Question: Create an Excel workbook containing two depreciation schedule templates, each on a separate spreadsheet. One template should be a SL depreciation schedule and the other

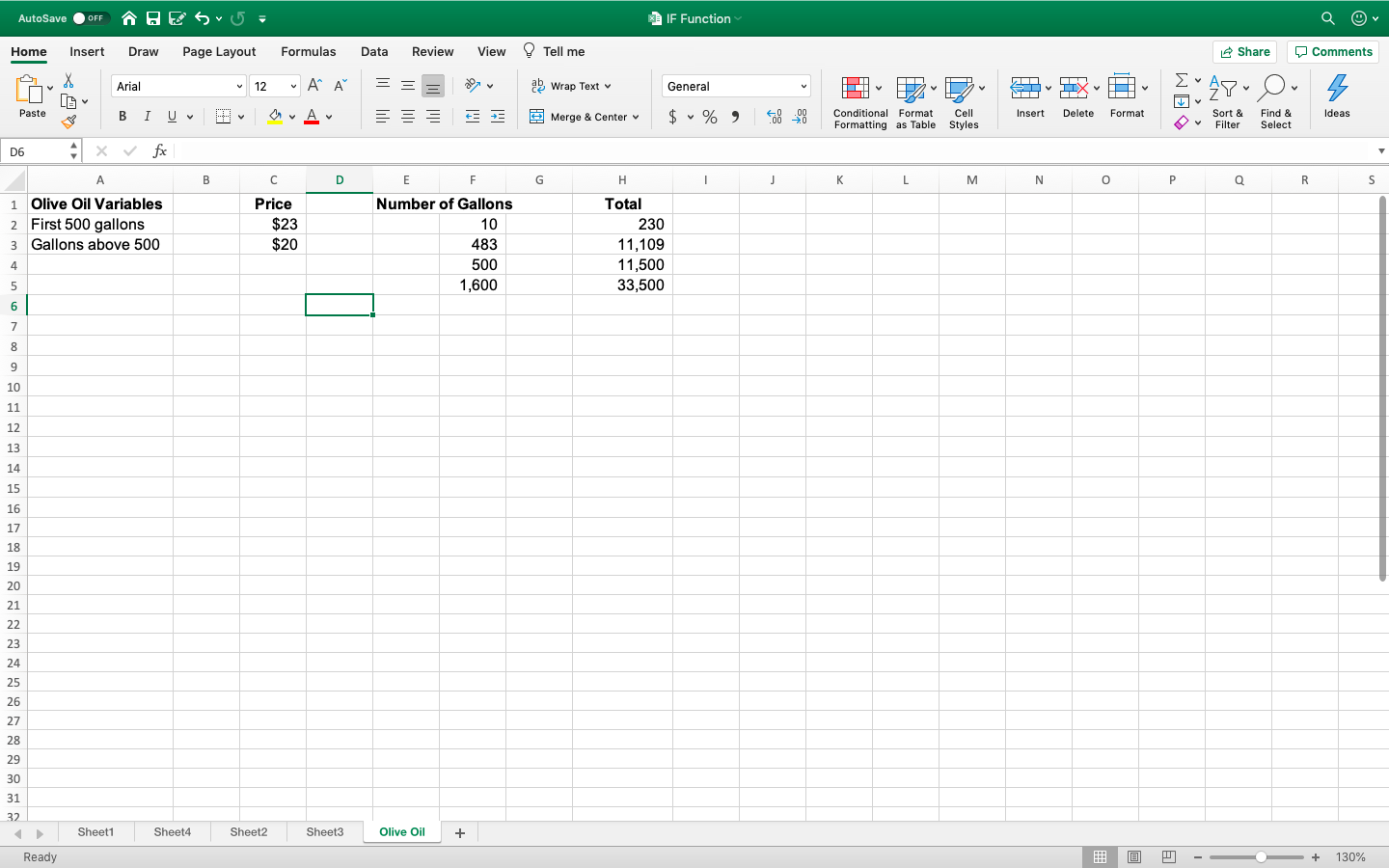

Create an Excel workbook containing two depreciation schedule templates, each on a separate spreadsheet. One template should be a SL depreciation schedule and the other template should be a DDB depreciation schedule. You should construct the spreadsheets using the formulas and cell referencing so that when the value of input variables are altered the calculations which automatically adjust. The spreadsheet columns should include depreciation expense, accumulated depreciation, and book value end of year (see textbook 575-576 for examples). Please note, you can not depreciate assets below any salvage value, therefore you will need to use IF function (see IF function guidance below). You must construct the worksheet with the appropriate numeric format and professional layout. Round number values to the nearest whole dollar. The fixed variables for the assignment are as follows:

Life of asset = 10 years

Depreciation methods = straight-line or double-declining balance method

Purchase date of asset = January 1, 2018

Can you please explain with formula please

some one answered of this question but they did not put formula ?

some one answered of this question but they did not put formula ?

I do not know if this is right or not. can you please help me with this with formula

please.

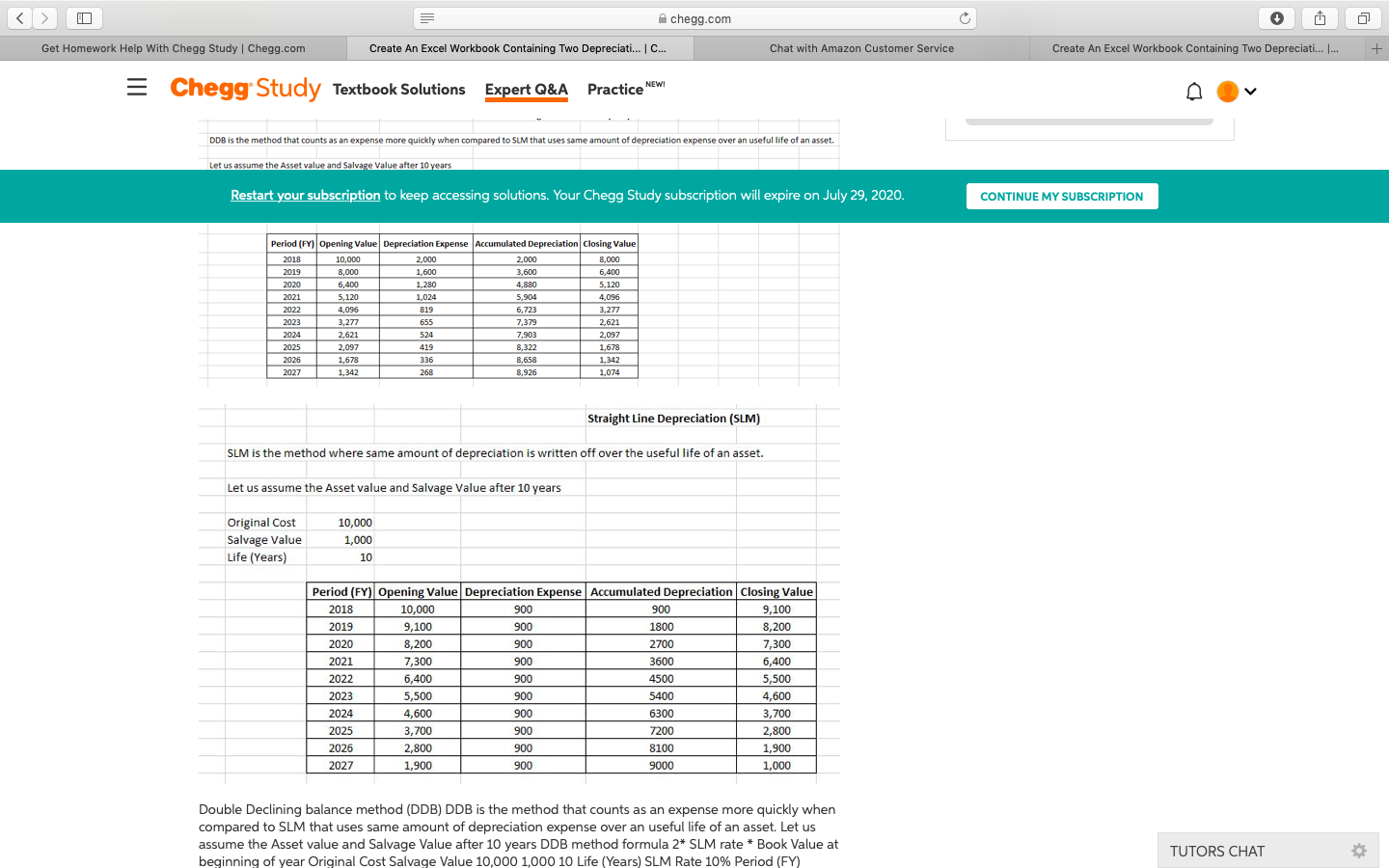

AutoSave OFF BESU- | IF Function Home Insert Draw Page Layout Formulas Data Review View Tell me Share Comments X V Arial 12 ~ AF = = v ab Wrap Text 480 General V Do LIX s Paste B I U A Merge & Center $ % ) * 40 .00 00 0 Insert Delete Format Ideas Conditional Format Formatting as Table Cell Styles v Sort & Filter Find & Select D6 x fx A B D E F G H 1 J L M N 0 P Q R S 1 Olive Oil Variables 2 First 500 gallons 3 Gallons above 500 Price $23 $20 Number of Gallons 10 483 500 1,600 Total 230 11,109 11,500 33,500 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 Sheet1 Sheet4 Sheet2 Sheet3 Olive Oil + Ready - + 130% chegg.com FT Get Homework Help With Chegg Study | Chegg.com Create An Excel Workbook Containing Two Depreciati... C... Chat with Amazon Customer Service Create An Excel Workbook Containing Two Depreciati... ... + = Chegg Study Textbook Solutions Expert Q&A Practice NEW! DDB is the method that counts as an expense more quickly when compared to SLM that uses same amount of depreciation expense over an useful life of an asset. Let us assume the Asset value and Salvage Value after 10 years Restart your subscription to keep accessing solutions. Your Chegg Study subscription will expire on July 29, 2020. CONTINUE MY SUBSCRIPTION Period (FY) Opening Value Depreciation Expense Accumulated Depreciation Closing Value 2018 10,000 2,000 2,000 8,000 2019 8,000 1,600 3,600 6,400 2020 6,400 1,280 4,880 5,120 2021 5,120 1,024 5,904 4,096 2022 4,096 819 6,723 3,277 2023 3,277 655 7,379 2,621 2024 2,621 524 7,903 2,097 2025 2,097 419 8,322 1,678 2026 1,678 336 8,658 1,342 2027 1,342 268 8,926 1,074 Straight Line Depreciation (SLM) SLM is the method where same amount of depreciation is written off over the useful life of an asset. Let us assume the Asset value and Salvage Value after 10 years Original Cost Salvage Value Life (Years) 10,000 1,000 10 Period (FY) Opening Value Depreciation Expense Accumulated Depreciation Closing Value 2018 10,000 900 900 9,100 2019 9,100 900 1800 8,200 2020 8,200 900 2700 7,300 2021 7,300 900 3600 6,400 6,400 900 4500 5,500 2023 5,500 900 5400 4,600 2024 4,600 900 6300 3,700 2025 3,700 900 7200 2,800 2026 2.800 900 1,900 2027 1,900 900 9000 1,000 2022 8100 Double Declining balance method (DDB) DDB is the method that counts as an expense more quickly when compared to SLM that uses same amount of depreciation expense over an useful life of an asset. Let us assume the Asset value and Salvage Value after 10 years DDB method formula 2* SLM rate * Book Value at beginning of year Original Cost Salvage Value 10,000 1,000 10 Life (Years) SLM Rate 10% Period (FY) TUTORS CHAT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts