Question: create a tax return 1040 from ghis scenario The order of pictures are reversed and there is a duplicate of the page 2. This is

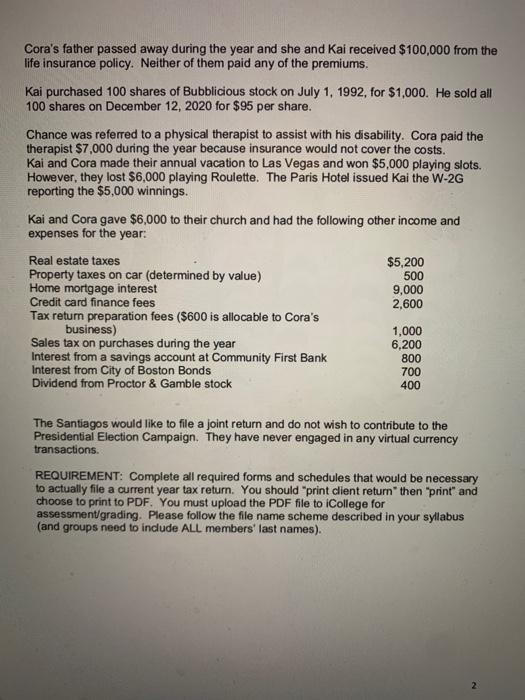

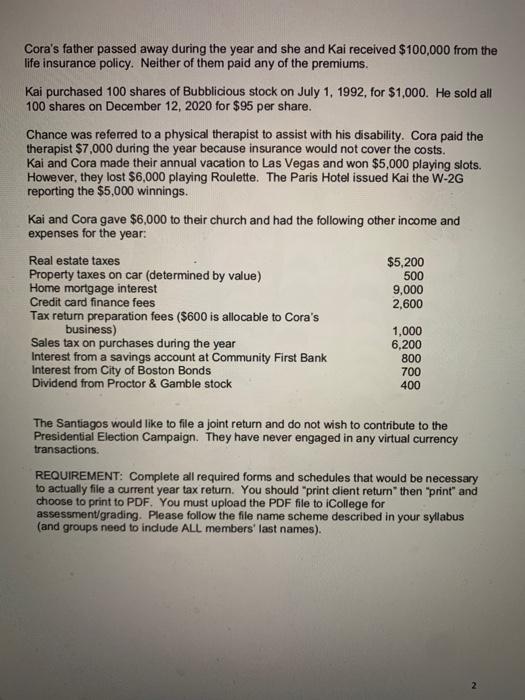

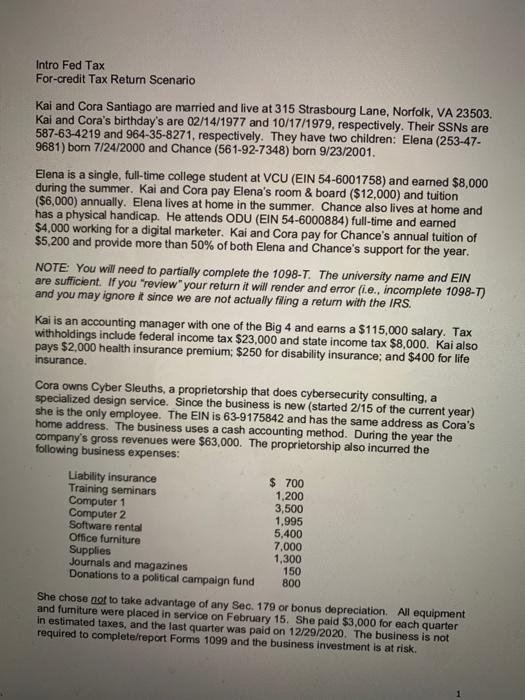

Intro Fed Tax For-credit Tax Return Scenario Kai and Cora Santiago are married and live at 315 Strasbourg Lane, Norfolk, VA 23503. Kal and Cora's birthday's are 02/14/1977 and 10/17/1979, respectively. Their SSNs are 587-63-4219 and 964-35-8271, respectively. They have two children: Elena (253-47. 9681) born 7/24/2000 and Chance (561-92-7348) born 9/23/2001 Elena is a single, full-time college student at VCU (EIN 54-6001758) and earned $8,000 during the summer. Kai and Cora pay Elena's room & board ($12,000) and tuition ($6,000) annually. Elena lives at home in the summer. Chance also lives at home and has a physical handicap. He attends ODU (EIN 54-6000884) full-time and earned $4,000 working for a digital marketer. Kai and Cora pay for Chance's annual tuition of $5,200 and provide more than 50% of both Elena and Chance's support for the year. NOTE You will need to partially complete the 1098-T. The university name and EIN are sufficient. If you "review"your return it will render and error (i.e., incomplete 1098-T) and you may ignore it since we are not actually filing a return with the IRS. Kai is an accounting manager with one of the Big 4 and earns a $115,000 salary. Tax withholdings include federal income tax $23,000 and state income tax $8,000. Kai also pays $2,000 health insurance premium: $250 for disability insurance; and $400 for life insurance Cora owns Cyber Sleuths, a proprietorship that does cybersecurity consulting, a specialized design service. Since the business is new (started 2/15 of the current year) she is the only employee. The EIN is 63-9175842 and has the same address as Cora's home address. The business uses a cash accounting method. During the year the company's gross revenues were $63,000. The proprietorship also incurred the following business expenses: Liability insurance $ 700 Training seminars 1,200 Computer 1 3,500 Computer 2 1.995 Software rental 5,400 Office furniture 7,000 Supplies 1,300 Journals and magazines 150 Donations to a political campaign fund 800 She chose not to take advantage of any Sec. 179 or bonus depreciation. All equipment and furniture were placed in service on February 15. She paid $3,000 for each quarter in estimated taxes, and the last quarter was paid on 12/29/2020. The business is not required to complete/report Forms 1099 and the business investment is at risk. Intro Fed Tax For-credit Tax Return Scenario Kai and Cora Santiago are married and live at 315 Strasbourg Lane, Norfolk, VA 23503. Kal and Cora's birthday's are 02/14/1977 and 10/17/1979, respectively. Their SSNs are 587-63-4219 and 964-35-8271, respectively. They have two children: Elena (253-47. 9681) born 7/24/2000 and Chance (561-92-7348) born 9/23/2001 Elena is a single, full-time college student at VCU (EIN 54-6001758) and earned $8,000 during the summer. Kai and Cora pay Elena's room & board ($12,000) and tuition ($6,000) annually. Elena lives at home in the summer. Chance also lives at home and has a physical handicap. He attends ODU (EIN 54-6000884) full-time and earned $4,000 working for a digital marketer. Kai and Cora pay for Chance's annual tuition of $5,200 and provide more than 50% of both Elena and Chance's support for the year. NOTE You will need to partially complete the 1098-T. The university name and EIN are sufficient. If you "review"your return it will render and error (i.e., incomplete 1098-T) and you may ignore it since we are not actually filing a return with the IRS. Kai is an accounting manager with one of the Big 4 and earns a $115,000 salary. Tax withholdings include federal income tax $23,000 and state income tax $8,000. Kai also pays $2,000 health insurance premium: $250 for disability insurance; and $400 for life insurance Cora owns Cyber Sleuths, a proprietorship that does cybersecurity consulting, a specialized design service. Since the business is new (started 2/15 of the current year) she is the only employee. The EIN is 63-9175842 and has the same address as Cora's home address. The business uses a cash accounting method. During the year the company's gross revenues were $63,000. The proprietorship also incurred the following business expenses: Liability insurance $ 700 Training seminars 1,200 Computer 1 3,500 Computer 2 1.995 Software rental 5,400 Office furniture 7,000 Supplies 1,300 Journals and magazines 150 Donations to a political campaign fund 800 She chose not to take advantage of any Sec. 179 or bonus depreciation. All equipment and furniture were placed in service on February 15. She paid $3,000 for each quarter in estimated taxes, and the last quarter was paid on 12/29/2020. The business is not required to complete/report Forms 1099 and the business investment is at risk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts