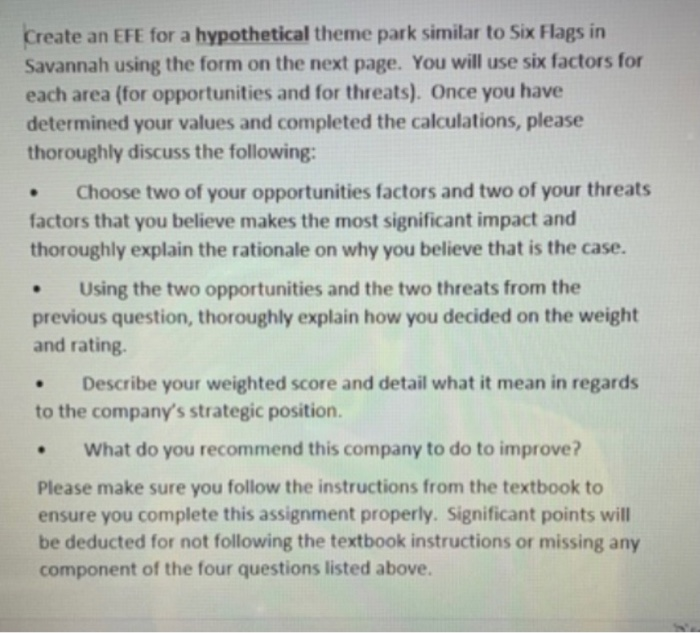

Question: . Create an EFE for a hypothetical theme park similar to Six Flags in Savannah using the form on the next page. You will use

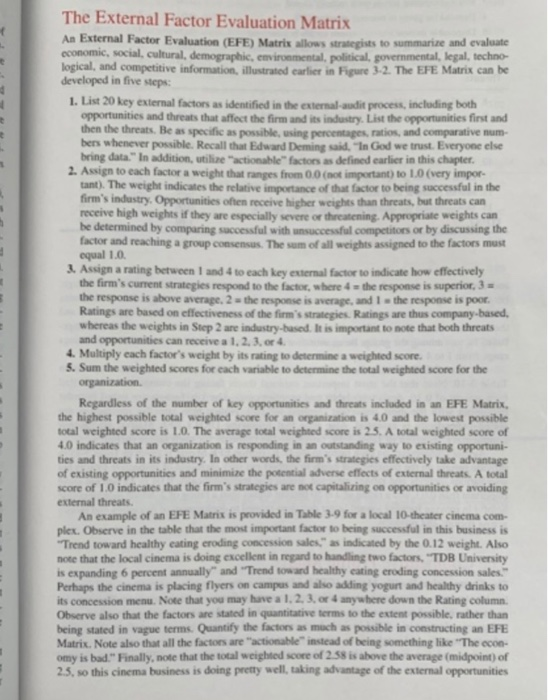

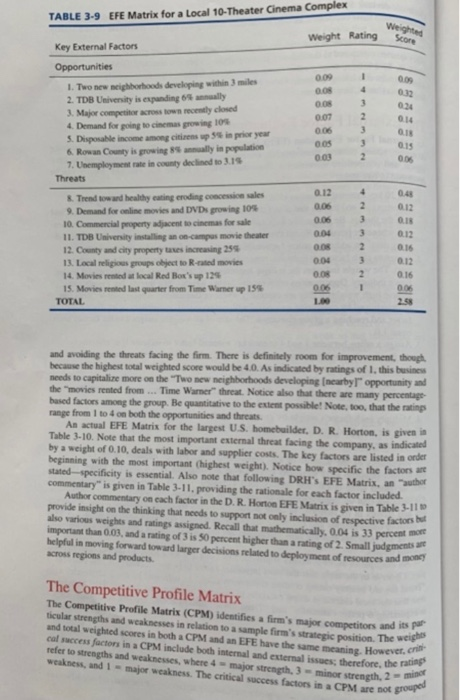

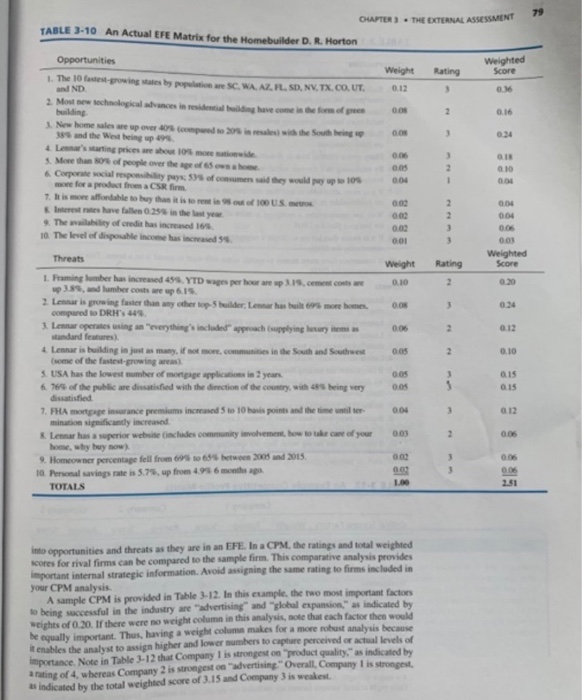

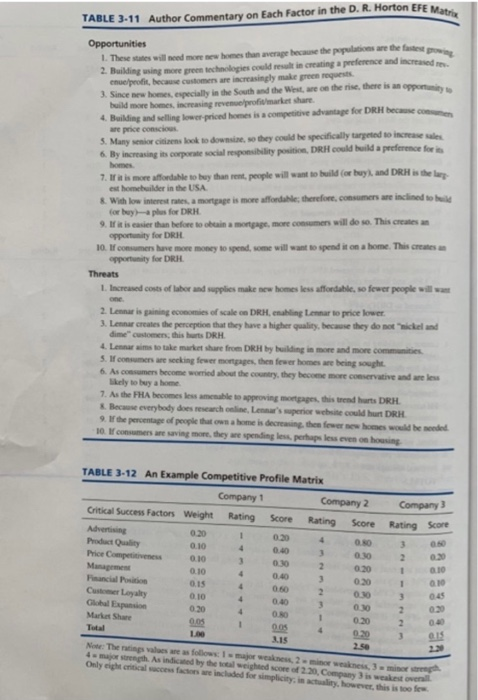

. Create an EFE for a hypothetical theme park similar to Six Flags in Savannah using the form on the next page. You will use six factors for each area (for opportunities and for threats). Once you have determined your values and completed the calculations, please thoroughly discuss the following: Choose two of your opportunities factors and two of your threats factors that you believe makes the most significant impact and thoroughly explain the rationale on why you believe that is the case. Using the two opportunities and the two threats from the previous question, thoroughly explain how you decided on the weight and rating Describe your weighted score and detail what it mean in regards to the company's strategic position. What do you recommend this company to do to improve? Please make sure you follow the instructions from the textbook to ensure you complete this assignment properly. Significant points will be deducted for not following the textbook instructions or missing any component of the four questions listed above. Opportunities wenig weed Score Threats TOTAS The External Factor Evaluation Matrix An External Factor Evaluation (EFE) Matrix allows strategists to summarize and evaluate economic, social, cultural, demographic, environmental, political, governmental, legal, techno logical, and competitive information, illustrated earlier in Figure 3-2. The EFE Matrix can be developed in five steps 1. List 20 key external factors as identified in the external-audit process, including both opportunities and threats that affect the form and its industry. List the opportunities first and then the threats. Be as specific as possible, using percentages, ratios, and comparative num- bers whenever possible. Recall that Edward Deming said. "In God we trust. Everyone else bring data." In addition, utilize "actionable" factors as defined earlier in this chapter. 2. Assign to each factor a weight that ranges from 0.0 (not important) to 1.0 (very impor. tant). The weight indicates the relative importance of that factor to being successful in the firm's industry. Opportunities often receive higher weights than threats, but threats can receive high weights if they are especially severe or threatening. Appropriate weights can be determined by comparing successful with unsuccessful competitors or by discussing the factor and reaching a group consensus. The sum of all weights assigned to the factors must equal 1.0 3. Assign a rating between 1 and 4 to each key external factor to indicate how effectively the firm's current strategies respond to the factor, where the response is superior, 3- the response is above average, 2 the response is average, and the response is poor. Ratings are based on effectiveness of the firm's strategies. Ratings are thus company based, whereas the weights in Step 2 are industry-based. It is important to note that both threats and opportunities can receive a 1.2.3.4 4. Multiply cach factor's weight by its rating to determine a weighted score. 5. Sum the weighted scores for each variable to determine the total weighted score for the organization Regardless of the number of key opportunities and threats included in an EFE Matrix, the highest possible total weighted score for an organization is 4.0 and the lowest possible total weighted score is 1.0. The average total weighted score is 25. A total weighted score of 4.0 indicates that an organization is responding in an outstanding way to existing opportuni- ties and threats in its industry. In other words, the firm's strategies effectively take advantage of existing opportunities and minimize the potential adverse effects of external threats. A total score of 1.0 indicates that the firm's strategies are not capitalizing on opportunities or avoiding external threats. An example of an EFE Matrix is provided in Table 3-9 for a local 10-theater cinema com plex. Observe in the table that the most important factor to being successful in this business is "Trend toward healthy eating eroding concession sales." as indicated by the 0.12 weight. Also note that the local cinema is doing excellent in regard to handling two factors, "TDB University is expanding 6 percent annually" and "Trend toward healthy eating eroding concession sales." Perhaps the cinema is placing flyers on campus and also adding yogurt and healthy drinks to its concession menu. Note that you may have a 1. 2. 3. or 4 anywhere down the Rating column. Observe also that the factors are stated in quantitative terms to the extent possible, rather than being stated in vague terms. Quantify the factors as much as possible in constructing an EFE Matrix. Note also that all the factors are "actionable" instead of being something like "The con- omy is bad." Finally, note that the total weighted score of 2.58 is above the average (midpoint) of 2.5, so this cinema business is doing pretty well, taking advantage of the external opportunities refer to strengths and weaknesses, where 4 - major strength, 3 minor strength, 2min TABLE 3-9 EFE Matrix for a Local 10-Theater Cinema Complex Weighted Weight Rating Score 1 4 0:32 0.00 DOS DOS 0.07 0.06 0.0 003 14 2 3 3 2 015 005 Key External factors Opportunities 1. Two new neighborhoods developing within 3 miles 2. TDB University is expanding only 3. Major competitor across town recently closed 4. Demand for going to cinemas growing 10 S. Disposable income among citizens up 3 in prior year 6. Rowan County is growing ally in population 7. Unemployment rate in cont declined to 3.15 Threats & Trend toward healthy eating credingssic sales 9. Demand for online movies and DVDs growing 10 10. Commercial property adjacent to cinemas for sale 11. TDB University installing an on-campus movie theater 12. County and city property taxes increasing 259 13. Local religious groups object to R-rated movies 14. Movies rented at local Red Box's up 125 15. Movies rented last quarter from Time Warner up 15% TOTAL 0.43 012 0.12 0.06 0.06 0.04 0.08 004 0.08 4 2 3 3 2 3 0.12 0.15 0.12 0.16 006 2.58 1 and avoiding the threats facing the firm. There is definitely room for improvement, though, because the highest total weighted score would be 40. As indicated by ratings of this business needs to capitalize more on the "Two new neighborhoods developing (nearbyl opportunity and the movies rented from ... Time Warner" threat. Notice also that there are many percentage based factors among the group. Be quantitative to the extent possible! Note, too, that the ratings range from 1 to 4 on both the opportunities and threats. An actual EFE Matrix for the largest US. homebuilder, D. R. Horton, is given in Table 3-10. Note that the most important external threat facing the company, as indicated by a weight of 0.10, deals with labor and supplier costs. The key factors are listed in order beginning with the most important (highest weight). Notice how specific the factors are stated-specificity is essential. Also note that following DRH'S EFE Matrix, anter commentary" is given in Table 3-11. providing the rationale for each factor included Author commentary on cach factor in the D. R. Howto EFE Matrix is given in Table 3-11 provide insight on the thinking that needs to support not only inclusion of respective factors also various weights and ratings assigned. Recall that mathematically, 0.04 is 33 percent important than 0.03.and a rating of 3 is 50 percent higher than a rating of 2. Small judgments helpful in moving forward toward larger decisions related to deployment of resources and many across regions and products The Competitive Profile Matrix The Competitive Profile Matrix (CPM) identifies a firm's major competitors and its per ticular strengths and weaknesses in relation to a sample firm's strategic position. The weight cal success factors in a CPM include both internal and external issues, therefore, the rating 79 OPTER). THE EXTERNAL ASSESSMENT TABLE 3-10 An Actual EFE Matrix for the Homebuilder D. R. Horton Rating Weighted Score Weight 0.12 3 0.36 00 2 0.16 2 0.34 Opportunities 1. The 10 fastest growing wat by PSC, WA AZILSD, NY.TX.CO.UT. and ND 2. Most new technological mesin dhe form building New home sales eup over de with 35 and the West being up L'arting prices we wet 10wide More than 80of people over the posse & Corporate social responsibility : 55 of consumers said he would up to los more for a product from a CSR firm 1. It is more affordable to buy than it is to rest of US. les have all 0.255 in the last year The way of credit has increased 10. The level of disposable income has increased 3 2 1 18 010 0.03 000 2 2 0.02 002 0.00 0.01 0.04 0.04 005 0.03 Weighted Score 3 Threats Weight 0.10 Rating 2 020 0.08 3 0.34 005 2 0.12 1. Pringlumber has increased 455. YTD wages per hoor are up 115.cement contre wp385, and lumber costs are up 6.15 2. Lemar is growing faster than any other top builder Lennar has builtmore homes. compared to DRH'S 445 3. Lear operates using an everything's included proach supplying sensas dard features 4. Lennar is building is just as many, if not more communities in the South and Southwest some of the fastest growing was 5. USA has the lowest number of more applications in 2 years 6 76% of the public are dissatisfied with the direction of the country with 485 being very 0.05 2 0.10 os 005 0.15 015 0.04 0.12 003 2 0.05 7. FHA mortgage Insurance premiums increased to 10 his points and the time until ter mination significantly increased & Lemar has a superior website includes community involvement, how to take care of your home, why buy now) 9. Homeowner percentage fell from 695 1655 between 2008 and 2015 10 Personal savingsrate is 5.7%, up from 498 6 months ago TOTALS 3 3 0.05 2.51 into opportunities and threats as they are in an EFE. In a CPM, the ratings and total weighted scores for rival firms can be compared to the sample firm. This comparative analysis provides important internal strategic information. Avoid assigning the same rating to firms included in your CPM analysis A sample CPM is provided in Table 3-12. In this example, the two most important factors to being successful in the industry are "advertising" and "global expansion." as indicated by weights of 0.20. If there were no weight column in this analysis, note that each factor then would be equally important. Thus, having a weight colum makes for a more robust analysis because enables the analyst to assign higher and lower numbers to capture perceived or actual levels of importance. Note in Table 3-12 that Company is strongest on product quality, as indicated by a rating of 4 whereas Company 2 is strongest on "advertising." Overall, Company I is strongest as indicated by the total weighted score of 3.15 and Company 3 is weakest. TABLE 3-11 Author Commentary on Each Factor in the D. R. Horton EFE Matrix 1. These we will need more homes than average because the popules are the fastest grow Opportunities 2. Building using more green technologies could result in creating a preference and increased to neprofit, because customers are increasingly make green requests 3. Since new homes, especially in the South and the West, are on the rise, there is an opportunity build more homes, increasing revenue profit market share 4. Building and selling lower priced homes is a competitive advantage for DRH because.com are price conscious 5. Many senior citizens look to downsime, so they could be specifically targeted to increases 6. By increasing its corporate social responsibility position, DRH.could build a preference for 7. Wat is more affordable to buy than rent, people will want to build (or buyland DRH is the larg est homebuilder in the USA & With low interest rates a mortgage is more affordable, therefore, consumers are inclined to be for buy plus for DRH 9. If it is easier than before to obtain a mortgage, more consumers will do so. This creates opportunity for DR 10. Wf consumers have more money to spend, come will want to spend it on a home. This creates an opportunity for DRL Threats 1. Increased costs of labor and supplies make new homes less affordable, so fewer people will 2. Lennar is gaining economies of scale DRH, ng Lamar to price lower 3. Lennar creates the perception that they have a higher quality, because they do not ickel und dime" customers this hurts DRH 4. Lenims to take market share from DH by building is more and more communities 5. Inmers are seeking fewer mortgages, then fewer homes are being sought. 6. As consumers become worried about the country, they become more conservative and are less likely to buy a home 7. As the FHA becomes less amenable to approving mortgages, this trend hurts DRH. Because everybody does research. Lema'superior website could hurt DRH 9. the percentage of people that was a home is decreasing the fewer new homes would be model 10. If consumers are saving more they we spending less perhaps even showing 05 0:30 TABLE 3-12 An Example Competitive Profile Matrix Company 1 Company 2 Company] Critical Success Factors Weight Rating Score Rating Score Rating Score Advertising 0.20 1 4 OS Product Quality 3 0.10 4 Price Competitie 0.10 2 3 0:30 2 0.30 Moment 1 010 0.10 4 0.00 ancial 020 0.15 1 010 4 0.60 2 010 0.10 4 0.40 030 0.20 4 Marke Share 1 0.05 0.20 2 1 005 4 020 1.00 3 2.50 Now The values was follows Imajor weaknes, 2 min weakness, 3 min As indicated by the weighted score of 2.20, Company is weakest on Clay Global Expo 030 3.15 Only right to face included for simplicity is actually, however, this is too few 81 OUTER). THENAL ASSESSMENT Lennar PiteGroup Score L Price Rating 3 0.48 Rating Score 2 032 2 016 3 ON 2 TABLE 3-13 An Actual CPM for D. R. Horton DR. Horton Critical Success Factors Weight Rating Score 0.16 4 2. Market Share 0.14 4 3. Geographical Coverage 0.12 4. Quality 0.10 0.30 5. Customer Service 0.09 2 IS 6. Profitability OOS 3 7. Financial Position 0.07 3 021 & Energy Efficiencies 2 012 Growth 0.06 3 18 10 W GOS 3 0.15 11. Warto 0.00 3 0.12 12. Social Responsibility 0.03 0.06 1.00 214 3 4 0.16 0.14 18 0.34 3 4 4 4 2 2 GOS 0.10 0.16 012 3 4 Other than the critical success factors listed in the sample CPM, factors the included in this analysis include breadth of product line, effectiveness of sales distribution, proprietary or patent advantages, location of facilities, production capacity and efficiency, experience relations, technological advantages, and e-commerce expertise Just because one firm receives a 3.30 overall rating and another receives a 2.80 in a CPM it does not necessarily follow that the first firm is precisely 14.3 percent better than the second but it does suggest that the first form is better in some areas. Regarding weights in a CPM EFE Matrix, be mindful that 0.05 is mathematically 33 percent higher than 0.05, so even small dif ferences can reveal important perceptions regarding the relative importance of various factors The aim with numbers is to assimilate and evaluate information in a meaningful way that aids in decision making An actual CPM is provided in Table 3-13. again for the largest homebuilder in the United Stes, D. R. Horton. Note that the two rival firm, Lennar and PulteGroup, receive higher ratings "Quality" than D. R. Horton. Also note the factors are listed beginning with the most impor tant highest weight). D. R. Horton, Land PueGroup are headquartered in Fort Worth Tea Miami, Florida, and Atlanta, Georgia, respectively IMPLICATIONS FOR STRATEGISTS Figure 3-4 reveals that to gain and competitive advantages promod ctionele en normations tyngredient hatgists must collect analyse and print information regard for making decisions that culmine in a winning strategic plan ing the firm's competitors, as well as identify and consider relevant rowsingy, busness is being used to dettyy Socialdemographie economic and technology trends and events na trends that otherwise go noticed from cober impacting the firm and its industry. This engineering hunt for tion The Bear Factor banon Mand Competitie facts is essential because expensive and sometimes seves M presented in this chapter are excelent strategic planning strategies are ultimately formulated and implemented based on toos formating and printing Information to enhance that information This chapter reveals that wanted organd, decision making