc. issued an additional note payable, receiving cash of $210,000. On January 1, MMAP, Inc. issued a $504,000, 5.3%, semiannual, 8 year bond to yield 5%. On September 31, the company called 10% of the bonds for 99 plus accrued interest. On April 30, MMAP, Inc. purchased land for $659,116. On January 5, MMAP, Inc. purchased new equipment for $2,240,000. During the year MMAP, Inc. paid $70,000 on their outstanding loan. On September 9, MMAP, Inc. declared and paid a $107,000 dividend. On November 13, MMAP, Inc. purchased $728,228 of land for 10,000 shares of stock. On January 1, MMAP, Inc. leased a piece of equipment to another company for 4 years. MMAP, Inc.'s initial costs to create the lease were $4,000 and were paid on the day the lease started. The equipment originally cost MMAP, Inc. $180,000 to produce, but it has a market value of $300,000 and a useful life of 6 years. At the end of the useful lifem, the salvage value should be $26,000. MMAP, Inc.'s interest rate for leases is 6%. Lease payments of $60,112 will be paid by the lessee at the beginning of each year; the first payment was made at the time the lease was signed. The lease includes a purchase option to buy the assest for $100,000, the estimated residual value at the end of the lease, and MMAP, Inc. believes that their client intends to purchase the equipment. Since MMAP, Inc. doesn't lease assets very often, it records these assets as equipment instead of as inventory. MMAP, Inc. Balance Sheet As of 12/31Year 1 Year 1 Year o Assets Current Assets Cash $736,362 $1,260,000 ($75,600) $1,680,000 $294,000 $3,894,762 $210,000 $1,190,000 ($71,400) $1,960,000 $350,000 $3,638,600 AR Allowance for Bad Debts Inventory Other Current Assets Total Current Assets Long-term Investments Expansion Fund Net Investment in Leases Total Long-term Investments PPE Land Building Equipment Accumulated Depreciation Total PPE Total Assets $44,600 $814,281 $858,881 $0 $560,000 $560,000 $2,367,344 $1,120,000 $7,520,000 ($3,080,000) $7,927,344 $12,680,987 $980,000 $1,120,000 $7,000,000 ($2,800,000) $6,300,000 $10,498,600 Liabilities and Stockholders' Equity Current Liabilities Accounts Payable* $630,000 Unearned Revenue $350,000 Current Portion of Loan Payable $70,000 Total Current Liabilities $1,050,000 Long-term Debt $560,000 $210,000 $70,000 $840,000 So Loan Payable $350,000 $420,000 Bonds Payable, net $462,483 Notes Payable $1,330,000 $1,120,000 Total Long-term Debt S2,142,483 $1,540,000 Total Liabilities $3,192,483 $2,380,000 Stockholders' Equity Common stock $3,610,000 $3,600,000 ($2 par, 3,000,000 authorized, 1,800,000 outstanding) Additional Paid-In capital $490,000 $420,000 OCI - Investments ($5,100) $o Retained Earnings $5,393,604 $4,098,600 Total Stockholders' Equity $8,118,600 Total Liabilities and Stockholder's $12,680,987 $10,498,600 *Please note that Accounts Payable includes all of the normal payable balances (traditional accounts payable, interest payable, taxes payable, wages payable, etc.) MMAP, Inc. Multi-Step Income Statement For the Year Ended December 31, Year 1 Sales Revenue Sales Revenue Less: Sales Discounts $140,000 Sales Returns $1,225,000 $14,120,000 $1,365,000 Net Sales Revenue $12,755,000 Cost of Goods Sold Gross Profit $8,680,000 $4,075,000 Operating Activities Selling Expenses Advertising Expense Bad Debt Expense Miscellaneous Selling Expenses Sales Force Salaries Expense Shipping Expense $262,500 $34,020 $68,250 $192,500 $114,625 $671,895 Administrative Expenses Depreciation Expense Executive Salaries Expense Insurance Expense Miscellaneous Admin. Expenses Rent Expense Utilities Expense Total Administrative Expenses Income from Operations $674,000 $612,500 $21,000 $62,913 $4,000 $105,000 $1,479,413 $2,151,308 $1,923,692 Other Gains and Losses Interest Revenue Loss on Sale of Equipment Gain on Early Retirement Interest Expense Income from Continuing Operations before Taxes Income Tax Expense Net Income $58,143 ($50,000) $956 ($102,739) ($93,640) $1,830,052 $428,048 $1,402,004 EPS $0.78

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts