Question: Create a Microsoft Excel spreadsheet that will replicate example 13-9 in your textbook. This should be fairly easy (see figures in the book that provide

Create a Microsoft Excel spreadsheet that will replicate example 13-9 in your textbook.

This should be fairly easy (see figures in the book that provide useful formulas for this activity). One change that needs to be added is the use of WACC instead of a given interest rate.

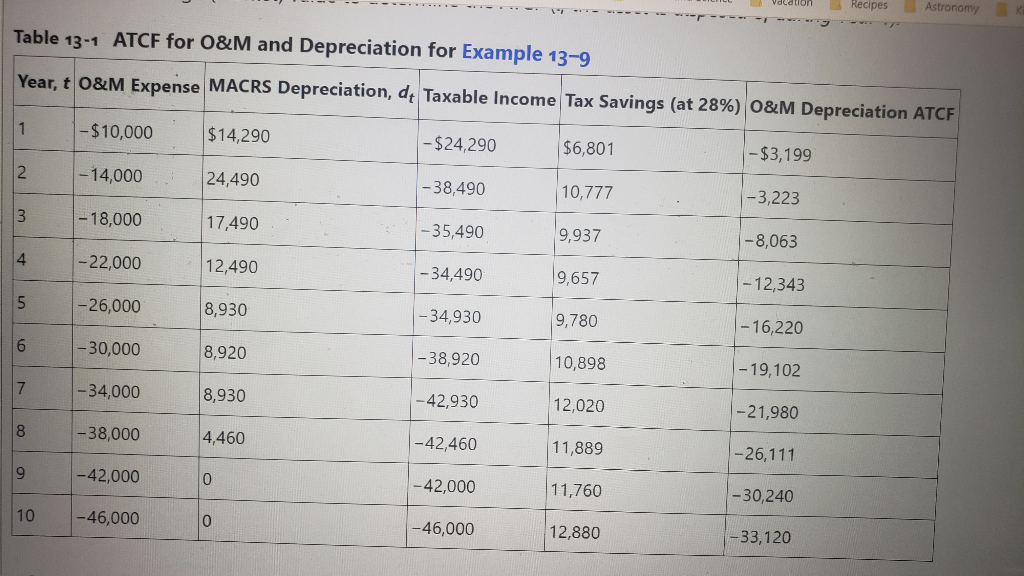

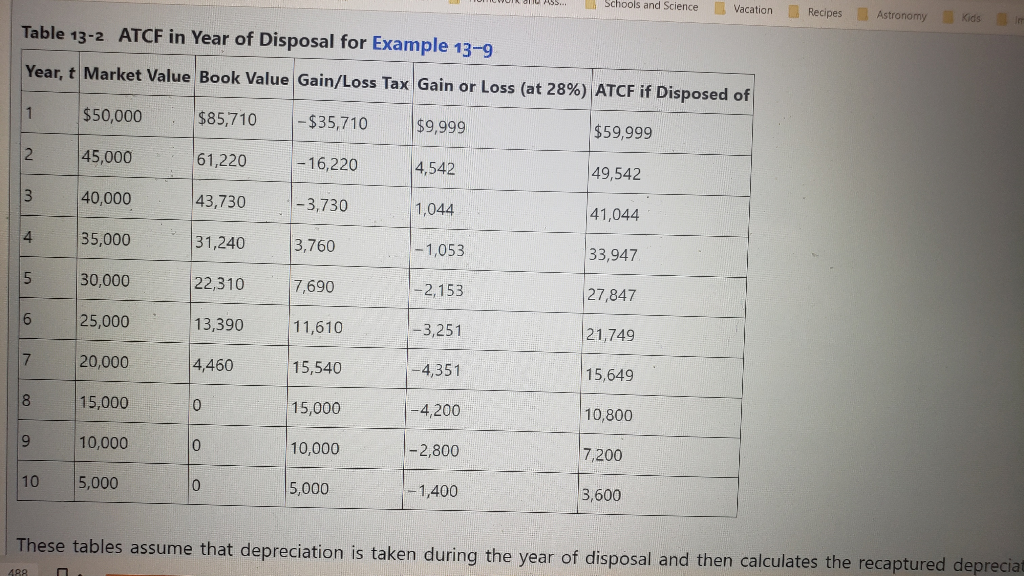

Your model should be able to accommodate different tax rates. Your submission should generate/replicate a working model of Tables 13-1 and 13-2. The optimal life should be identified.

*Note: WACC is 6%

- --- - - - - - Table 13-1 ATCF for O&M and Depreciation for Example 13-9 Year, t O&M Expense MACRS Depreciation, dt Taxable Income Tax Savings (at 28%) O&M Depreciation ATCF -$10,000 $14,290 - $24,290 $6,801 - $3,199 - 14,000 24,490 -38,490 10,777 -3,223 -18,000 17,490 -35,490 9,937 - 8,063 -22,000 12,490 - 34,490 9,657 - 12,343 -26,000 8,930 - 34,930 9,780 - 16,220 -30,000 8,920 -38,920 10,898 -19,102 - 34,000 8,930 - 42,930 12,020 -21,980 -38,000 4,460 -42,460 11,889 - 26,111 - 42,000 - 42,000 11,760 -30,240 - 46,000 - 46,000 12,880 -33,120 ... SLIDIS and Science Vacation Recipes Astronomy Kids Table 13-2 ATCF in Year of Disposal for Example 13-9 Year, t Market Value Book Value Gain/Loss Tax Gain or Loss (at 28%) ATCF if Disposed of $50,000 $85,710 -$35,710 $9,999 $59,999 45,000 61,220 -16,220 4,542 49,542 40,000 43,730 -3,730 1,044 41,044 35,000 31,240 3,760 -1,053 33,947 30,000 22,310 7,690 -2,153 27,847 25,000 13,390 11,610 -3,251 21,749 20,000 4,460 15,540 -4,351 15,649 15,000 15,000 -4,200 10,800 10,000 10,000 - 2,800 7,200 5,000 5,000 -1,400 3,600 These tables assume that depreciation is taken during the year of disposal and then calculates the recaptured deprecia - --- - - - - - Table 13-1 ATCF for O&M and Depreciation for Example 13-9 Year, t O&M Expense MACRS Depreciation, dt Taxable Income Tax Savings (at 28%) O&M Depreciation ATCF -$10,000 $14,290 - $24,290 $6,801 - $3,199 - 14,000 24,490 -38,490 10,777 -3,223 -18,000 17,490 -35,490 9,937 - 8,063 -22,000 12,490 - 34,490 9,657 - 12,343 -26,000 8,930 - 34,930 9,780 - 16,220 -30,000 8,920 -38,920 10,898 -19,102 - 34,000 8,930 - 42,930 12,020 -21,980 -38,000 4,460 -42,460 11,889 - 26,111 - 42,000 - 42,000 11,760 -30,240 - 46,000 - 46,000 12,880 -33,120 ... SLIDIS and Science Vacation Recipes Astronomy Kids Table 13-2 ATCF in Year of Disposal for Example 13-9 Year, t Market Value Book Value Gain/Loss Tax Gain or Loss (at 28%) ATCF if Disposed of $50,000 $85,710 -$35,710 $9,999 $59,999 45,000 61,220 -16,220 4,542 49,542 40,000 43,730 -3,730 1,044 41,044 35,000 31,240 3,760 -1,053 33,947 30,000 22,310 7,690 -2,153 27,847 25,000 13,390 11,610 -3,251 21,749 20,000 4,460 15,540 -4,351 15,649 15,000 15,000 -4,200 10,800 10,000 10,000 - 2,800 7,200 5,000 5,000 -1,400 3,600 These tables assume that depreciation is taken during the year of disposal and then calculates the recaptured deprecia

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts