Question: Credit Card Use a cell reference or a single formula where appropriate in order to receive full credit. Do not copy and paste values or

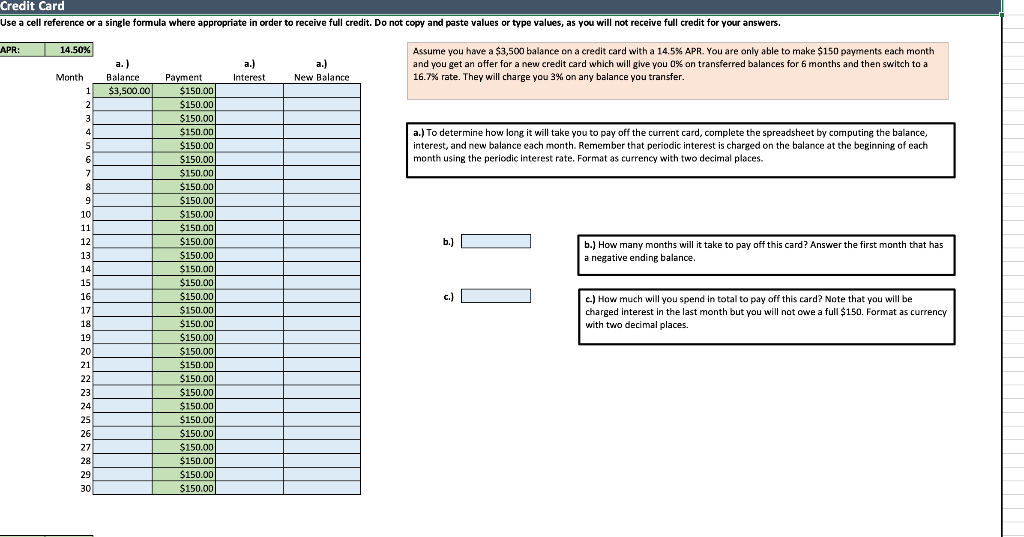

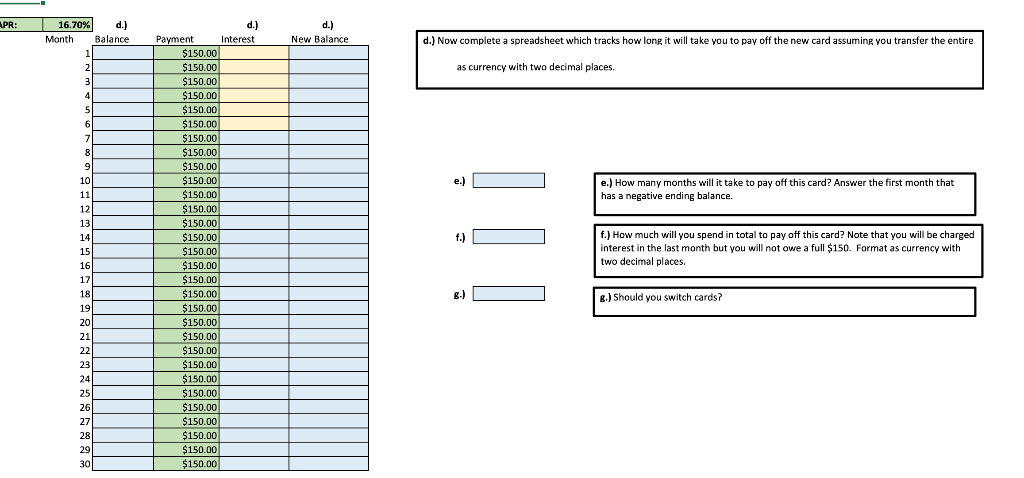

Credit Card Use a cell reference or a single formula where appropriate in order to receive full credit. Do not copy and paste values or type values, as you will not receive full credit for your answers. APR: 14.50% a.) Assume you have a $3,500 balance on a credit card with a 14.5% APR. You are only able to make $150 payments each month and you get an offer for a new credit card which will give you 0% on transferred balances for 6 months and then switch to a 16.7% rate. They will charge you 3% on any balance you transfer. Month a.) New Balance Interest Balance $3,500.00 1 in a.) To determine how long it will take you to pay off the current card, complete the spreadsheet by computing the balance, interest, and new balance each month. Remember that periodic interest is charged on the balance at the beginning of each month using the periodic interest rate. Format as currency with two decimal places. och b.) D b.) How many months will it take to pay off this card? Answer the first month that has a negative ending balance. Payment $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $ 150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 c.) D c.) How much will you spend in total to pay off this card? Note that you will be charged interest in the last month but you will not owe a full $150. Format as currency with two decimal places. APR: 16.70% Month d.) Balance d.) New Balance d.) Now complete a spreadsheet which tracks how long it will take you to pay off the new card assuming you transfer the entire as currency with two decimal places. e.) e.) How many months will it take to pay off this card? Answer the first month that has a negative ending balance. f.) Payment Interest $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 | $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 f.) How much will you spend in total to pay off this card? Note that you will be charged interest in the last month but you will not owe a full $150. Format as currency with two decimal places. g.) g.) Should you switch cards? Credit Card Use a cell reference or a single formula where appropriate in order to receive full credit. Do not copy and paste values or type values, as you will not receive full credit for your answers. APR: 14.50% a.) Assume you have a $3,500 balance on a credit card with a 14.5% APR. You are only able to make $150 payments each month and you get an offer for a new credit card which will give you 0% on transferred balances for 6 months and then switch to a 16.7% rate. They will charge you 3% on any balance you transfer. Month a.) New Balance Interest Balance $3,500.00 1 in a.) To determine how long it will take you to pay off the current card, complete the spreadsheet by computing the balance, interest, and new balance each month. Remember that periodic interest is charged on the balance at the beginning of each month using the periodic interest rate. Format as currency with two decimal places. och b.) D b.) How many months will it take to pay off this card? Answer the first month that has a negative ending balance. Payment $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $ 150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 c.) D c.) How much will you spend in total to pay off this card? Note that you will be charged interest in the last month but you will not owe a full $150. Format as currency with two decimal places. APR: 16.70% Month d.) Balance d.) New Balance d.) Now complete a spreadsheet which tracks how long it will take you to pay off the new card assuming you transfer the entire as currency with two decimal places. e.) e.) How many months will it take to pay off this card? Answer the first month that has a negative ending balance. f.) Payment Interest $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 | $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 $150.00 f.) How much will you spend in total to pay off this card? Note that you will be charged interest in the last month but you will not owe a full $150. Format as currency with two decimal places. g.) g.) Should you switch cards

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts