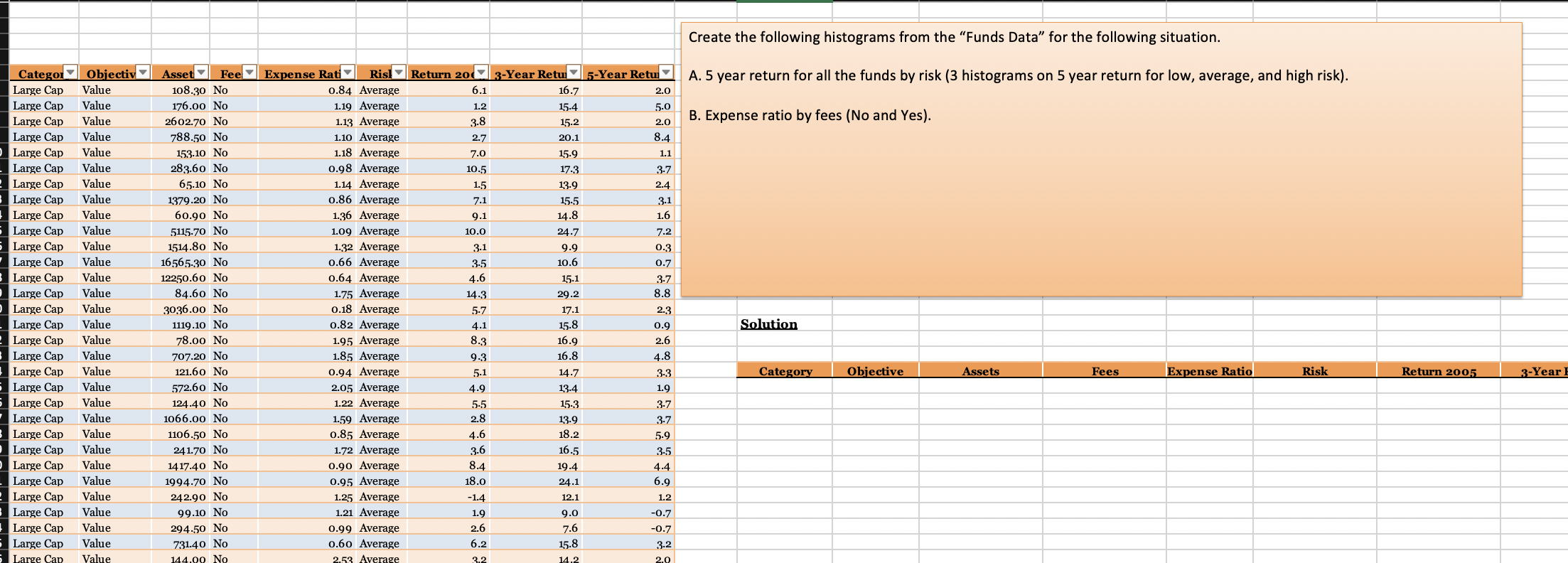

Question: Create the following histograms from the Funds Data for the following situation. Fee 5-Year Retu A. 5 year return for all the funds by risk

Create the following histograms from the "Funds Data for the following situation. Fee 5-Year Retu A. 5 year return for all the funds by risk (3 histograms on 5 year return for low, average, and high risk). 2.0 B. Expense ratio by fees (No and Yes). 5.0 2.0 8.4 1.1 20.1 3.7 2.4 3.1 1.6 Categor Objectiv Large Cap Value Large Cap Value Large Cap Value Large Cap Value Large Cap Value Large Cap Value Large Cap Value Large Cap Value Large Cap Value Large Cap Value Large Cap Value Large Cap Value Large Cap Value Large Cap Value Large Cap Value Large Cap Value Large Cap Value Large Cap Value Large Cap Value Large Cap Value Large Cap Value Large Cap Value Large Cap Value Large Cap Value Large Cap Value Large Cap Value Large Cap Value Large Cap Value Large Cap Value Large Cap Value Large Cap Value Asset 108.30 No 176.00 No 2602.70 No 788.50 No 153.10 No 283.60 No 65.10 No 1379.20 No 60.90 No 5115.70 No 1514.80 No 16565-30 No 12250.60 No 84.60 No 3036.00 No 1119.10 No 78.00 No 707.20 No 121.60 No 572.60 No 124.40 No 1066.00 No 1106.50 No 241.70 No 1417.40 No 1994.70 No 242.90 No 99.10 No 294-50 No 731.40 No 144.00 No Expense Rat Risi 0.84 Average 1.19 Average 1.13 Average 1.10 Average 1.18 Average 0.98 Average 1.14 Average 0.86 Average 1.36 Average 1.09 Average 1.32 Average 0.66 Average 0.64 Average 1.75 Average 0.18 Average 0.82 Average 1.95 Average 1.85 Average 0.94 Average 2.05 Average 1.22 Average 1.59 Average 0.85 Average 1.72 Average 0.90 Average 0.95 Average 1.25 Average 1.21 Average 0.99 Average 0.60 Average 2.53 Average Return 20 3-Year Retu 6.1 16.7 1.2 15.4 3.8 15.2 2.7 7.0 15.9 10.5 17-3 1.5 13.9 7.1 15-5 9.1 14.8 10.0 24.7 3.1 9.9 3-5 10.6 4.6 15.1 14-3 29.2 5.7 17.1 4.1 8.3 16.9 9.3 16.8 5.1 14.7 4.9 13.4 5-5 15-3 2.8 13.9 4.6 18.2 3.6 16.5 8.4 19.4 18.0 24.1 -1.4 12.1 1.9 9.0 2.6 7.6 6.2 15.8 3.2 14.2 7.2 0.3 0.7 3.7 8.8 2.3 0.9 2.6 4.8 3-3 15.8 Solution Category Objective Assets Fees Expense Ratio Risk Return 2005 3-Year! 1.9 3.7 3.7 5.9 3-5 4.4 6.9 1.2 -0.7 -0.7 3.2 2.9 Create the following histograms from the "Funds Data for the following situation. Fee 5-Year Retu A. 5 year return for all the funds by risk (3 histograms on 5 year return for low, average, and high risk). 2.0 B. Expense ratio by fees (No and Yes). 5.0 2.0 8.4 1.1 20.1 3.7 2.4 3.1 1.6 Categor Objectiv Large Cap Value Large Cap Value Large Cap Value Large Cap Value Large Cap Value Large Cap Value Large Cap Value Large Cap Value Large Cap Value Large Cap Value Large Cap Value Large Cap Value Large Cap Value Large Cap Value Large Cap Value Large Cap Value Large Cap Value Large Cap Value Large Cap Value Large Cap Value Large Cap Value Large Cap Value Large Cap Value Large Cap Value Large Cap Value Large Cap Value Large Cap Value Large Cap Value Large Cap Value Large Cap Value Large Cap Value Asset 108.30 No 176.00 No 2602.70 No 788.50 No 153.10 No 283.60 No 65.10 No 1379.20 No 60.90 No 5115.70 No 1514.80 No 16565-30 No 12250.60 No 84.60 No 3036.00 No 1119.10 No 78.00 No 707.20 No 121.60 No 572.60 No 124.40 No 1066.00 No 1106.50 No 241.70 No 1417.40 No 1994.70 No 242.90 No 99.10 No 294-50 No 731.40 No 144.00 No Expense Rat Risi 0.84 Average 1.19 Average 1.13 Average 1.10 Average 1.18 Average 0.98 Average 1.14 Average 0.86 Average 1.36 Average 1.09 Average 1.32 Average 0.66 Average 0.64 Average 1.75 Average 0.18 Average 0.82 Average 1.95 Average 1.85 Average 0.94 Average 2.05 Average 1.22 Average 1.59 Average 0.85 Average 1.72 Average 0.90 Average 0.95 Average 1.25 Average 1.21 Average 0.99 Average 0.60 Average 2.53 Average Return 20 3-Year Retu 6.1 16.7 1.2 15.4 3.8 15.2 2.7 7.0 15.9 10.5 17-3 1.5 13.9 7.1 15-5 9.1 14.8 10.0 24.7 3.1 9.9 3-5 10.6 4.6 15.1 14-3 29.2 5.7 17.1 4.1 8.3 16.9 9.3 16.8 5.1 14.7 4.9 13.4 5-5 15-3 2.8 13.9 4.6 18.2 3.6 16.5 8.4 19.4 18.0 24.1 -1.4 12.1 1.9 9.0 2.6 7.6 6.2 15.8 3.2 14.2 7.2 0.3 0.7 3.7 8.8 2.3 0.9 2.6 4.8 3-3 15.8 Solution Category Objective Assets Fees Expense Ratio Risk Return 2005 3-Year! 1.9 3.7 3.7 5.9 3-5 4.4 6.9 1.2 -0.7 -0.7 3.2 2.9

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts