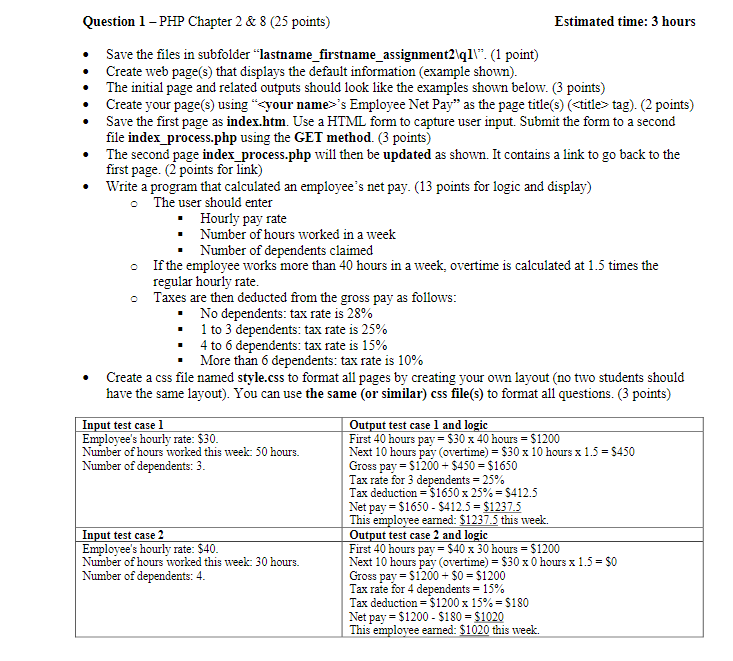

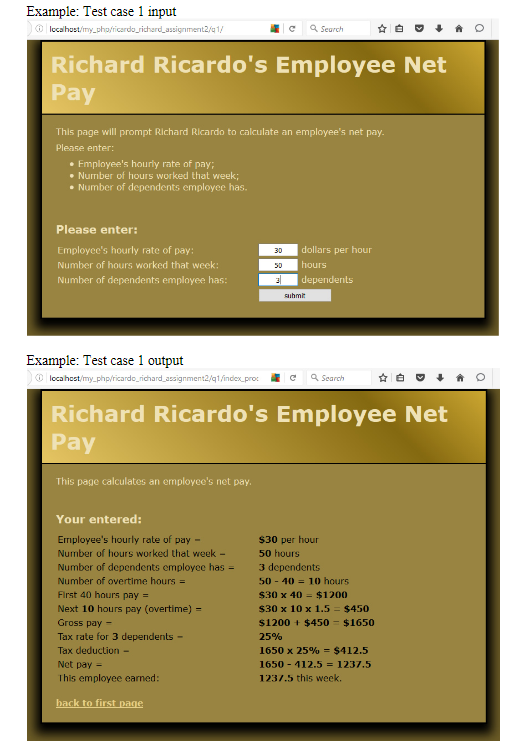

Question: Create web page(s) that displays the default information (example shown). The initial page and related outputs should look like the examples shown below. (3 points)

Create web page(s) that displays the default information (example shown).

The initial page and related outputs should look like the examples shown below. (3 points)

Create your page(s) using s Employee Net Pay as the page title(s) ( tag). (2 points)

Save the first page as index.htm. Use a HTML form to capture user input. Submit the form to a second file index_process.php using the GET method. (3 points)

The second-page index_process then will be updated as shown. It contains a link to go back to the first page

Write a program that calculated an employees net pay. (13 points for logic and display)

oThe user should enter

Hourly pay rate

Number of hours worked in a week

Number of dependents claimed

o If the employee works more than 40 hours in a week, overtime is calculated at 1.5 times the regular hourly rate.

o Taxes are then deducted from the gross pay as follows:

No dependents: tax rate is 28%

1 to 3 dependents: tax rate is 25%

4 to 6 dependents: tax rate is 15%

More than 6 dependents: tax rate is 10%

Create a css file named style.css to format all pages by creating your own layout (no two students should have the same layout). You can use the same (or similar)css file(s) to format all questions.

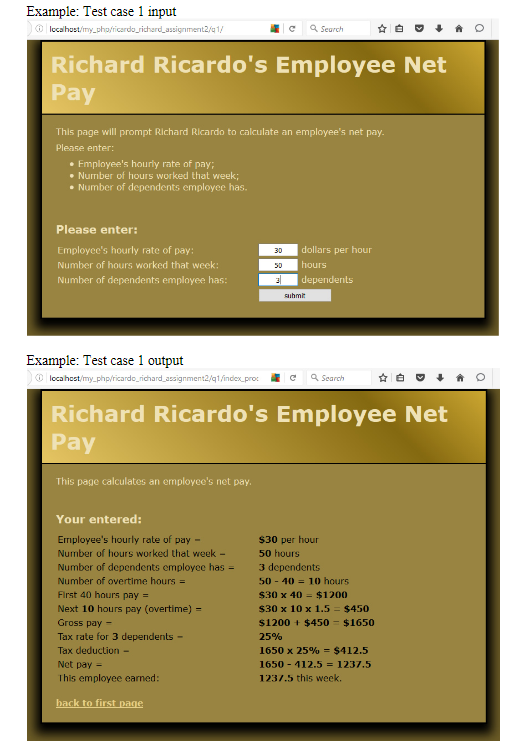

| Input test case 1 | Output test case 1 and logic |

| Employee's hourly rate: $30. Number of hours worked this week: 50 hours. Number of dependents: 3. | First 40 hours pay = $30 x 40 hours = $1200 Next 10 hours pay (overtime) = $30 x 10 hours x 1.5 = $450 Gross pay = $1200 + $450 = $1650 Tax rate for 3 dependents = 25% Tax deduction = $1650 x 25% = $412.5 Net pay = $1650 - $412.5 = $1237.5 This employee earned: $1237 this week. |

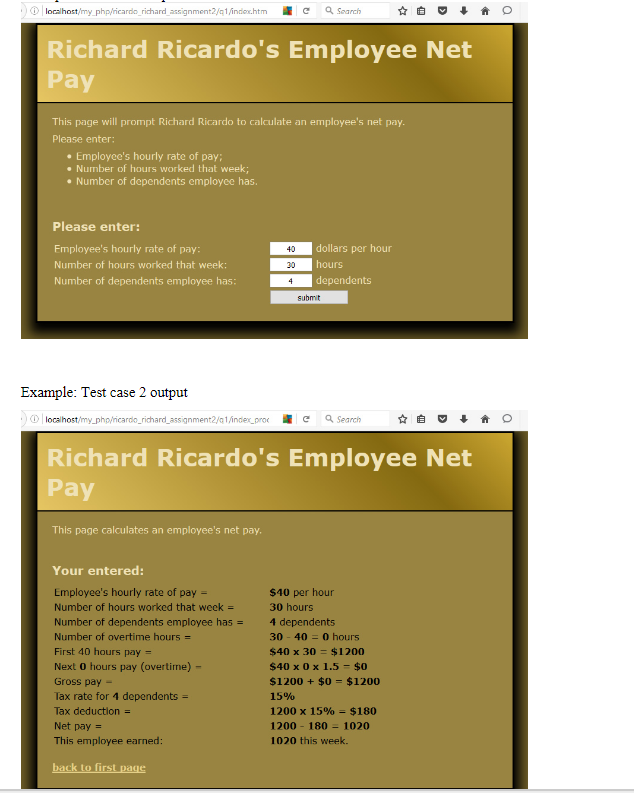

| Input test case 2 | Output test case 2and logic |

| Employee's hourly rate: $40. Number of hours worked this week: 30 hours. Number of dependents: 4. | First 40 hours pay = $40 x 30 hours = $1200 Next 10 hours pay (overtime) = $30 x 0 hours x 1.5 = $0 Gross pay = $1200 + $0 = $1200 Tax rate for 4 dependents = 15% Tax deduction = $1200 x 15% = $180 Net pay = $1200 - $180 = $1020 This employee earned: $1020 this week |

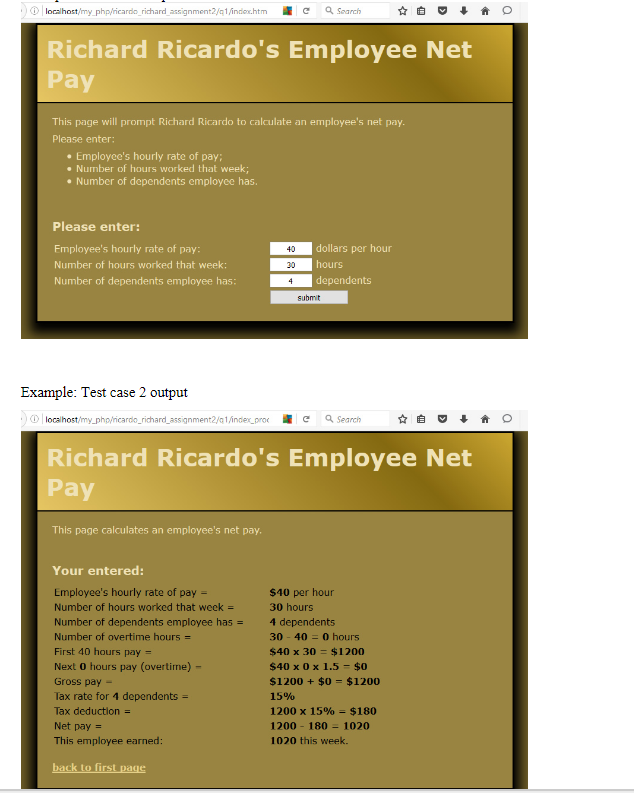

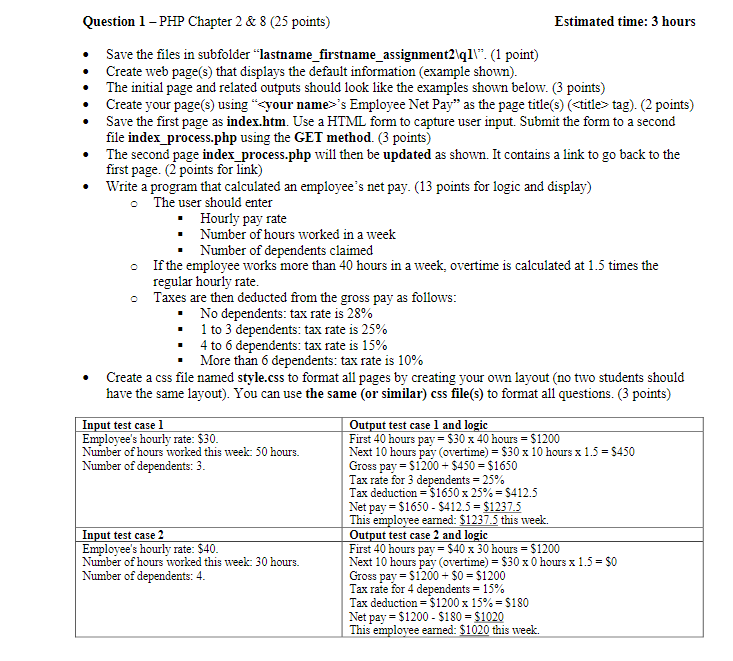

Question 1 - PHP Chapter 2 & 8 (25 points) Estimated time: 3 hours Save the files in subfolder "lastname_firstname_assignment2\q11". (1 point) Create web page(s) that displays the default information (example shown). The initial page and related outputs should look like the examples shown below. (3 points) Create your page(s) using your name>'s Employee Net Pay" as the page title(s) (

tag). (2 points) Save the first page as index.htm. Use a HTML form to capture user input. Submit the form to a second file index_process.php using the GET method. (3 points) The second page index process.php will then be updated as shown. It contains a link to go back to the first page. (2 points for link) Write a program that calculated an employee's net pay. (13 points for logic and display) o The user should enter Hourly pay rate Number of hours worked in a week Number of dependents claimed If the employee works more than 40 hours in a week, overtime is calculated at 1.5 times the regular hourly rate. Taxes are then deducted from the gross pay as follows: No dependents: tax rate is 28% 1 to 3 dependents: tax rate is 25% . 4 to 6 dependents: tax rate is 15% . More than 6 dependents: tax rate is 10% Create a css file named style.css to format all pages by creating your own layout (no two students should have the same layout). You can use the same (or similar) css file(s) to format all questions. (3 points) Input test case 1 Employee's hourly rate: $30. Number of hours worked this week: 50 hours. Number of dependents: 3. Input test case 2 Employee's hourly rate: $40. Number of hours worked this week: 30 hours. Number of dependents: 4. Output test case 1 and logic First 40 hours pay= $30 x 40 hours = $1200 Next 10 hours pay (overtime) = $30 x 10 hours x 1.5 = $450 Gross pay = $1200+ $450 = $1650 Tax rate for 3 dependents = 25% Tax deduction = $1650 x 25%= 5412.5 Net pay = $1650 - $412.5 = $1237.5 This employee earned: $1237.5 this week. Output test case 2 and logic First 40 hours pay = $40 x 30 hours = $1200 Next 10 hours pay (overtime) = $30 x 0 hours x 1.5 = $0 Gross pay = $1200 + $0 = $1200 Tax rate for 4 dependents = 15% Tax deduction = $1200 x 15%= $180 Net pay = $1200 - $180 = $1020 This employee earned: $1020 this week. Example: Test case 1 input localhost my haricardo_richard_assignment2/01/ c Search O Richard Ricardo's Employee Net Pay This page will prompt Richard Ricardo to calculate an employee's net pay. Please enter: Employee's hourly rate of pay, Number of hours worked that week; Number of dependents employee has. Please enter: 30 Employee's hourly rate of pay: Number of hours worked that week: Number of domendants, employee has dollars per hour hours dependents a ihmit Example: Test case 1 output loca host/my.php/ricardo_richard assignment2/1/index.pro: Search Richard Ricardo's Employee Net Pay This page calculates an employee's net pay. Your entered: Employee's hourly rate of pay - Number of hours worked that week - Number of dependents employee has = Number of overtime hours = First 40 hours pay = Next 10 hours pay (overtime) = Gross pay- Tax rate for 3 dependents - Tax deduction - Net pay This employee eamed: $30 per hour 50 hours 3 dependents 50 - 40 = 10 hours $30 x 40 = $1200 $30 x 10 x 1.5 = $450 $1200 + $450 - $1650 25% 1650 x 25% = $412.5 1650 - 412.5 = 1237.5 1237.5 this week. back to first page 1 localhost/my.php/ricardo_richard assignment2/1/index.htm c Search Richard Ricardo's Employee Net Pay This page will prompt Richard Ricardo to calculate an employee's net pay. Please enter: Employee's hourly rate of pay; Number of hours worked that week; Number of dependents employee has. Please enter: Employee's hourly rate of pay: Number of hours worked that week: Number of dependents employee has: 40 30 dollars per hour hours dependents submit Example: Test case 2 output localhost/my.php/ricardo_richard_assignment2/01/index_proc c a Search O Richard Ricardo's Employee Net Pay This page calculates an employee's net pay. Your entered: Employee's hourly rate of pay = Number of hours worked that week = Number of dependents employee has = Number of overtime hours = First 40 hours pay = Next O hours pay (overtime) - Gross pay- Tax rate for 4 dependents = Tax deduction = Net pay = This employee earned: $40 per hour 30 hours 4 dependents 30 - 40 = 0 hours $40 x 30 = $1200 $40 x0x 1.5 = $0 $1200 + $0 = $1200 15% 1200 x 15% = $180 1200 - 180 = 1020 1020 this week. back to first page Question 1 - PHP Chapter 2 & 8 (25 points) Estimated time: 3 hours Save the files in subfolder "lastname_firstname_assignment2\q11". (1 point) Create web page(s) that displays the default information (example shown). The initial page and related outputs should look like the examples shown below. (3 points) Create your page(s) using your name>'s Employee Net Pay" as the page title(s) (<title> tag). (2 points) Save the first page as index.htm. Use a HTML form to capture user input. Submit the form to a second file index_process.php using the GET method. (3 points) The second page index process.php will then be updated as shown. It contains a link to go back to the first page. (2 points for link) Write a program that calculated an employee's net pay. (13 points for logic and display) o The user should enter Hourly pay rate Number of hours worked in a week Number of dependents claimed If the employee works more than 40 hours in a week, overtime is calculated at 1.5 times the regular hourly rate. Taxes are then deducted from the gross pay as follows: No dependents: tax rate is 28% 1 to 3 dependents: tax rate is 25% . 4 to 6 dependents: tax rate is 15% . More than 6 dependents: tax rate is 10% Create a css file named style.css to format all pages by creating your own layout (no two students should have the same layout). You can use the same (or similar) css file(s) to format all questions. (3 points) Input test case 1 Employee's hourly rate: $30. Number of hours worked this week: 50 hours. Number of dependents: 3. Input test case 2 Employee's hourly rate: $40. Number of hours worked this week: 30 hours. Number of dependents: 4. Output test case 1 and logic First 40 hours pay= $30 x 40 hours = $1200 Next 10 hours pay (overtime) = $30 x 10 hours x 1.5 = $450 Gross pay = $1200+ $450 = $1650 Tax rate for 3 dependents = 25% Tax deduction = $1650 x 25%= 5412.5 Net pay = $1650 - $412.5 = $1237.5 This employee earned: $1237.5 this week. Output test case 2 and logic First 40 hours pay = $40 x 30 hours = $1200 Next 10 hours pay (overtime) = $30 x 0 hours x 1.5 = $0 Gross pay = $1200 + $0 = $1200 Tax rate for 4 dependents = 15% Tax deduction = $1200 x 15%= $180 Net pay = $1200 - $180 = $1020 This employee earned: $1020 this week. Example: Test case 1 input localhost my haricardo_richard_assignment2/01/ c Search O Richard Ricardo's Employee Net Pay This page will prompt Richard Ricardo to calculate an employee's net pay. Please enter: Employee's hourly rate of pay, Number of hours worked that week; Number of dependents employee has. Please enter: 30 Employee's hourly rate of pay: Number of hours worked that week: Number of domendants, employee has dollars per hour hours dependents a ihmit Example: Test case 1 output loca host/my.php/ricardo_richard assignment2/1/index.pro: Search Richard Ricardo's Employee Net Pay This page calculates an employee's net pay. Your entered: Employee's hourly rate of pay - Number of hours worked that week - Number of dependents employee has = Number of overtime hours = First 40 hours pay = Next 10 hours pay (overtime) = Gross pay- Tax rate for 3 dependents - Tax deduction - Net pay This employee eamed: $30 per hour 50 hours 3 dependents 50 - 40 = 10 hours $30 x 40 = $1200 $30 x 10 x 1.5 = $450 $1200 + $450 - $1650 25% 1650 x 25% = $412.5 1650 - 412.5 = 1237.5 1237.5 this week. back to first page 1 localhost/my.php/ricardo_richard assignment2/1/index.htm c Search Richard Ricardo's Employee Net Pay This page will prompt Richard Ricardo to calculate an employee's net pay. Please enter: Employee's hourly rate of pay; Number of hours worked that week; Number of dependents employee has. Please enter: Employee's hourly rate of pay: Number of hours worked that week: Number of dependents employee has: 40 30 dollars per hour hours dependents submit Example: Test case 2 output localhost/my.php/ricardo_richard_assignment2/01/index_proc c a Search O Richard Ricardo's Employee Net Pay This page calculates an employee's net pay. Your entered: Employee's hourly rate of pay = Number of hours worked that week = Number of dependents employee has = Number of overtime hours = First 40 hours pay = Next O hours pay (overtime) - Gross pay- Tax rate for 4 dependents = Tax deduction = Net pay = This employee earned: $40 per hour 30 hours 4 dependents 30 - 40 = 0 hours $40 x 30 = $1200 $40 x0x 1.5 = $0 $1200 + $0 = $1200 15% 1200 x 15% = $180 1200 - 180 = 1020 1020 this week. back to first page