Question: Chapter 3: Profitability analysis and interpretation Activity 1: Formulae ROE-Net income/ Average Stockholders' equity ROE [Net income/ Average total Assets] x [Average total Assets/Average

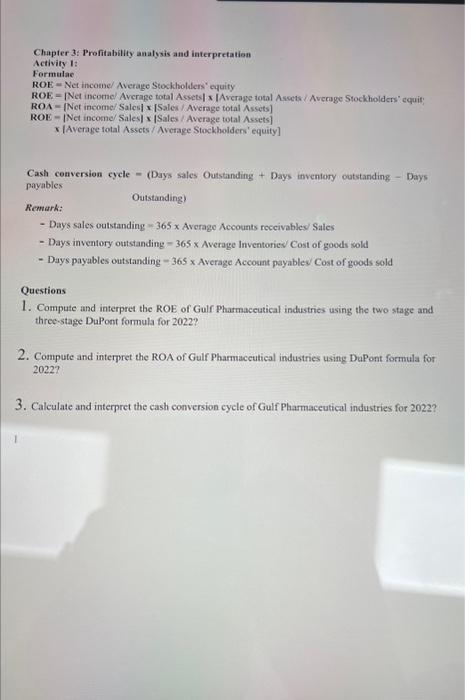

Chapter 3: Profitability analysis and interpretation Activity 1: Formulae ROE-Net income/ Average Stockholders' equity ROE [Net income/ Average total Assets] x [Average total Assets/Average Stockholders' equit; ROA (Net income/ Sales] x [Sales/ Average total Assets] ROE[Net income/ Sales] x [Sales/Average total Assets] x (Average total Assets/ Average Stockholders' equity] Cash conversion cycle (Days sales Outstanding + Days inventory outstanding - Days payables Outstanding) Remark: - Days sales outstanding - 365 x Average Accounts receivables/ Sales - Days inventory outstanding - 365 x Average Inventories/ Cost of goods sold - Days payables outstanding-365 x Average Account payables/ Cost of goods sold Questions 1. Compute and interpret the ROE of Gulf Pharmaceutical industries using the two stage and three-stage DuPont formula for 2022? 2. Compute and interpret the ROA of Gulf Pharmaceutical industries using DuPont formula for 2022? 3. Calculate and interpret the cash conversion cycle of Gulf Pharmaceutical industries for 2022?

Step by Step Solution

3.43 Rating (162 Votes )

There are 3 Steps involved in it

1 Compute and interpret the ROE of Gulf Pharmaceutical industries using the two stage and threestage ... View full answer

Get step-by-step solutions from verified subject matter experts