Question: Creating a VBA Function that Values a Delayed Annuity Create a user defined VBA function that has the flexibility to value either a delayed perpetuity

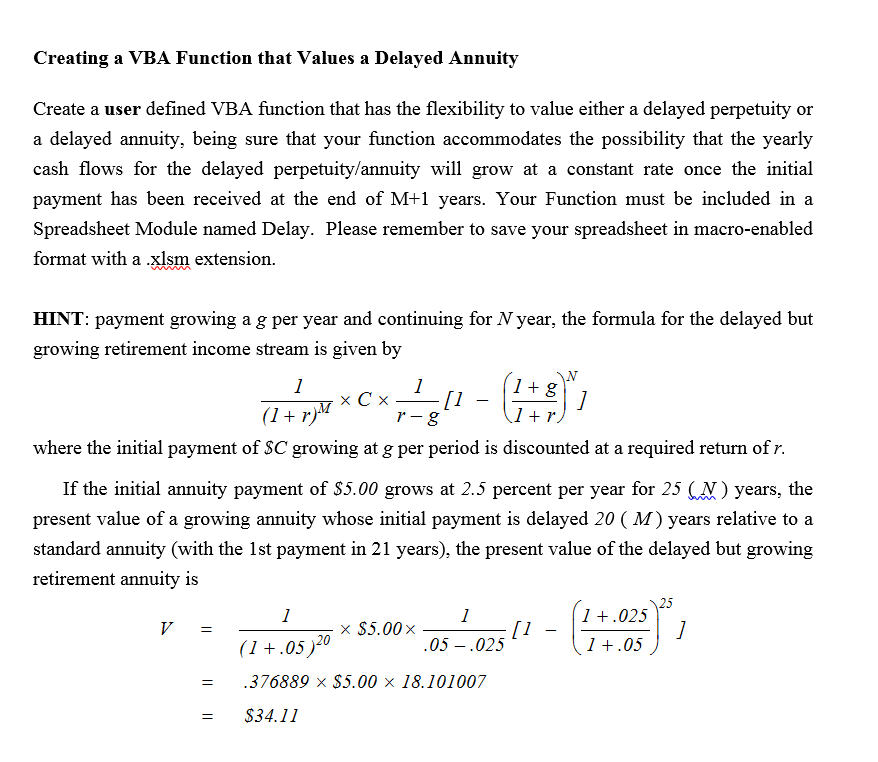

Creating a VBA Function that Values a Delayed Annuity Create a user defined VBA function that has the flexibility to value either a delayed perpetuity or a delayed annuity, being sure that your function accommodates the possibility that the yearly cash flows for the delayed perpetuity/annuity will grow at a constant rate once the initial payment has been received at the end of M+1 years. Your Function must be included in a Spreadsheet Module named Delay. Please remember to save your spreadsheet in macro-enabled format with a .xlsm extension. HINT: payment growing a g per year and continuing for / year, the formula for the delayed but growing retirement income stream is given by 1 ( 1 + p)M x CX 1 + r - 8 where the initial payment of SC growing at g per period is discounted at a required return of r. If the initial annuity payment of $5.00 grows at 2.5 percent per year for 25 ( M ) years, the present value of a growing annuity whose initial payment is delayed 20 ( M ) years relative to a standard annuity (with the 1st payment in 21 years), the present value of the delayed but growing retirement annuity is 1 + .025 25 1 V = * $5.00X (1+. 05 ) 20 .05 -.025 1 +.05 = .376889 x $5.00 x 18.101007 = $34.11

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts