Question: Case Study 17, AliExpress: Can It Mount a Global Challenge to Amazon - from the textbook Crafting & Executing Strategy, The Quest for Competitive Advantage,

Case Study 17, AliExpress: Can It Mount a Global Challenge to Amazon - from the textbook Crafting & Executing Strategy, The Quest for Competitive Advantage, Concepts and Cases Edition 22e (Thompson, Peteraf, Gamble & Strickland, 2019) - pages c184-c190

Instructions:

1. You will need to analyse the case study given from the textbook.

2. Read the case thoroughly.

3. Understand and critically analyse the case.

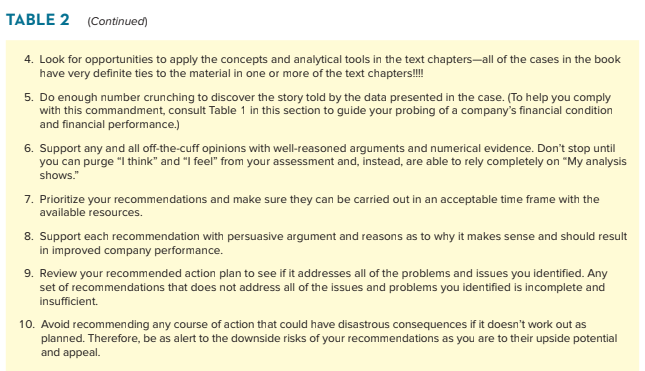

4. Refer to The Ten Commandments of Case Analysis below to analyse the case study.

5. Reports must be accompanied by a plagiarism check report (i.e. Turnitin). Plagiarism Similarity Index should be

Questions:

1. Identify the strategically relevant factors in the macro-environment of the online retailing industry. Prepare a PESTEL analysis.

Which of the factors identified appear the most likely to have the greatest effect on the online retailing industry? (30 marks)

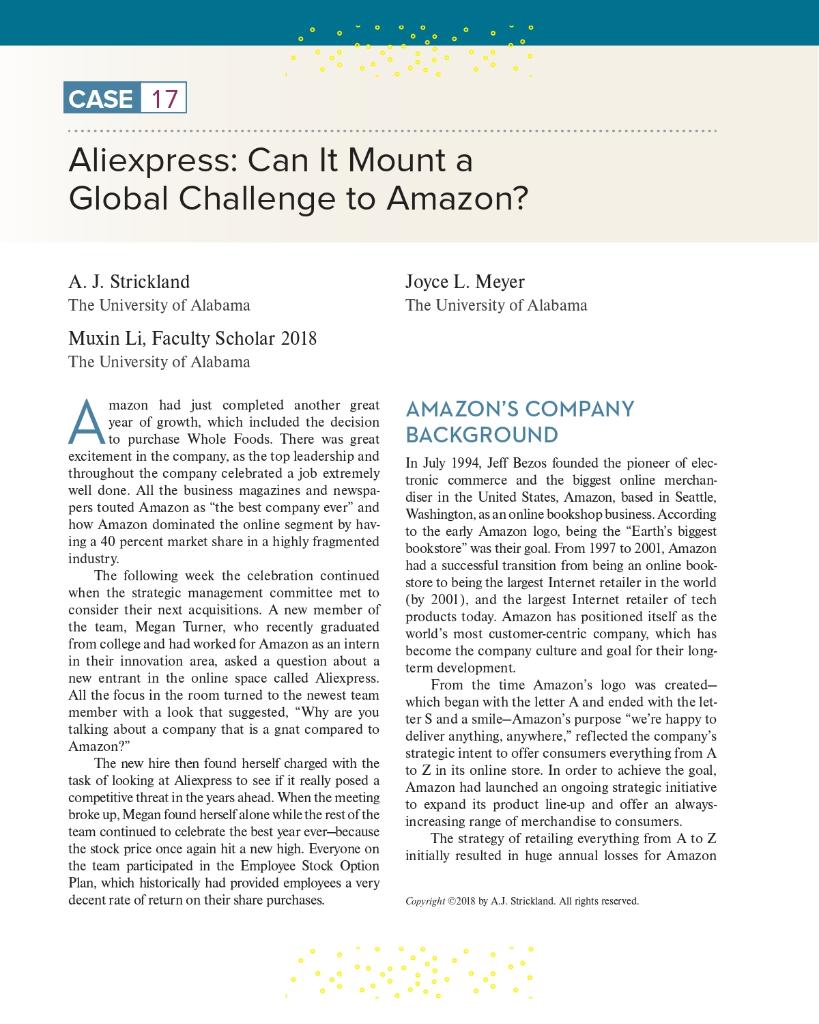

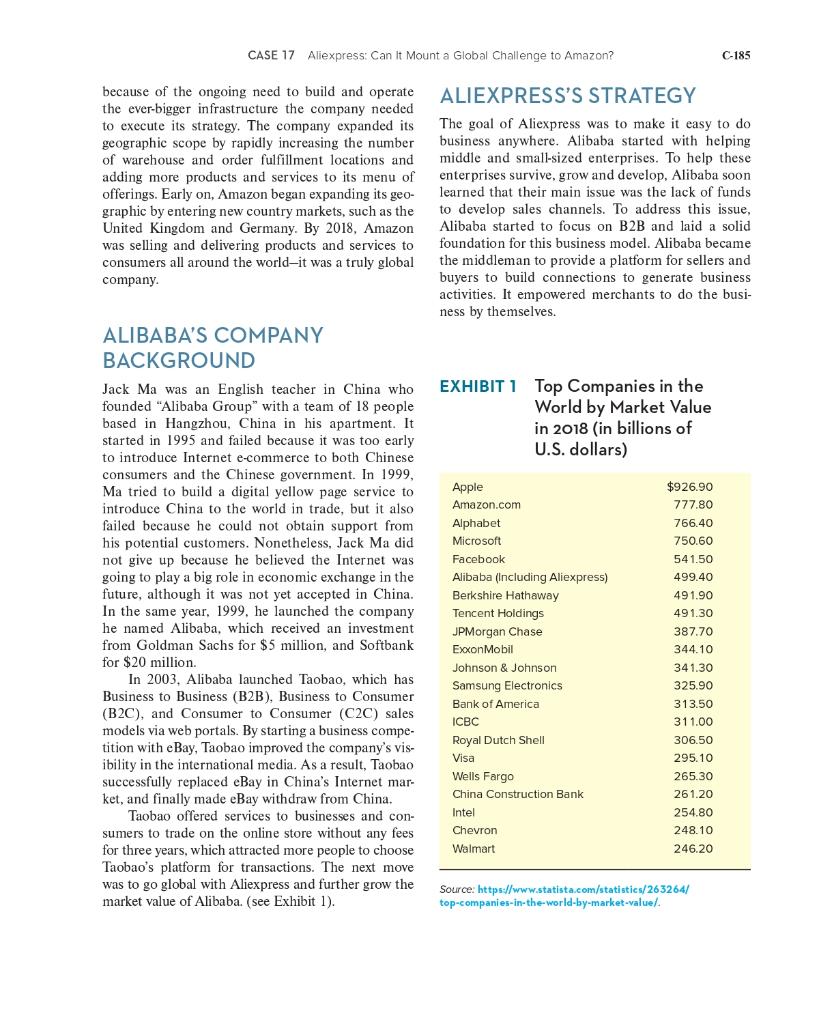

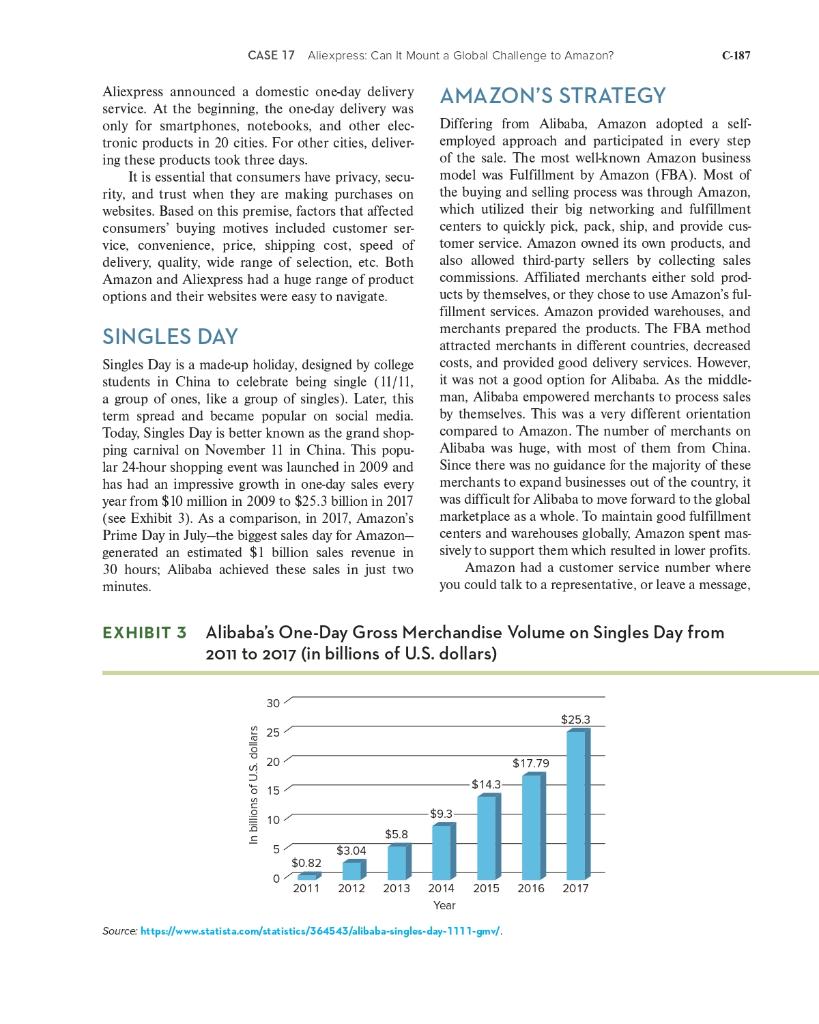

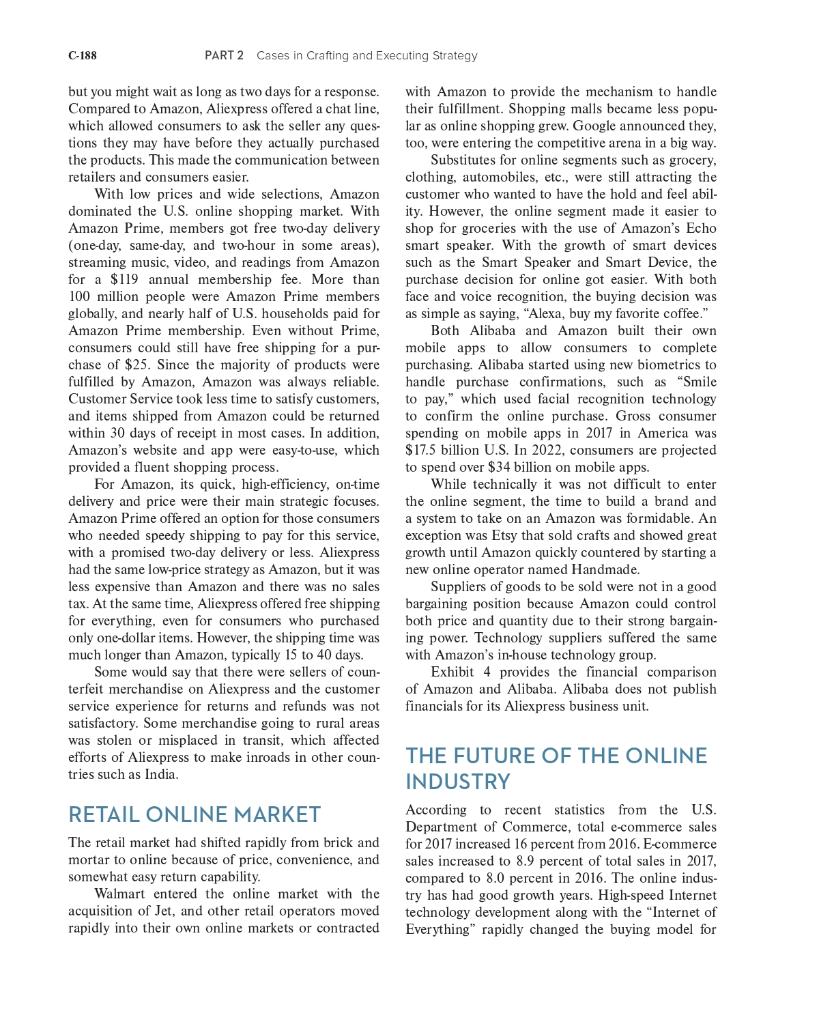

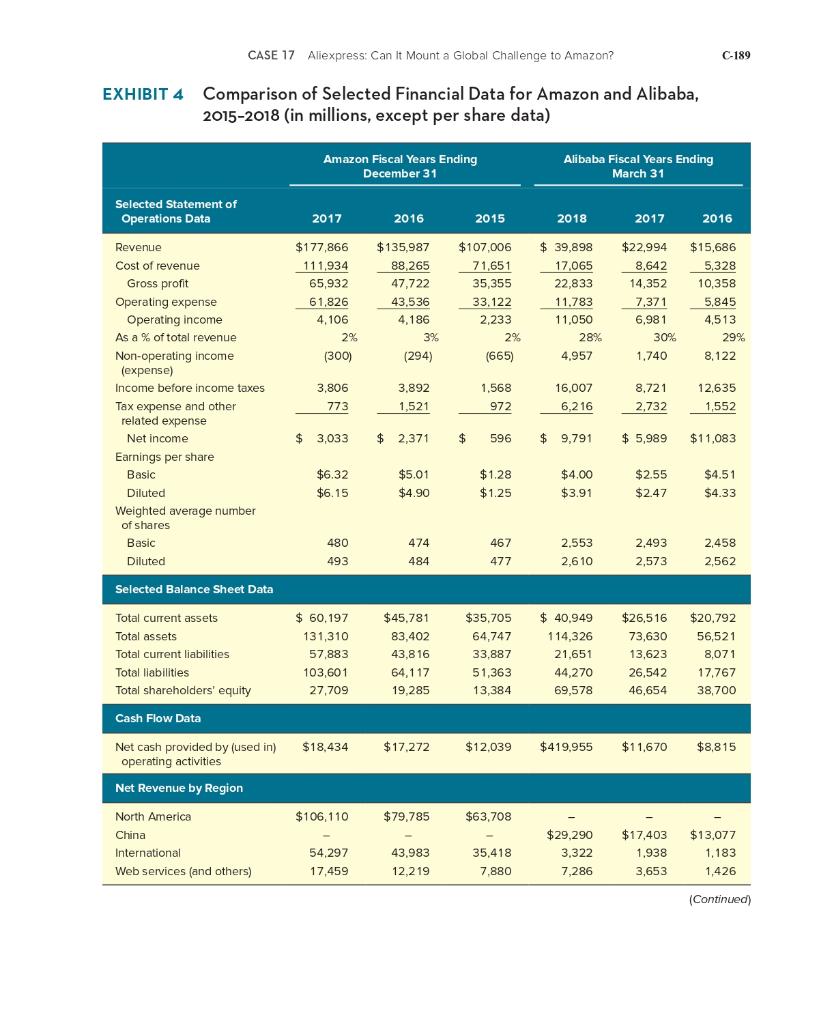

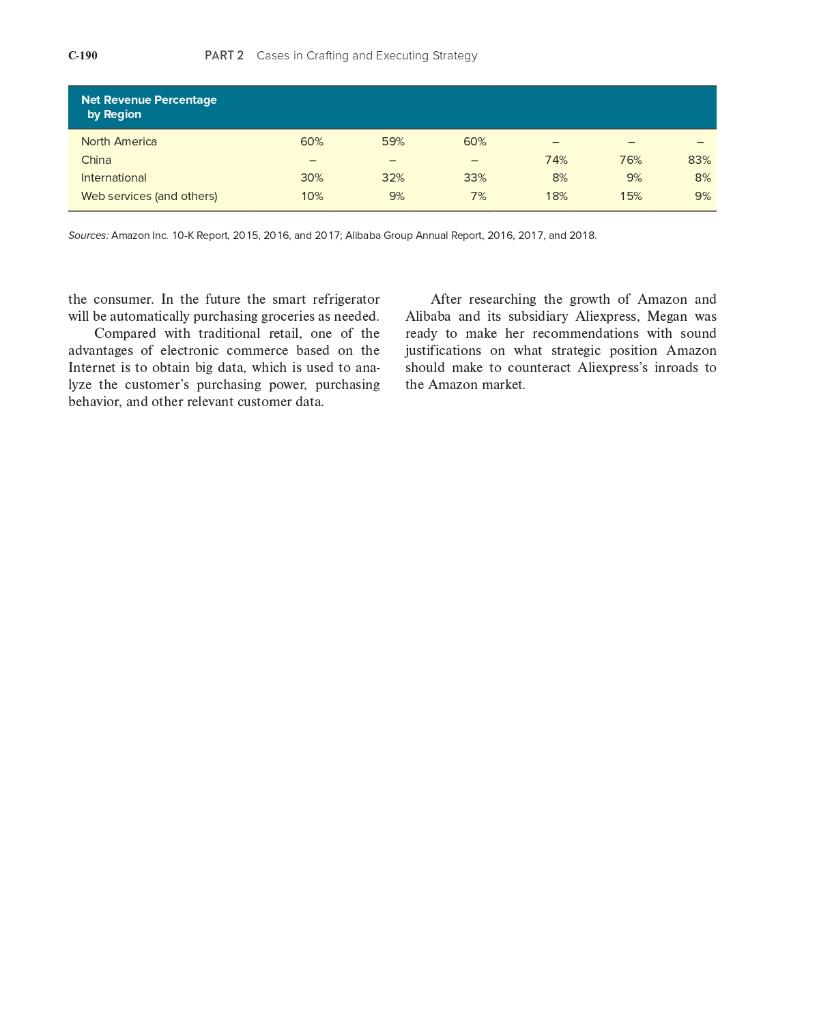

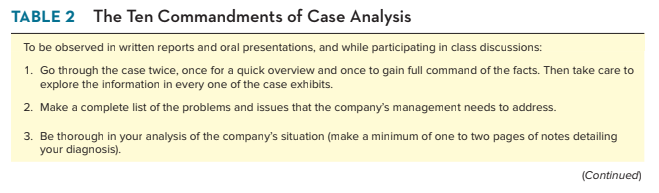

CASE 17 Aliexpress: Can It Mount a Global Challenge to Amazon? Joyce L. Meyer The University of Alabama A. J. Strickland The University of Alabama Muxin Li, Faculty Scholar 2018 The University of Alabama mazon had just completed another great year of growth, which included the decision excitement in the company, as the top leadership and throughout the company celebrated a job extremely well done. All the business magazines and newspa- pers touted Amazon as "the best company ever" and how Amazon dominated the online segment by hav- ing a 40 percent market share in a highly fragmented industry. The following week the celebration continued when the strategic management committee met to consider their next acquisitions. A new member of the team, Megan Turner, who recently graduated from college and had worked for Amazon as an intern in their innovation area, asked a question about a new entrant in the online space called Aliexpress. All the focus in the room turned to the newest team member with a look that suggested, "Why are you talking about a company that is a gnat compared to Amazon?" The new hire then found herself charged with the task of looking at Aliexpress to see if it really posed a competitive threat in the years ahead. When the meeting broke up, Megan found herself alone while the rest of the team continued to celebrate the best year ever-because the stock price once again hit a new high. Everyone on the team participated in the Employee Stock Option Plan, which historically had provided employees a very decent rate of return on their share purchases. AMAZON'S COMPANY BACKGROUND In July Jeff founded the pioneer of elec- tronic commerce and the biggest online merchan- diser in the United States, Amazon, based in Seattle, Washington, as an online bookshop business. According to the early Amazon logo, being the "Earth's biggest bookstore" was their goal. From 1997 to 2001, Amazon had a successful transition from being an online book- store to being the largest Internet retailer in the world (by 2001), and the largest Internet retailer of tech products today. Amazon has positioned itself as the world's most customer-centric company, which has become the company culture and goal for their long- term development From the time Amazon's logo was created- which began with the letter A and ended with the let- ter S and a smile-Amazon's purpose "we're happy to deliver anything, anywhere," reflected the company's strategic intent to offer consumers everything from A to Z in its online store. In order to achieve the goal, Amazon had launched an ongoing strategic initiative to expand its product line-up and offer an always- increasing range of merchandise to consumers. The strategy of retailing everything from A to Z initially resulted in huge annual losses for Amazon Copyright 2018 by AJ Strickland. All rights reserved. CASE 17 Aliexpress: Can It Mount a Global Challenge to Amazon? C-185 because of the ongoing need to build and operate the ever-bigger infrastructure the company needed to execute its strategy. The company expanded its geographic scope by rapidly increasing the number of warehouse and order fulfillment locations and adding more products and services to its menu of offerings. Early on, Amazon began expanding its geo- graphic by entering new country markets, such as the United Kingdom and Germany. By 2018, Amazon was selling and delivering products and services to consumers all around the world-it was a truly global company. ALIEXPRESS'S STRATEGY The goal of Aliexpress was to make it easy to do business anywhere. Alibaba started with helping middle and small-sized enterprises. To help these enterprises survive, grow and develop, Alibaba soon learned that their main issue was the lack of funds to develop sales channels. To address this issue, Alibaba started to focus on B2B and laid a solid foundation for this business model. Alibaba became the middleman to provide a platform for sellers and buyers to build connections to generate business activities. It empowered merchants to do the busi- ness by themselves. EXHIBIT 1 Top Companies in the World by Market Value in 2018 (in billions of U.S. dollars) ALIBABA'S COMPANY BACKGROUND Jack Ma was an English teacher in China who founded "Alibaba Group" with a team of 18 people based in Hangzhou, China in his apartment. It started in 1995 and failed because it was too early to introduce Internet e-commerce to both Chinese consumers and the Chinese government. In 1999, Ma tried to build a digital yellow page service to introduce China to the world in trade, but it also failed because he could not obtain support from his potential customers. Nonetheless, Jack Ma did not give up because he believed the Internet was going to play a big role in economic exchange in the future, although it was not yet accepted in China. In the same year, 1999, he launched the company he named Alibaba, which received an investment from Goldman Sachs for $5 million, and Softbank for $20 million. In 2003, Alibaba launched Taobao, which has Business to Business (B2B), Business to Consumer (B2C), and Consumer to Consumer (C2C) sales models via web portals. By starting a business compe- tition with eBay, Taobao improved the company's vis- ibility in the international media. As a result, Taobao successfully replaced eBay in China's Internet mar- ket, and finally made eBay withdraw from China. Taobao offered services to businesses and con- sumers to trade on the online store without any fees for three years, which attracted more people to choose Taobao's platform for transactions. The next move was to go global with Aliexpress and further grow the market value of Alibaba. (see Exhibit 1). Apple Amazon.com Alphabet Microsoft Facebook Alibaba (Including Aliexpress) Berkshire Hathaway Tencent Holdings JPMorgan Chase ExxonMobil Johnson & Johnson Samsung Electronics Bank of America ICBC Royal Dutch Shell Visa Wells Fargo China Construction Bank Intel Chevron Walmart $926.90 777.80 766.40 750.60 541.50 499.40 491.90 491.30 387.70 344.10 341.30 325.90 313.50 311.00 306.50 295.10 265.30 261.20 254.80 248.10 246.20 Source: https://www.statista.com/statistics/263264/ top-companies-in-the-world-by-market value/. C-186 PART 2 Cases in Crafting and Executing Strategy EXHIBIT 2 Leading Shopping Apps in the Google Play Store Worldwide in April 2018 Number of Downloads in Millions Name 16.56 5.87 Wish - Shopping Made Fun AliExpress - Smarter Shopping, Better Living Lazada - Online Shopping & Deals Joom Amazon Shopping Mercado Libre: Encuentra tus marcas favoritas Flipkart Online Shopping App Club Factory - Fair Price Shein-Shop Women's Fashion Pandao 4.43 3.44 3.08 2.73 2.27 2.27 2.02 1.74 Source: https://www.statista.com/statistics/691274/ leading-google-play-shopping-worldwide-downloads/ Taobao offered plenty of unknown products directly from small manufacturers. Tmall, however, had more well-known brands, usually sold directly by the brand. These two retail sites generated more opportu- nities for middle and small-sized merchants. Aliexpress is the international version of Taobao. Aliexpress launched in 2010 targeting international consumers in the United States as well as Australia and Russia. By utilizing the market environment and resources, Alibaba expanded business services to new areas: C2C, software, search engine, auctioning, money transfer, advertising, and logistics. These areas in general covered different kinds of e-commerce services, which meant that Alibaba provided better and more comprehensive support for enterprises. In the beginning, Alibaba offered free membership to gather more merchants to this platform. Today, com- missions and fees have become an essential source of income. The more merchants and consumers who participate in this platform, the more transactions can be made. Alibaba is a platform and does not own any products. Merchants can sell products directly to consumers through Alibaba's website. In general, Alibaba does not participate in sale processing, but provides a platform and services for merchants and consumers to make transactions. In 2018, there were thousands of well-known brand name products and an even greater number of unknown brands on Alibaba and Aliexpress, with an incredible selection and low prices for the same prod- ucts compared to brick-and-mortar businesses and the limited number of online retail sites in China. Both Taobao and Aliexpress apps and websites were well developed in 2018, and the search engines directed consumers efficiently to the products they were shopping for. In addition, Alibaba developed Alipay, an eWallet service that enabled shoppers to easily pay for their purchases. In 2018, there were over 110 countries that used Alipay as a payment option. It was popular throughout a big portion of China and Southeast Asia because of its simplicity. convenience, and safety. Before a consumer made a purchase they chatted directly with sellers to know the products better and have a quick response for after-sales services. There few merchants who still charged for shipping, but the majority of the products listed on Alibaba were free shipping, even for a small purchase or single item. Aliexpress, as the international market, continued Alibaba's features and provided free shipping around the world, but it took longer to get the products. Consumers were able to track their delivery status. As shown in Exhibit 2, Aliexpress had 5.87 mil- lion app downloads and was the second leading shop- ping app in the Google Play Store worldwide in April 2018. Amazon was fifth with 3.08 million downloads. Aliexpress, as a global retail marketplace, had approx- imately 60 million annual active buyers in the world in 12 months ending March 31, 2017 ALIEXPRESS IN RUSSIA With the facilitating conditions of distance, culture, and good terms of trading between China and Russia, Aliexpress targeted Russia as a good market to start expanding their business internationally. By the end of 2014, Aliexpress was the number one online retailer in Russia selling essentially Chinese prod- ucts, and enjoying huge popularity among Russian online consumers who appreciated its low prices and large assortment. The inclusion of additional offers from Russian companies helped Aliexpress close gaps in its product range such as heavy home appli- ances that are difficult to deliver from China. Given the close proximity between Russia and China, are CASE 17 Aliexpress: Can It Mount a Global Challenge to Amazon? C-187 Aliexpress announced a domestic one-day delivery service. At the beginning, the one-day delivery was only for smartphones, notebooks, and other elec- tronic products in 20 cities. For other cities, deliver- ing these products took three days. It is essential that consumers have privacy, secu- rity, and trust when they are making purchases on websites. Based on this premise, factors that affected consumers' buying motives included customer ser- vice, convenience, price, shipping cost, speed of delivery, quality, wide range of selection, etc. Both Amazon and Aliexpress had a huge range of product options and their websites were easy to navigate. SINGLES DAY Singles Day is a made-up holiday, designed by college students in China to celebrate being single (11/11, a group of ones, like a group of singles). Later, this term spread and became popular on social media. Today, Singles Day is better known as the grand shop- ping carnival on November 11 in China. This popu- lar 24-hour shopping event was launched in 2009 and has had an impressive growth in one-day sales every year from $10 million in 2009 to $25.3 billion in 2017 (see Exhibit 3). As a comparison, in 2017, Amazon's Prime Day in July-the biggest sales day for Amazon- generated an estimated $1 billion sales revenue in 30 hours; Alibaba achieved these sales in just two minutes AMAZON'S STRATEGY Differing from Alibaba, Amazon adopted a self- employed approach and participated in every step of the sale. The most well-known Amazon business model was Fulfillment by Amazon (FBA). Most of the buying and selling process was through Amazon, which utilized their big networking and fulfillment centers to quickly pick, pack, ship, and provide cus- tomer service. Amazon owned its own products, and also allowed third-party sellers by collecting sales commissions. Affiliated merchants either sold prod- ucts by themselves, or they chose to use Amazon's ful- fillment services. Amazon provided warehouses, and merchants prepared the products. The FBA method attracted merchants in different countries, decreased costs, and provided good delivery services. However, it was not a good option for Alibaba. As the middle- man, Alibaba empowered merchants to process sales by themselves. This was a very different orientation compared to Amazon. The number of merchants on Alibaba was huge, with most of them from China. Since there was no guidance for the majority of these merchants to expand businesses out of the country, it was difficult for Alibaba to move forward to the global marketplace as a whole. To maintain good fulfillment centers and warehouses globally, Amazon spent mas- sively to support them which resulted in lower profits. Amazon had a customer service number where you could talk to a representative, or leave a message, EXHIBIT 3 Alibaba's One-Day Gross Merchandise Volume on Singles Day from 2011 to 2017 (in billions of U.S. dollars) 30 $25.3 25 20 $17.79 In billions of U.S. dollars $14.3 $9.3 10 $5.8 5 $3.04 $0.82 0 2011 2012 2013 2015 2016 2017 2014 Year Source: https://www.statista.com/statistics/364543/alibaba-singles-day-1111-gmy/ C-188 PART 2 Cases in Crafting and Executing Strategy but you might wait as long as two days for a response. Compared to Amazon, Aliexpress offered a chat line, which allowed consumers to ask the seller any ques- tions they may have before they actually purchased the products. This made the communication between retailers and consumers easier. With low prices and wide selections, Amazon dominated the U.S. online shopping market. With Amazon Prime, members got free two-day delivery (one-day, same-day, and two-hour in some areas). streaming music, video, and readings from Amazon for a $119 annual membership fee. More than 100 million people were Amazon Prime members globally, and nearly half of U.S. households paid for Amazon Prime membership. Even without Prime, consumers could still have free shipping for a pur- chase of $25. Since the majority of products were fulfilled by Amazon, Amazon was always reliable. Customer Service took less time to satisfy customers, and items shipped from Amazon could be returned within 30 days of receipt in most cases. In addition, Amazon's website and app were easy-to-use, which provided a fluent shopping process. For Amazon, its quick, high-efficiency, on-time delivery and price were their main strategic focuses. Amazon Prime offered an option for those consumers who needed speedy shipping to pay for this service, with a promised two-day delivery or less. Aliexpress had the same low-price strategy as Amazon, but it was less expensive than Amazon and there was no sales tax. At the same time, Aliexpress offered free shipping for everything, even for consumers who purchased only one-dollar items. However, the shipping time was much longer than Amazon, typically 15 to 40 days. Some would say that there were sellers of coun- terfeit merchandise on Aliexpress and the customer service experience for returns and refunds was not satisfactory. Some merchandise going to rural areas was stolen or misplaced in transit, which affected efforts of Aliexpress to make inroads in other coun- tries such as India. with Amazon to provide the mechanism to handle their fulfillment. Shopping malls became less popu- lar as online shopping grew. Google announced they, too, were entering the competitive arena in a big way. Substitutes for online segments such as grocery, clothing, automobiles, etc., were still attracting the customer who wanted to have the hold and feel abil- ity. However, the online segment made it easier to shop for groceries with the use of Amazon's Echo smart speaker. With the growth of smart devices such as the Smart Speaker and Smart Device, the purchase decision for online got easier. With both face and voice recognition, the buying decision was as simple as saying, "Alexa, buy my favorite coffee." Both Alibaba and Amazon built their own mobile apps to allow consumers to complete purchasing. Alibaba started using new biometrics to handle purchase confirmations, such as "Smile to pay," which used facial recognition technology to confirm the online purchase. Gross consumer spending on mobile apps in 2017 in America was $17.5 billion U.S. In 2022, consumers are projected to spend over $34 billion on mobile apps. While technically was not difficult to enter the online segment, the time to build a brand and a system to take on an Amazon was formidable. An exception was Etsy that sold crafts and showed great growth until Amazon quickly countered by starting a new online operator named Handmade. Suppliers of goods to be sold were not in a good bargaining position because Amazon could control both price and quantity due to their strong bargain- ing power. Technology suppliers suffered the same with Amazon's in-house technology group. Exhibit 4 provides the financial comparison of Amazon and Alibaba. Alibaba does not publish financials for its Aliexpress business unit RETAIL ONLINE MARKET The retail market had shifted rapidly from brick and mortar to online because of price, convenience, and somewhat easy return capability. Walmart entered the online market with the acquisition of Jet, and other retail operators moved rapidly into their own online markets or contracted THE FUTURE OF THE ONLINE INDUSTRY According to recent statistics from the U.S. Department of Commerce, total e-commerce sales for 2017 increased 16 percent from 2016. E-commerce sales increased to 8.9 percent of total sales in 2017, compared to 8.0 percent in 2016. The online indus- try has had good growth years. High-speed Internet technology development along with the "Internet of Everything" rapidly changed the buying model for CASE 17 Aliexpress: Can It Mount a Global Challenge to Amazon? C-189 EXHIBIT 4 Comparison of Selected Financial Data for Amazon and Alibaba, 2015-2018 (in millions, except per share data) Amazon Fiscal Years Ending December 31 Alibaba Fiscal Years Ending March 31 Selected Statement of Operations Data 2017 2016 2015 2018 2017 2016 $177,866 111,934 65,932 61.826 4,106 2% (300) $135,987 88.265 47,722 43,536 4,186 3% (294) $107,006 71,651 35,355 33.122 2,233 2% (665) $ 39,898 17,065 22,833 11.783 11,050 28% 4.957 $22.994 8,642 14,352 7.371 6,981 30% 1,740 $15,686 5,328 10,358 5,845 4,513 29% 8,122 Revenue Cost of revenue Gross profit Operating expense Operating income As a % of total revenue Non-operating income (expense) Income before income taxes Tax expense and other related expense Net income Earnings per share Basic Diluted Weighted average number of shares Basic Diluted 3,806 773 3,892 1,521 1.568 972 16.007 6,216 8,721 2,732 12,635 1,552 $ 3,033 $ 2,371 $ 596 $ 9,791 $ 5,989 $11,083 $6.32 $6.15 $5.01 $4.90 $1.28 $1.25 $4.00 $3.91 $2.55 $2.47 $4.51 $4.33 480 467 474 484 2,553 2,610 2,493 2,573 2,458 2,562 493 477 Selected Balance Sheet Data Total current assets Total assets Total current liabilities Total liabilities Total shareholders' equity $ 60,197 131,310 57,883 103,601 27,709 $45.781 83,402 43,816 64,117 19,285 $35.705 64,747 33,887 51,363 13,384 $ 40,949 114,326 21.651 44,270 69,578 $26,516 73,630 13,623 26,542 46,654 $20.792 56,521 8,071 17,767 38,700 Cash Flow Data $18,434 $17,272 $12.039 $419,955 $11,670 $8,815 Net cash provided by (used in) operating activities Net Revenue by Region $106, 110 $79,785 $63,708 North America China International Web services (and others) 54,297 17,459 43.983 12,219 35,418 7.880 $29,290 3,322 7,286 $17,403 1.938 3,653 $13,077 1,183 1,426 (Continued) C-190 PART 2 Cases in Crafting and Executing Strategy 60% 59% 60% Net Revenue Percentage by Region North America China International Web services (and others) 74% 83% 8% 30% 10% 32% 9% 33% 7% 76% 9% 15% 8% 18% 9% Sources: Amazon Inc. 10-K Report, 2015, 2016 and 2017: Alibaba Group Annual Report 2016, 2017, and 2018. the consumer. In the future the smart refrigerator will be automatically purchasing groceries as needed. Compared with traditional retail, one of the advantages of electronic commerce based on the Internet is to obtain big data, which is used to ana- lyze the customer's purchasing power, purchasing behavior, and other relevant customer data. After researching the growth of Amazon and Alibaba and its subsidiary Aliexpress, Megan was ready to make her recommendations with sound justifications on what strategic position Amazon should make to counteract Aliexpress's inroads to the Amazon market. The Ten Commandments of Case Analysis As a way of summarizing our suggestions about how to approach the task of case analysis, we have put together what we like to call "The Ten Command- ments of Case Analysis." They are shown in Table 2. If you observe all or even most of these command- ments faithfully as you prepare a case either for class discussion or for a written report, your chances of doing a good job on the assigned cases will be much improved. Hang in there, give it your best shot, and have some fun exploring what the real world of strate- gic management is all about. TABLE 2 The Ten Commandments of Case Analysis To be observed in written reports and oral presentations, and while participating in class discussions: 1. Go through the case twice, once for a quick overview and once to gain full command of the facts. Then take care to explore the information in every one of the case exhibits. 2. Make a complete list of the problems and issues that the company's management needs to address. 3. Be thorough in your analysis of the company's situation (make a minimum of one to two pages of notes detailing your diagnosis). (Continued) TABLE 2 (Continued) 4. Look for opportunities to apply the concepts and analytical tools in the text chaptersall of the cases in the book have very definite ties to the material in one or more of the text chapters!!!! 5. Do enough number crunching to discover the story told by the data presented in the case. (To help you comply with this commandment, consult Table 1 in this section to guide your probing of a company's financial condition and financial performance.) 6. Support any and all off-the-cuff opinions with well-reasoned arguments and numerical evidence. Don't stop until you can purge "I think" and "I feel" from your assessment and, instead, are able to rely completely on "My analysis shows." 7. Prioritize your recommendations and make sure they can be carried out in an acceptable time frame with the available resources. 8. Support each recommendation with persuasive argument and reasons as to why it makes sense and should result in improved company performance. 9. Review your recommended action plan to see if it addresses all of the problems and issues you identified. Any set of recommendations that does not address all of the issues and problems you identified is incomplete and insufficient 10. Avoid recommending any course of action that could have disastrous consequences if it doesn't work out as planned. Therefore, be as alert to the downside risks of your recommendations as you are to their upside potential and appeal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts