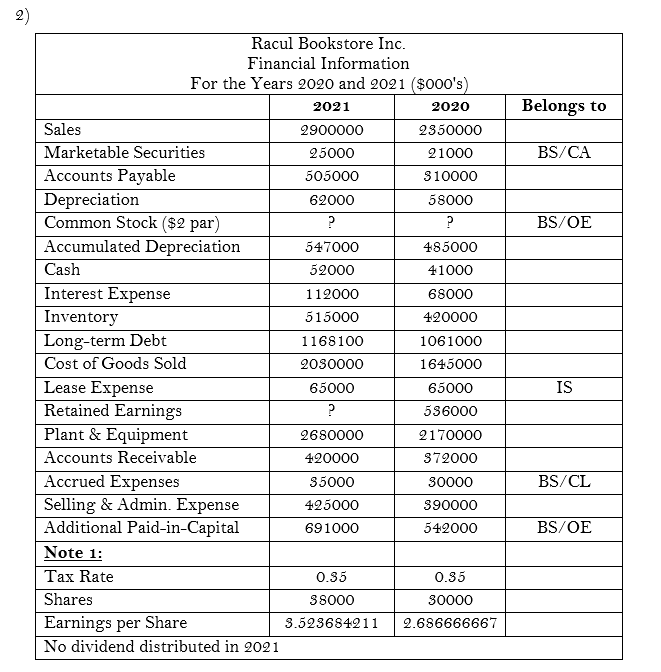

Question: Create Income Statement for 2021 and 2020 (20 Points) Create Balance Sheet for 2021 and 2020 (20 Points) Create Cash Flow Statement for 2021 (30

Create Income Statement for 2021 and 2020 (20 Points)

Create Balance Sheet for 2021 and 2020 (20 Points)

Create Cash Flow Statement for 2021 (30 Points)

Note: The numbers in financial statements are both market and book values. That means book and market values are the same, which are the current numbers in the statements.

2) \begin{tabular}{|l|c|c|c|} \hline \multicolumn{4}{|c|}{ Racul Bookstore Inc. Financial Information For the Years 2020 and 2021($000s)} \\ \hline & 2021 & 2020 & Belongs to \\ \hline Sales & 2900000 & 2350000 & \\ \hline Marketable Securities & 25000 & 21000 & BS/CA \\ \hline Accounts Payable & 505000 & 310000 & \\ \hline Depreciation & 62000 & 58000 & \\ \hline Common Stock (\$2 par) & ? & ? & BS/OE \\ \hline Accumulated Depreciation & 547000 & 485000 & \\ \hline Cash & 52000 & 41000 & \\ \hline Interest Expense & 112000 & 68000 & \\ \hline Inventory & 515000 & 420000 & \\ \hline Long-term Debt & 1168100 & 1061000 & \\ \hline Cost of Goods Sold & 2030000 & 1645000 & \\ \hline Lease Expense & 65000 & 65000 & IS \\ \hline Retained Earnings & ? & 536000 & \\ \hline Plant \& Equipment & 2680000 & 2170000 & \\ \hline Accounts Receivable & 420000 & 372000 & \\ \hline Accrued Expenses & 35000 & 30000 & BS/CL \\ \hline Selling \& Admin. Expense & 425000 & 390000 & \\ \hline Additional Paid-in-Capital & 691000 & 542000 & BS/OE \\ \hline Note 1: & & & \\ \hline Tax Rate & 0.35 & 0.35 & \\ \hline Shares & 38000 & 30000 & \\ \hline Earnings per Share & 3.523684211 & 2.686666667 & \\ \hline No dividend distributed in 2021 & & \\ \hline \end{tabular} 2) \begin{tabular}{|l|c|c|c|} \hline \multicolumn{4}{|c|}{ Racul Bookstore Inc. Financial Information For the Years 2020 and 2021($000s)} \\ \hline & 2021 & 2020 & Belongs to \\ \hline Sales & 2900000 & 2350000 & \\ \hline Marketable Securities & 25000 & 21000 & BS/CA \\ \hline Accounts Payable & 505000 & 310000 & \\ \hline Depreciation & 62000 & 58000 & \\ \hline Common Stock (\$2 par) & ? & ? & BS/OE \\ \hline Accumulated Depreciation & 547000 & 485000 & \\ \hline Cash & 52000 & 41000 & \\ \hline Interest Expense & 112000 & 68000 & \\ \hline Inventory & 515000 & 420000 & \\ \hline Long-term Debt & 1168100 & 1061000 & \\ \hline Cost of Goods Sold & 2030000 & 1645000 & \\ \hline Lease Expense & 65000 & 65000 & IS \\ \hline Retained Earnings & ? & 536000 & \\ \hline Plant \& Equipment & 2680000 & 2170000 & \\ \hline Accounts Receivable & 420000 & 372000 & \\ \hline Accrued Expenses & 35000 & 30000 & BS/CL \\ \hline Selling \& Admin. Expense & 425000 & 390000 & \\ \hline Additional Paid-in-Capital & 691000 & 542000 & BS/OE \\ \hline Note 1: & & & \\ \hline Tax Rate & 0.35 & 0.35 & \\ \hline Shares & 38000 & 30000 & \\ \hline Earnings per Share & 3.523684211 & 2.686666667 & \\ \hline No dividend distributed in 2021 & & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts