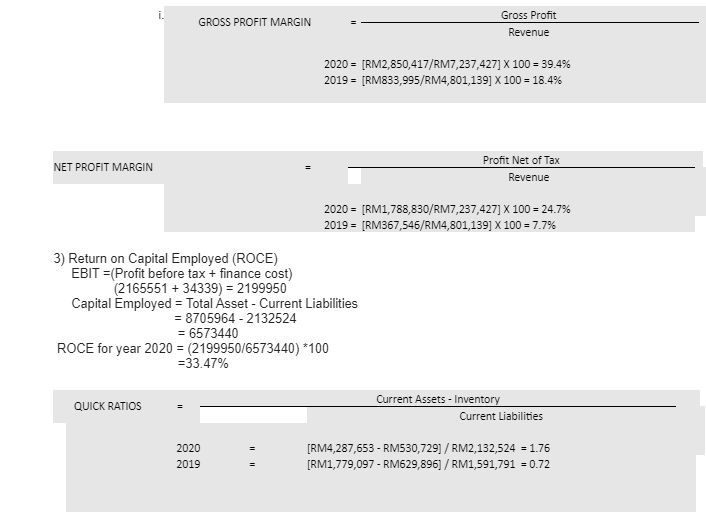

Question: Critically evaluate the ratios calculated above, and comment on your analysis. i. Gross Profit GROSS PROFIT MARGIN Revenue 2020 = [RM2,850,417/RM7,237,427] X 100 = 39.4%

![i. Gross Profit GROSS PROFIT MARGIN Revenue 2020 = [RM2,850,417/RM7,237,427] X 100](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/66fd2930a1ea6_18466fd29304071d.jpg)

Critically evaluate the ratios calculated above, and comment on your analysis.

i. Gross Profit GROSS PROFIT MARGIN Revenue 2020 = [RM2,850,417/RM7,237,427] X 100 = 39.4% 2019 = [RM833,995/RM4,801,139] X 100 = 18.4% Profit Net of Tax NET PROFIT MARGIN Revenue 2020 = [RM1,788,830/RM7,237,427] X 100 = 24.7% 2019 = [RM367,546/RM4,801,139] x 100 = 7.7% 3) Return on Capital Employed (ROCE) EBIT =(Profit before tax + finance cost) (2165551 + 34339) = 2199950 Capital Employed = Total Asset - Current Liabilities = 8705964 - 2132524 = 6573440 ROCE for year 2020 = (2199950/6573440) *100 = 33.47% Current Assets - Inventory QUICK RATIOS Current Liabilities 2020 [RM4,287,653 - RM530,729] / RM2,132,524 = 1.76 [RM1,779,097 - RM629,896]/RM1,591,791 = 0.72 2019 Current Assets CURRENT RATIOS Current Liabilities 2020 = RM4,287,653 / RM2,132,524 = 2.01 2019 = RM1,779,097 / RM1,591,791 = 1.12 Net Credit Sales ACCOUNT RECEIVABLE TURNOVER Avg Account Receivables 2020 RM7,237,427 / (RM798,805 + RM832,623/2] = 8.87 RM4,801, 139/(RM832,623 + RM877,715/2] = 5.614 2019 Since this has inventory (this is working for year 2020) Opening Inventory +Purchases -Closing Inventory = Cost of Sales therefore Purchases - Cost of Sales - Opening Inventory + Closing Inventory Purchases = 4387010 - 629896 +530729 Purchases =4287843 Accounts Payable Turnover = Purchases / avg Acc Payable = 4287843/((810824 + 492414)/2)) = 4287843 /651619 =6.580 Inventory Tumover = Cost of Sales / Average Inventory) 4387010/580312.5 = 7.56 Average Inventory = (opening inventory + closing inventory ) 2 = (Inventory 2020 + Inventory 2019)/2 =(530729-629896)2 = 580312.5 i. Gross Profit GROSS PROFIT MARGIN Revenue 2020 = [RM2,850,417/RM7,237,427] X 100 = 39.4% 2019 = [RM833,995/RM4,801,139] X 100 = 18.4% Profit Net of Tax NET PROFIT MARGIN Revenue 2020 = [RM1,788,830/RM7,237,427] X 100 = 24.7% 2019 = [RM367,546/RM4,801,139] x 100 = 7.7% 3) Return on Capital Employed (ROCE) EBIT =(Profit before tax + finance cost) (2165551 + 34339) = 2199950 Capital Employed = Total Asset - Current Liabilities = 8705964 - 2132524 = 6573440 ROCE for year 2020 = (2199950/6573440) *100 = 33.47% Current Assets - Inventory QUICK RATIOS Current Liabilities 2020 [RM4,287,653 - RM530,729] / RM2,132,524 = 1.76 [RM1,779,097 - RM629,896]/RM1,591,791 = 0.72 2019 Current Assets CURRENT RATIOS Current Liabilities 2020 = RM4,287,653 / RM2,132,524 = 2.01 2019 = RM1,779,097 / RM1,591,791 = 1.12 Net Credit Sales ACCOUNT RECEIVABLE TURNOVER Avg Account Receivables 2020 RM7,237,427 / (RM798,805 + RM832,623/2] = 8.87 RM4,801, 139/(RM832,623 + RM877,715/2] = 5.614 2019 Since this has inventory (this is working for year 2020) Opening Inventory +Purchases -Closing Inventory = Cost of Sales therefore Purchases - Cost of Sales - Opening Inventory + Closing Inventory Purchases = 4387010 - 629896 +530729 Purchases =4287843 Accounts Payable Turnover = Purchases / avg Acc Payable = 4287843/((810824 + 492414)/2)) = 4287843 /651619 =6.580 Inventory Tumover = Cost of Sales / Average Inventory) 4387010/580312.5 = 7.56 Average Inventory = (opening inventory + closing inventory ) 2 = (Inventory 2020 + Inventory 2019)/2 =(530729-629896)2 = 580312.5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts