Question: Create an income statement and a balance sheet from the information below. Assume that the income tax rate for Peters cookies is 6% and Peters

Create an income statement and a balance sheet from the information below. Assume that the income tax rate for Peters cookies is 6% and Peters cookies does not incur any additional debt, issue any additional stock or distribute any dividends (hint: round up taxes to next whole dollar and net income is equal to retained earnings).

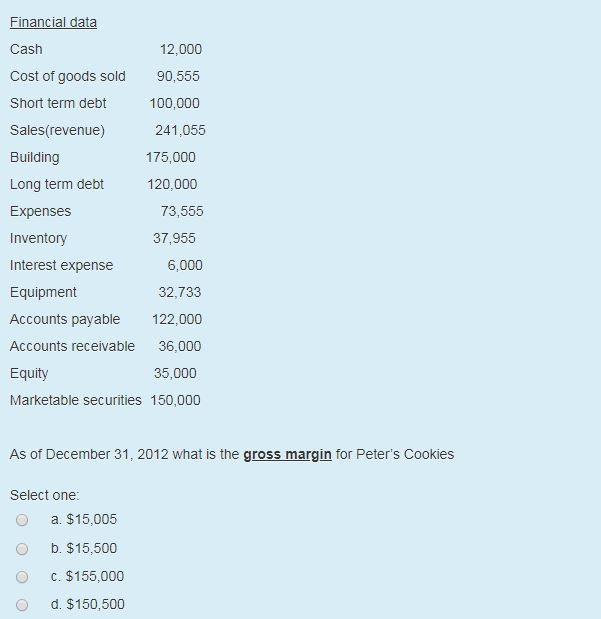

nancial data Cash Cost of goods sold 90,555 Short term debt Sales(revenue) Building Long term debt Expenses Inventory Interest expense Equipment Accounts payable 122,000 Accounts receivable 36.000 Equity Marketable securities 150,000 12,000 100,000 241,055 175,000 120,000 73,555 37,955 6,000 32,733 35,000 As of December 31, 2012 what is the gross margin for Peter's Cookies Select one O a. $15,005 O b. $15,500 ? ?. $155,000 O d. $150,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts