Question: Question 9 (4 points) Required: Briefly explain whether these two amounts ($11,000 and $2000) are assessable income (4 marks). Craig owns a large investment property

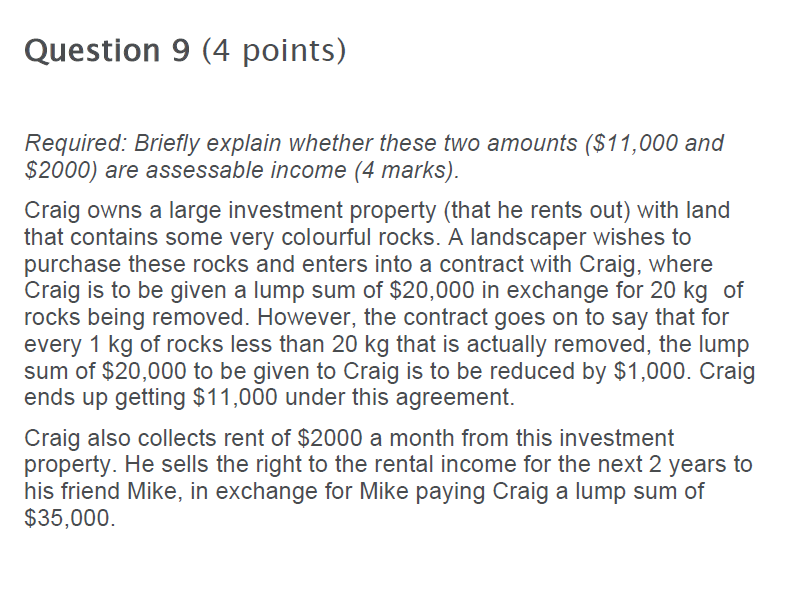

Question 9 (4 points) Required: Briefly explain whether these two amounts ($11,000 and $2000) are assessable income (4 marks). Craig owns a large investment property (that he rents out) with land that contains some very colourful rocks. A landscaper wishes to purchase these rocks and enters into a contract with Craig, where Craig is to be given a lump sum of $20,000 in exchange for 20 kg of rocks being removed. However, the contract goes on to say that for every 1 kg of rocks less than 20 kg that is actually removed, the lump sum of $20,000 to be given to Craig is to be reduced by $1,000. Craig ends up getting $11,000 under this agreement. Craig also collects rent of $2000 a month from this investment property. He sells the right to the rental income for the next 2 years to his friend Mike, in exchange for Mike paying Craig a lump sum of $35,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts