Question: Create an IFE for Buffalo Wild Wings using the form on the next page. You will use six factors for each area (for strengths and

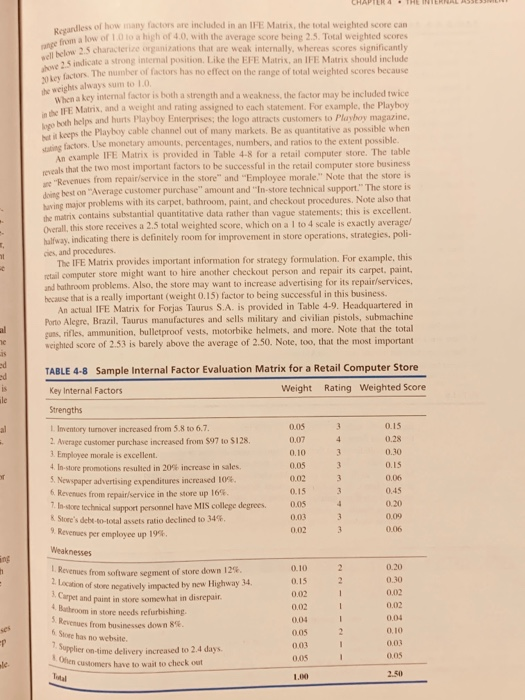

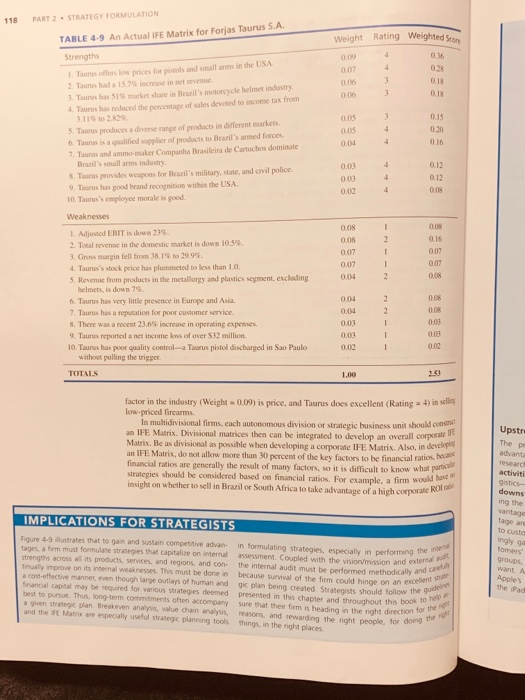

Create an IFE for Buffalo Wild Wings using the form on the next page. You will use six factors for each area (for strengths and for weaknesses). Once you have determined your values and completed the calculations, please thoroughly discuss the following: Choose two of your strengths factors and two of your weaknesses factors that you believe makes the most significant impact and thoroughly explain the rationale on why you believe that is the case. Using the two strengths and the two weaknesses from the previous question, thoroughly explain how you decided on the weight and rating. Describe your weighted score and detail what it mean in regards to the company's strategic position. What do you recommend this company to do to improve? Please make sure you follow the instructions from the textbook to ensure you complete this assignment properly. Remember that you are working with strengths and weaknesses, thus make sure you place the correct value in the cells. Significant points will be deducted for not following the textbook instructions or missing any component of the four questions listed above. ses with associated costs. Typical sources of benchmarking information, however, include pus The hardest part of benchmarking can be gaining access to other firms' value chaina lished reports, trade publications, suppliers, distributors, customers, partners, creditors, shing holders, lobbyists, and willing rival firms. Some rival firms share benchmarking data. However, the International Benchmarking Clearinghouse provides guidelines to help ensure that restrain of trade, price fixing, bid rigging, bribery, and other improper business conduct do not A summary step in conducting an internal strategic-management audit is to construct an Intern Transforming Value Chain Activi anal doir hay the Ove cies net and bec Por gue we TA 4. Multiply each factor's weight by its rating to determine a weighted score for each variable between participating firms. The Internal Factor Evaluation Matrix Factor Evaluation (IFE) Matrix. This strategy-formulation tool summarizes and evaluates the major strengths and weaknesses in the functional areas of a business, and it also provides a bei for identifying and evaluating relationships among those areas. Intuitive judgments are required in developing an IFE Matrix, so the appearance of a scientific approach should not be interpreted to mean this is an all-powerful technique. A thorough understanding of the factors included i more important than the actual numbers. Similar to the EFE Matrix and the Competitive Profile Matrix (CPM) described in Chapter 3, an IFE Matrix can be developed in five steps: 1. List key internal factors as identified in the internal-audit process. Use a total of 20 internal factors, including both strengths and weaknesses. List strengths first and then weaknesses Be as specific as possible, using percentages, ratios, and comparative numbers. Recall that Edward Deming said, "In God we trust. Everyone else bring data." Include action- able factors that can provide insight regarding strategies to pursue. For example, the factor "Our Quick Ratio is 2.1 versus industry average of 1.8" is not actionable, whereas the factor "Our chocolate division's ROI increased from 8 to 15 percent in South America" is actionable. Also, be as divisional as possible, because consolidated data oftentimes is not as revealing or useful in deciding among strategies as the underlying by-segment or division data. 2. Assign a weight that ranges from 0.0 (not important) to 1.0 (all-important) to each factor. The weight assigned to a given factor indicates the relative importance of the factor to bein successful in the firm's industry. Regardless of whether a key factor is an internal strength or weakness, factors considered to have the greatest effect on organizational performance should be assigned the highest weights. The sum of all weights must equal 1.0. 3. Assign a 1 to 4 rating to each factor to indicate whether that factor represents a major weakness (rating = 1), a minor weakness (rating = 2), a minor strength (rating = 3) , or a major strength (rating = 4). Note that strengths must receive a 3 or 4 rating and weaknesse must receive a 1 or 2 rating. Ratings are thus company-based, whereas the weights in step 2 are industry-based 5. Sum the weighted scores for each variable to determine the total weighted score for the organization 7. Supplier on-time delivery increased to 2.4 days he customers have to wait to check out CHAPIR 4. THE PEL te weights always sum to 10 Regardless of how many factors are included in an IFE Matrix, the total weighted score can mange from a low or to a high or with the average score being 2.5 Total weighted scores well below 2.5 characterize organizations that are weak internally, whereas scores significantly howe 2.5 indicate a strong intemal position. Like the EFE Matrix, an IFE Matrix should include Okey factors. The number of factors has no effect on the range of total weighted scores because When a key internal factor is both a strength and a weakness, the factor may be included twice in the IFE Matrix, and a weight and rating assigned to each statement. For example, the Playboy Topo troch helps and hurts Playboy Enterprises, the logo attracts customers to Playboy magazine, at it keeps the Playboy cable channel out of many markets. Be as quantitative as possible when starting factors. Use monetary amounts, percentages, numbers, and ratios to the extent possible. An example IFE Matrix is provided in Table 4-8 for a retail computer store. The table reveals that the two most important factors to be successful in the retail computer store business are "Revenues from repair service in the store" and "Employee morale." Note that the store is doing best on "Average customer purchase" amount and in-store technical support." The store is having major problems with its carpet, bathroom, paint, and checkout procedures. Note also that the matrix contains substantial quantitative data rather than vague statements, this is excellent Overall, this store receives a 2.5 total weighted score, which on a I to 4 scale is exactly average/ halfway, indicating there is definitely room for improvement in store operations, strategies, poli- cies, and procedures The IFE Matrix provides important information for strategy formulation. For example, this retail computer store might want to hire another checkout person and repair its carpet, paint, and bathroom problems. Also, the store may want to increase advertising for its repair/services, because that is a really important (weight 0.15) factor to being successful in this business. An actual IFE Matrix for Forjas Taurus S.A. is provided in Table 4.9. Headquartered in Porto Alegre, Brazil, Taurus manufactures and sells military and civilian pistols, submachine guns, rifles, ammunition, bulletproof vests, motorbike helmets, and more. Note that the total weighted score of 2.53 is barely above the average of 2.50. Note, too, that the most important he is TABLE 4-8 Sample Internal Factor Evaluation Matrix for a Retail Computer Store is ale Key Internal Factors Weight Rating Weighted Score 3 4 0.15 0.28 0.30 3 3 0.15 Strengths Inventory tumover increased from 5.8 to 6.7. 2. Average customer purchase increased from 597 to 5128 3. Employee morale is excellent. 4. In-store promotions resulted in 20% increase in sales. 5. Newspaper advertising expenditures increased 10%. 6. Revenues from repair/service in the store up 16% 7. In-store technical support persoanel have MIS college degrees & Store's debt-to-total assets ratio declined to 34% 9. Revenues per employee up 199. DUOS 0.07 0.10 0.05 0.02 0.15 00S 0.03 0.02 0.06 0.45 3 4 3 3 0.20 0.09 0.06 Weaknesses in 11 Revenues from software segment of store down 12% 2. Location of store negatively imported by new Highway 34. Carpet and paint in store somewhat in disrepair. 4 Bathroom in store needs refurbishing. 5. Revenues from businesses down 8%. 0.10 0.15 0.02 0.02 0.04 005 003 0.05 2 1 1 1 2 1 0.20 0.30 0.02 0.02 0.04 0.10 0.00 Ste has no website EP 1 0.05 le 1.00 015 03 0.13 Weight Rating Weighted Store in formulating strategies, especially in performing the assessment coupled with the visionmission and external the internal audit must be performed methodically and ca because Sural of the firm could hinge on an excellent plan being created Strategists should follow the guide a given strategic plan Breakeven analys, value chain analysis sons and rewarding the right people for doing the sure that the form is heading in the right direction for the 118 PART 2 STRATEGY FORMULATION TABLE 4-9 An Actual IFE Matrix for Forjas Taurus S.A. Strengths 0209 4 4 007 1. Taurus fers low prices for pistols and small arms in the USA 2. Thursda 15.7 increase in net een 3 Thursas 515 market share in Bearil's motorcycle helmet industry 006 3 4. Taurus has reduced the percentage of sales devoted to income tax from 005 3 0.15 5. This produces a diverse range of products in different markets 005 4 0:20 6. Tans is a qualified supplier of products to Brazil's armed forces, 00 4 0.16 7. Trus and ammo maker Companha Brasileira de Cartuchos dominate Brazil's small arms industry 002 4 0.12 8. Thus provides weapons for Brazil's military, state, and civil police 003 4 0.12 9. Thus has good brand recognition within the USA 0.02 0.08 10. Taurus's employee morale is good Weaknesses ON 1 Ons 1. Adjusted EBIT is down 23 2. Tocal revenue in the domestic market is down 1055 0.08 2 0.16 3. Gros margin fell from 38.1 a 29.95 0.07 1 0.07 4. Taurus's stock price has plummeted to less than 10 0.07 1 0.07 5. Revenue from products in the metallurgy and plastics segment, excluding 004 2 00 helmets, is down 6. Taurus has very little presence in Europe and Asia. 0.04 2 7. Taurus has a reputation for poor customer service. 0.04 2 008 8. There was a recent 23.6% increase in operating expenses 0.03 1 0.00 9. Taurus reported a net income kors of over $12 million 0.03 1 003 10. Taurus has poor quality control-a Taurus pistol discharged in Sao Paulo 0.02 1 without pulling the trigger TOTALS 1.00 factor in the industry (Weight 0.09) is price, and Taurus does excellent (Rating = 4) in selling low-priced firearms. In multidivisional firms, each autonomous division or strategic business unit should con an IFE Matrix. Divisional matrices then can be integrated to develop an overall corporate I Matris. Be as divisional as possible when developing a corporate IFE Matrix. Also, in developing an IFE Matrix, do not allow more than 30 percent of the key factors to be financial ratios, beca financial ratios are generally the result of many factors, so it is difficult to know what particule insight on whether to sell in Brazil or South Africa to take advantage of a high corporate Rol re IMPLICATIONS FOR STRATEGISTS Figure 4-9 illustrates that to gain and sustain competitive advan tages, a firm must formulate strategies that capitalize on internal strengths across all its products, services, and regions, and con tly improve on its internal weaknesses. This must be done in a co-effective best to pursue. Thus, long-term commitments often accompany Upstr: The De advant activiti downs ing the toare to custo ingly Somers groups want Apple's the Pad and the especially web strategic planning tools Things, in the right places